- EUR/USD is trading near 1.1080 after the London close.

- Earlier, the Retail Sales Control Group in the United States disappoints at 0% vs 0.3% in September, adding to the negative sentiment on the US Dollar.

- The Fiber is trading at levels not seen since mid-September.

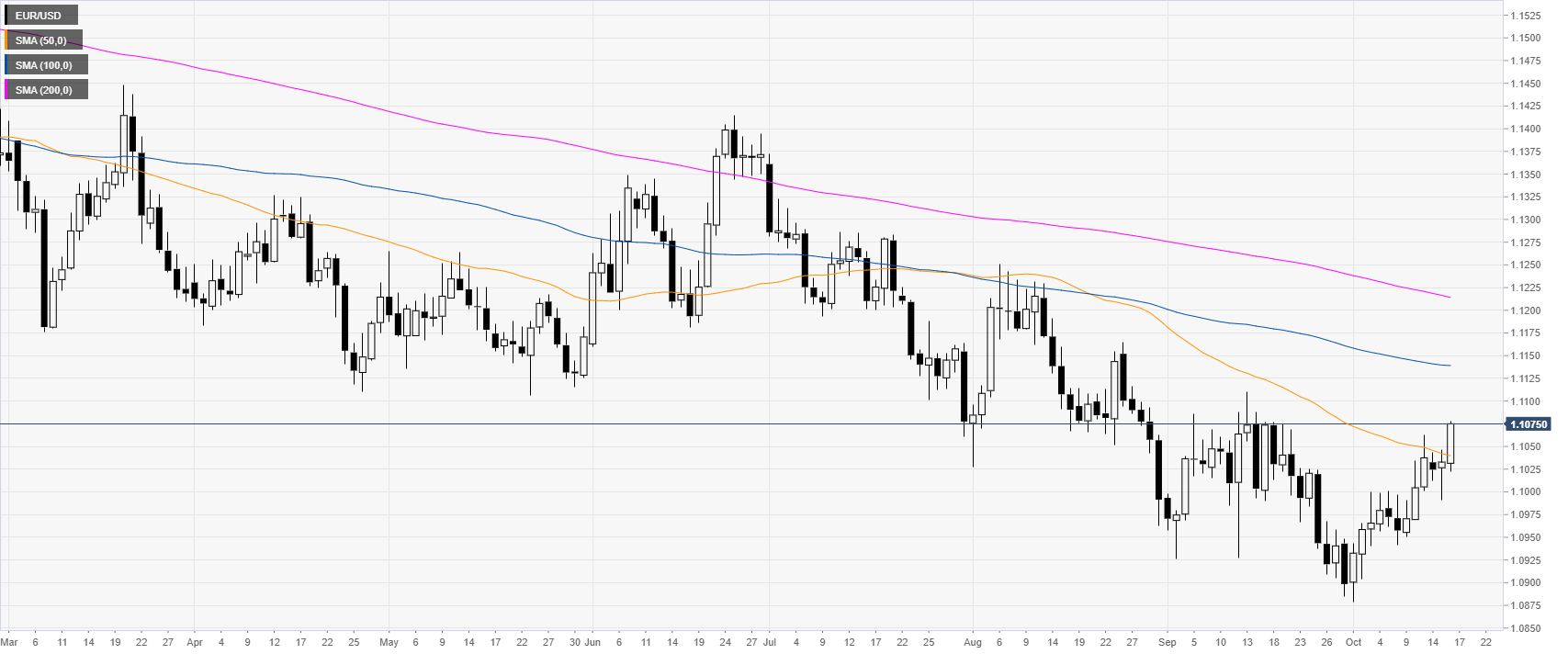

EUR/USD daily chart

On the daily chart, the shared currency is trading in a bear trend below the 100 and 200-day simple moving averages (DSMAs). The Euro is trading at levels not seen since mid-September. Additionally, the Retail Sales Control Group in the United States came out below expectations at 0% vs 0.3% for September, adding to the negative sentiment on the Greenback.

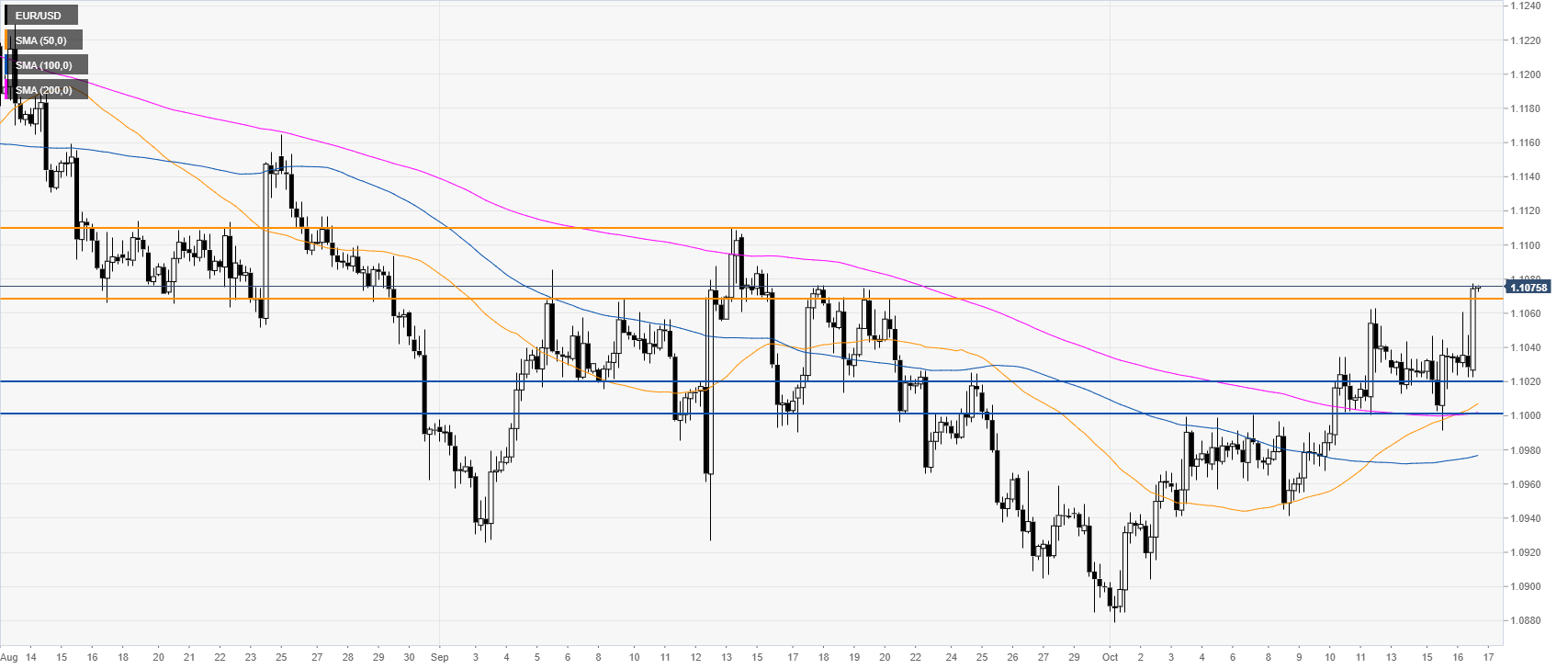

EUR/USD four-hour chart

The Fiber is trading above its main SMAs, suggesting bullish momentum in the medium term. EUR/USD is trying to settle above the 1.1069 resistance. A daily close above the level can lead to further gains towards the 1.1100 level, according to the Technical Confluences Indicator.

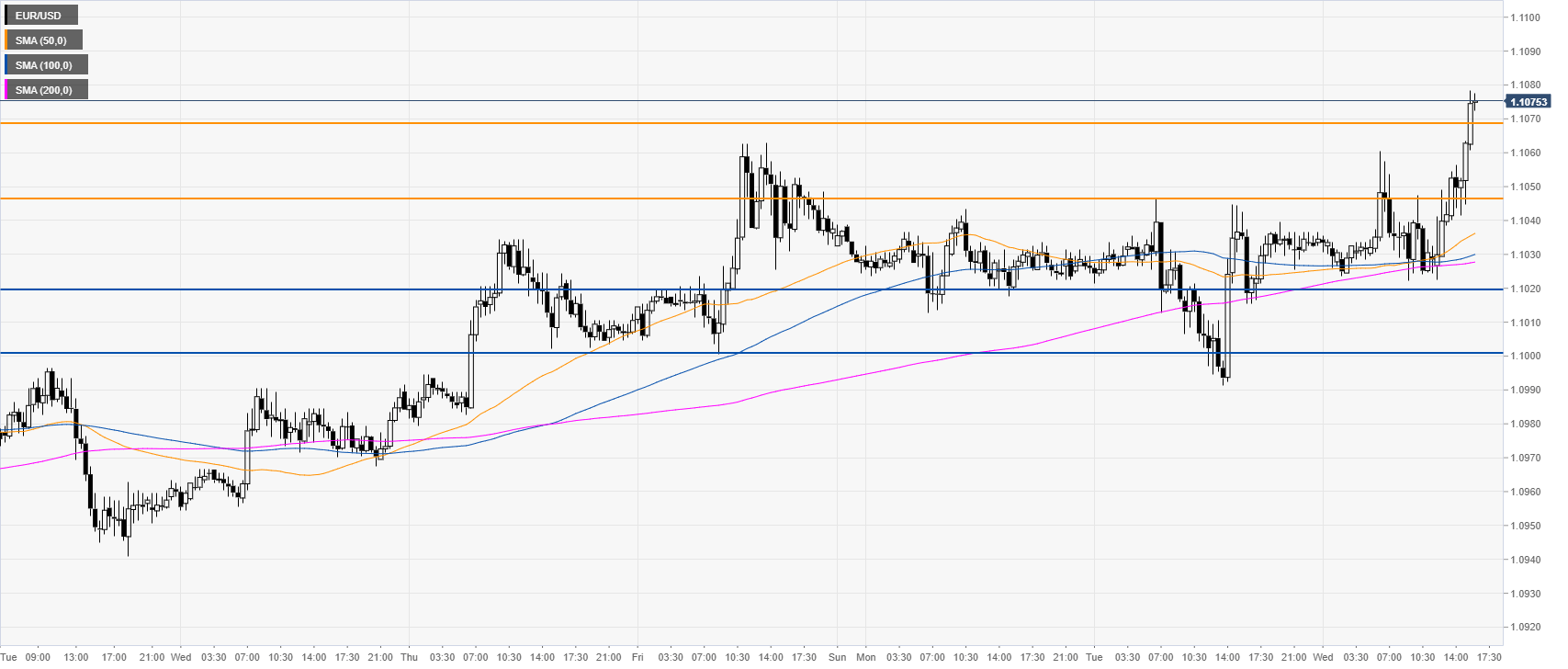

EUR/USD 30-minute chart

EUR/USD is trading above its main SMAs, suggesting bullish momentum in the near term. Support can be seen at the 1.1046 and 1.1020 price levels.

Additional key levels