- This Tuesday, Brexit optimism dragged the Euro back above the 1.1000 handle.

- EUR/USD remains bullish above the 1.1000 handle.

- On Wednesday, investors will be watching the Retail Sales Control Group in the United States (US).

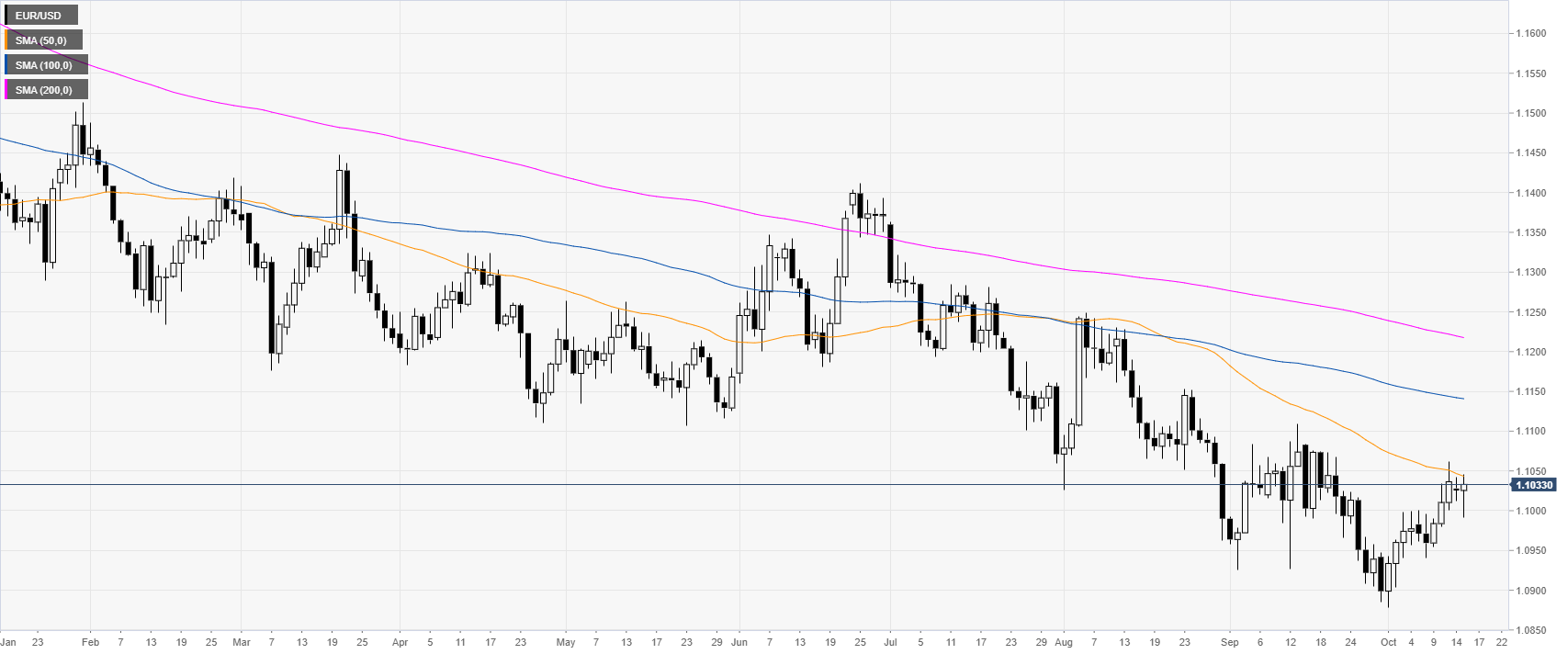

EUR/USD daily chart

On the daily chart, the common currency is trading in a bear trend below the main daily simple moving averages (DSMAs). The Euro got an intraday boost on the back of optimism over a Brexit deal draft. On Wednesday, investors will be watching the Retail Sales Control Group in the United States (US).

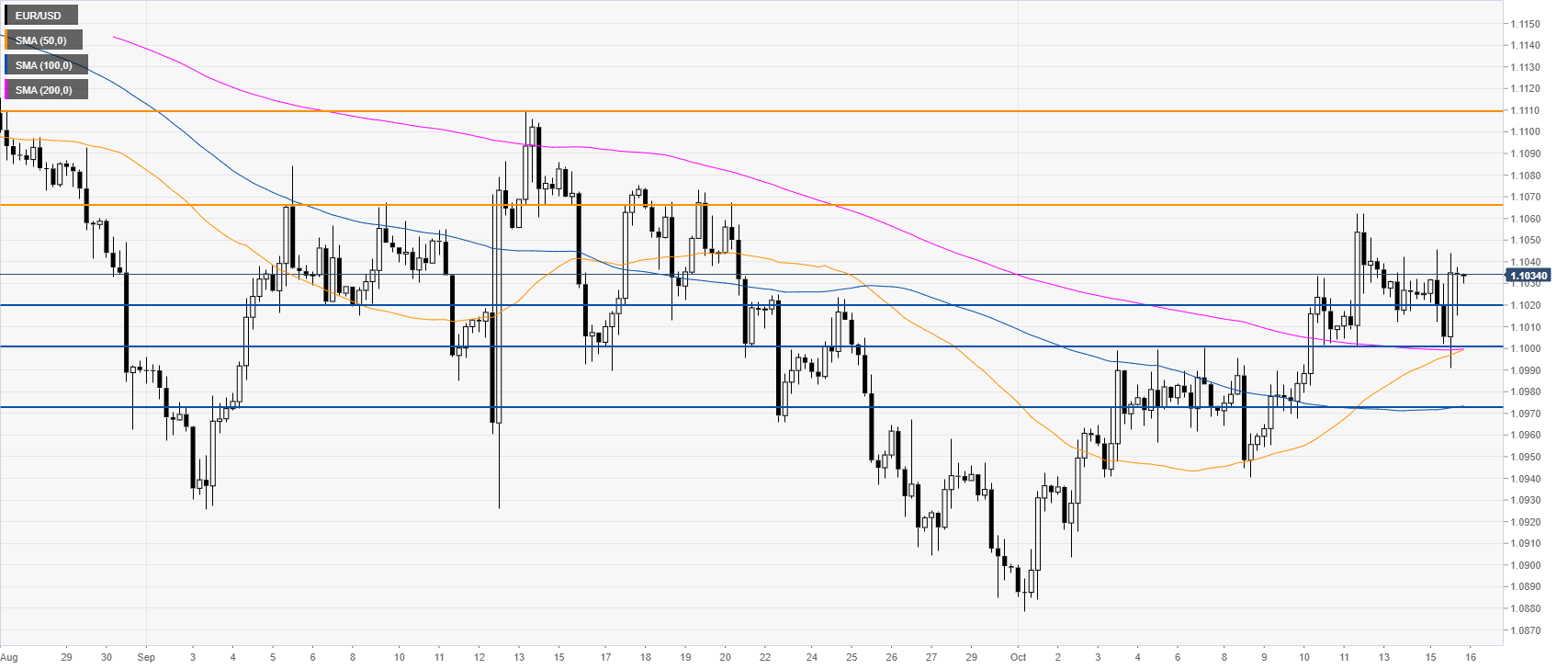

EUR/USD four-hour chart

The Fiber is trading above its main SMAs, suggesting bullish momentum in the medium term. EUR/USD is consolidating last week’s gains above the 1.1000 handle and the 200 SMA. A bullish break above the 1.1067 resistance could expose the 1.1100 level, according to the Technical Confluences Indicator.

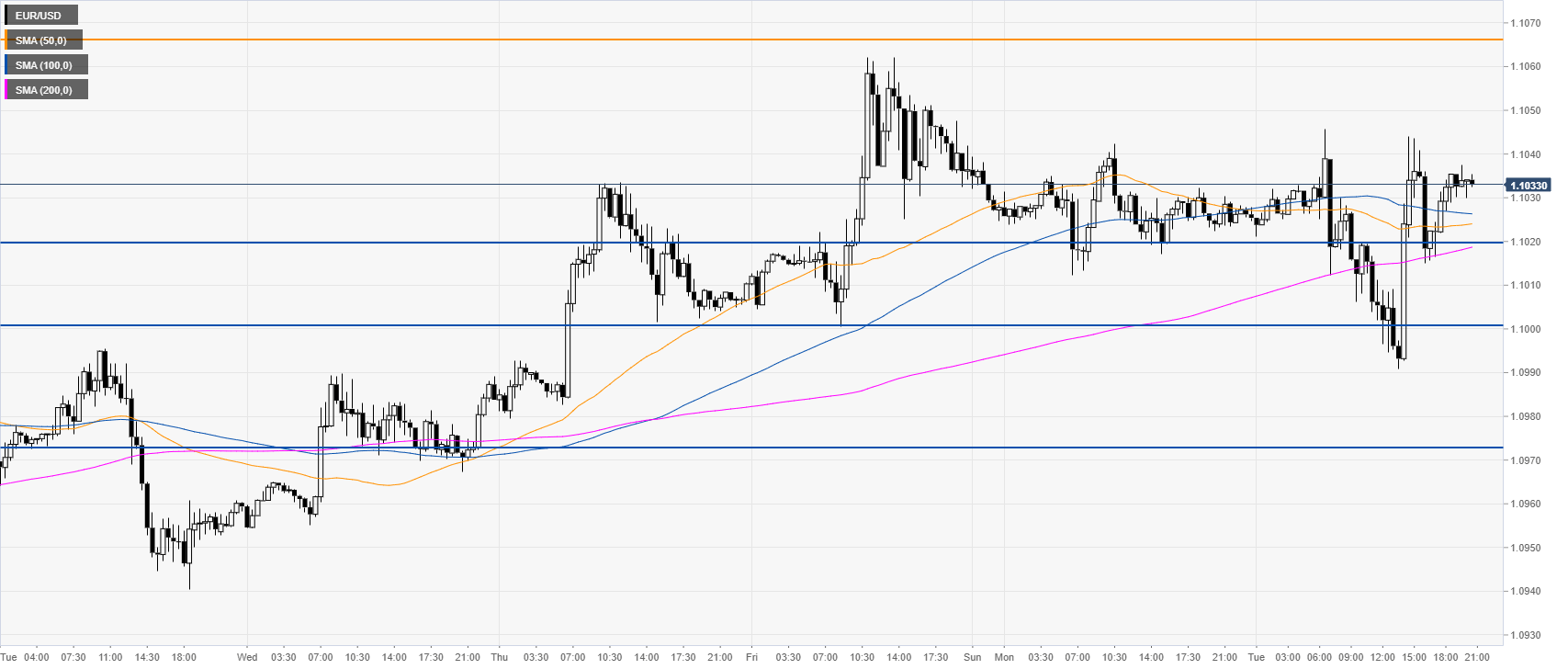

EUR/USD 30-minute chart

The Euro is trading above the main SMAs, suggesting bullish momentum in the near term. Support is seen at the 1.1020 and 1.1000 price levels. However, if prices close below 1.1000 on a daily basis, it could be a bearish sign in the near term.

Additional key levels