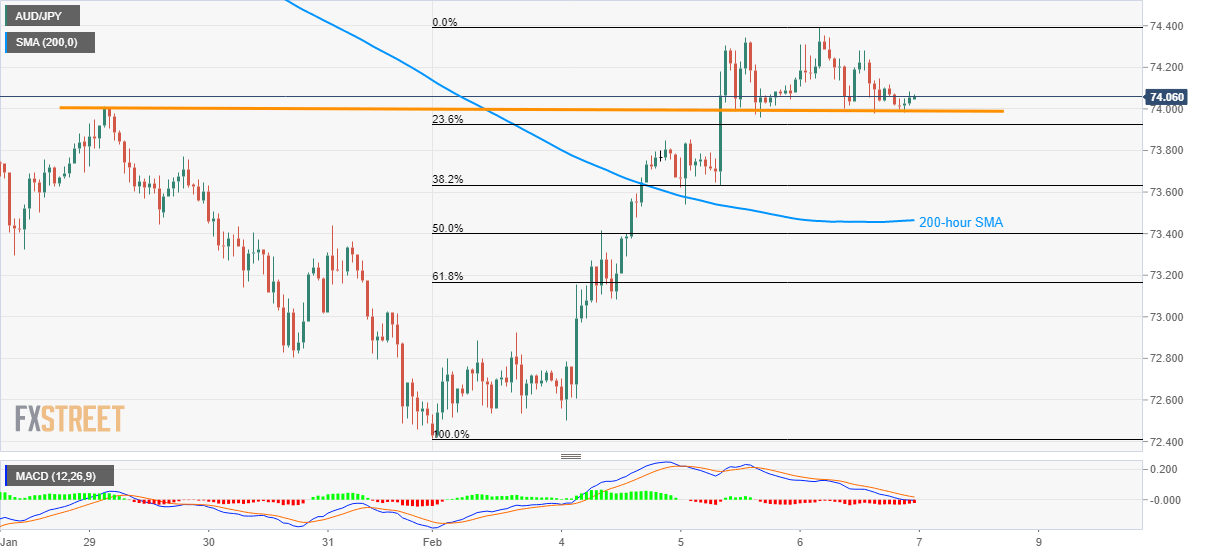

- AUD/JPY registers multiple pullbacks from the key horizontal support.

- Bearish MACD, lower high signal further downside towards 200-hour SMA.

- 100/200-day SMAs guard the pair’s near-term upside.

AUD/JPY trades mildly positive to 74.05 by the press time of early Asian session on Friday. In doing so, the pair takes another U-turn from one-week-old horizontal support. The pair’s latest moves could be attributed to the RBA Governor Philip Lowe’s speech.

Read: Breaking: RBA’s Lowe says economic growth to pick up to 2¾ percent this year and 3 percent over 2021

While the short-term support becomes the key, pair’s lower high formation from early Thursday and bearish MACD favor the sellers.

Hence, a downside break of 74.00 can fetch the quote to 38.2% Fibonacci retracement of the pair’s upside from February 02 to 06, at 73.63 now. Though, a 200-hour SMA level of 73.47 could restrict the quote’s further weakness.

In a case prices keep trading southwards below 200-hour SMA, 73.00 round-figure will be on the bears’ radars.

Alternatively, 100-day and 200-day SMAs limit the pair’s near-term upside around 74.35/40, a break of which could recall 75.00 on the charts.

AUD/JPY hourly chart

Trend: Pullback expected