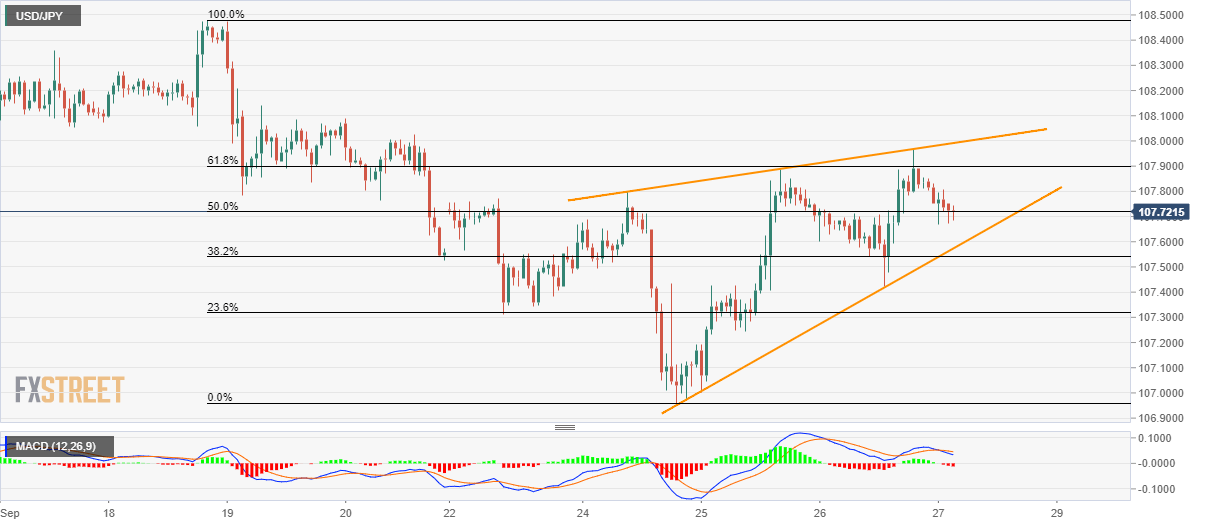

- USD/JPY stays inside a three-day-old rising wedge bearish technical pattern.

- Bearish MACD increases the odds favoring further selling.

With the 12-bar moving average convergence and divergence (MACD) flashing bearish signal, USD/JPY sellers await confirmation of near-term rising wedge for further weakness as the pair trades near 107.75 during early Friday.

In doing so, pattern support, at 107.57 now, becomes the key as a break of which could trigger fresh declines to 23.6% Fibonacci retracement level near 107.30.

Should prices refrain from bouncing off 107.30, 107.00 could lure bears.

On the contrary, an upside break of 108.00 pattern resistance negates the bearish formation but may have to clear 108.10 in order to validate the upside towards 108.50.

USD/JPY hourly chart

Trend: bearish