- Oversold RSI triggers EUR/GBP pullback.

- Sustained run-up beyond multi-month-old horizontal resistance can challenge 61.8% Fibonacci retracement level.

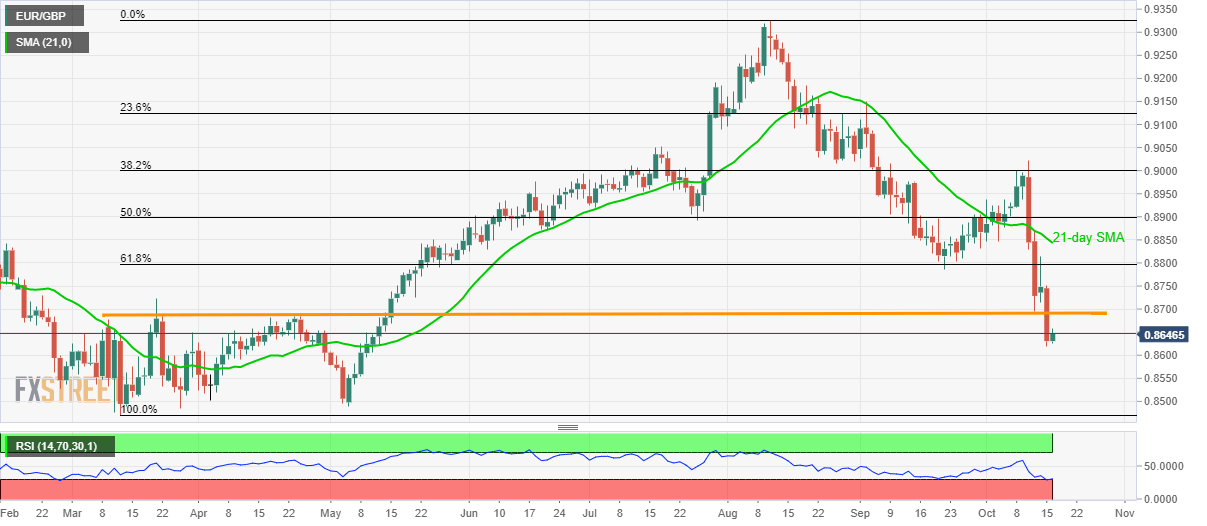

While sustained trading below 61.8% Fibonacci retracement dragged the EUR/GBP pair to five-month low, oversold conditions of RSI trigger pair’s U-turn to 0.8650 ahead of the European session open on Wednesday.

However, the pair needs to cross a multi-month-old horizontal resistance area, including late-March/April tops and Friday’s low, around 0.8685/95, before revisiting 61.8% Fibonacci retracement of March-August upside, at 0.8800.

It should also be noted that the pair’s recovery beyond 0.8800 enable bulls to target 21-day Simple Moving Average (SMA), near 0.8845 now.

Should bears refrain to respect oversold conditions of 14-bar Relative Strength Index (RSI), 0.8600 and May month low surrounding 0.8490 could entertain them ahead of reprinting 0.8470 on the chart.

EUR/GBP daily chart

Trend: pullback expected