- DXY is trading at levels not seen since May 2017.

- The level to beat for buyers is the 99.20 resistance.

- The FOMC Minutes will be released at 19.00 GMT.

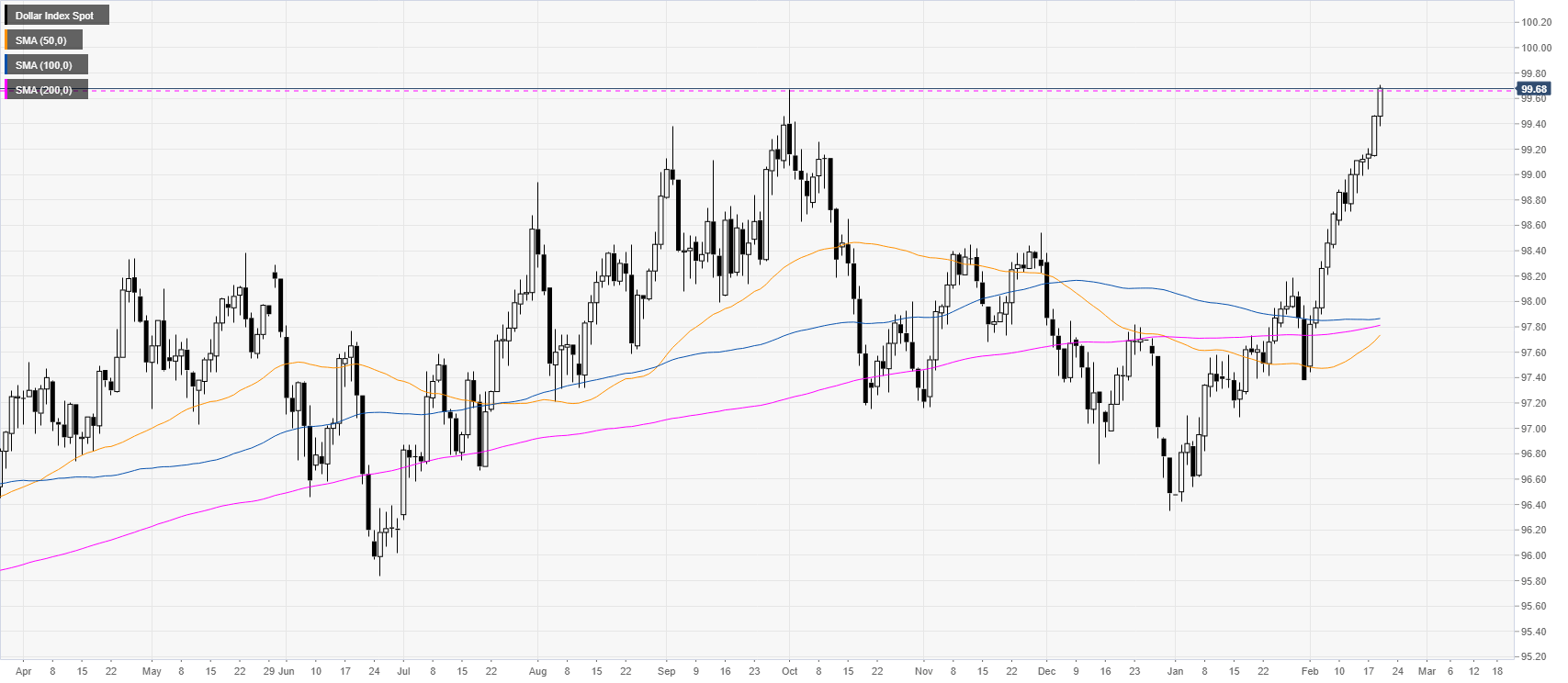

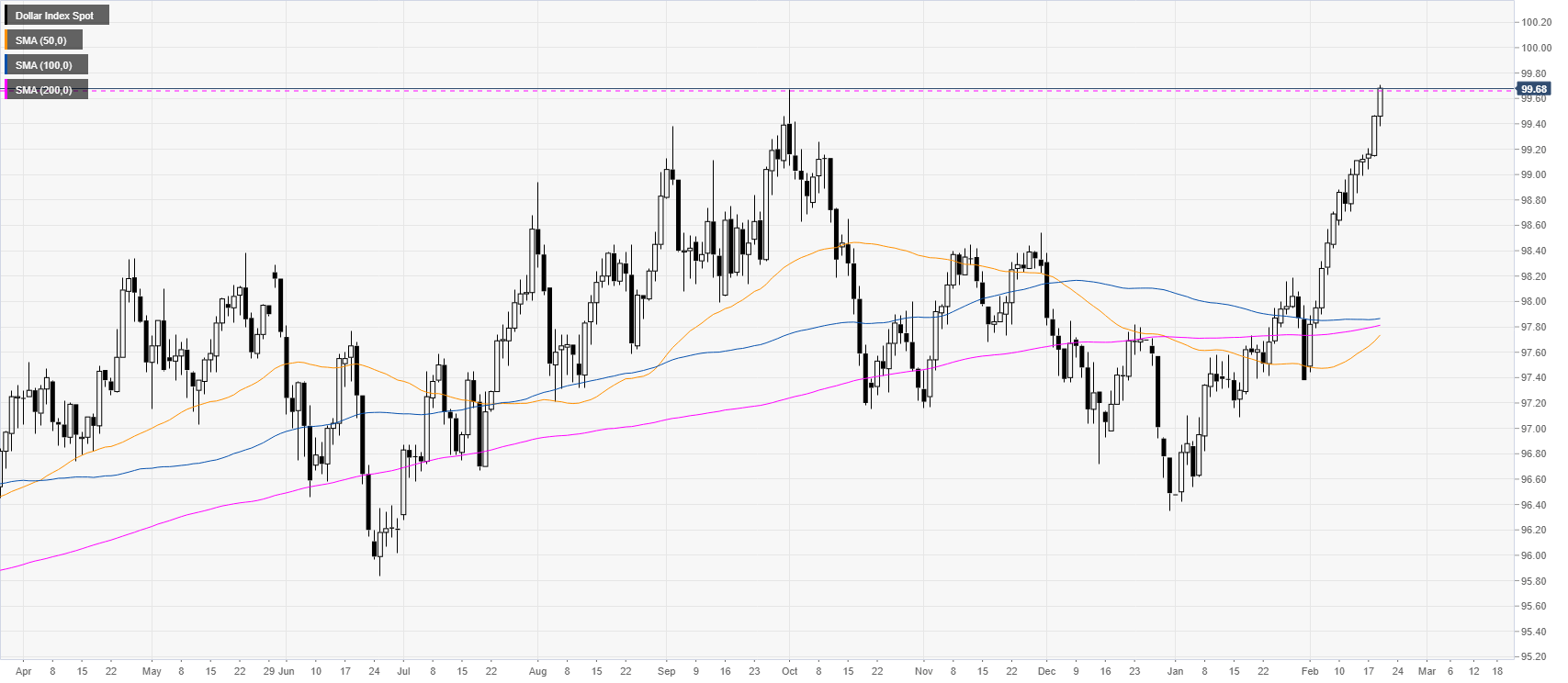

DXY daily chart

The US dollar index (DXY) is challenging the 2019 highs at 99.67 while trading on an intraday basis as high as 99.71 this Wednesday ahead of the FOMC Minutes. This is the highest level since May 2017.

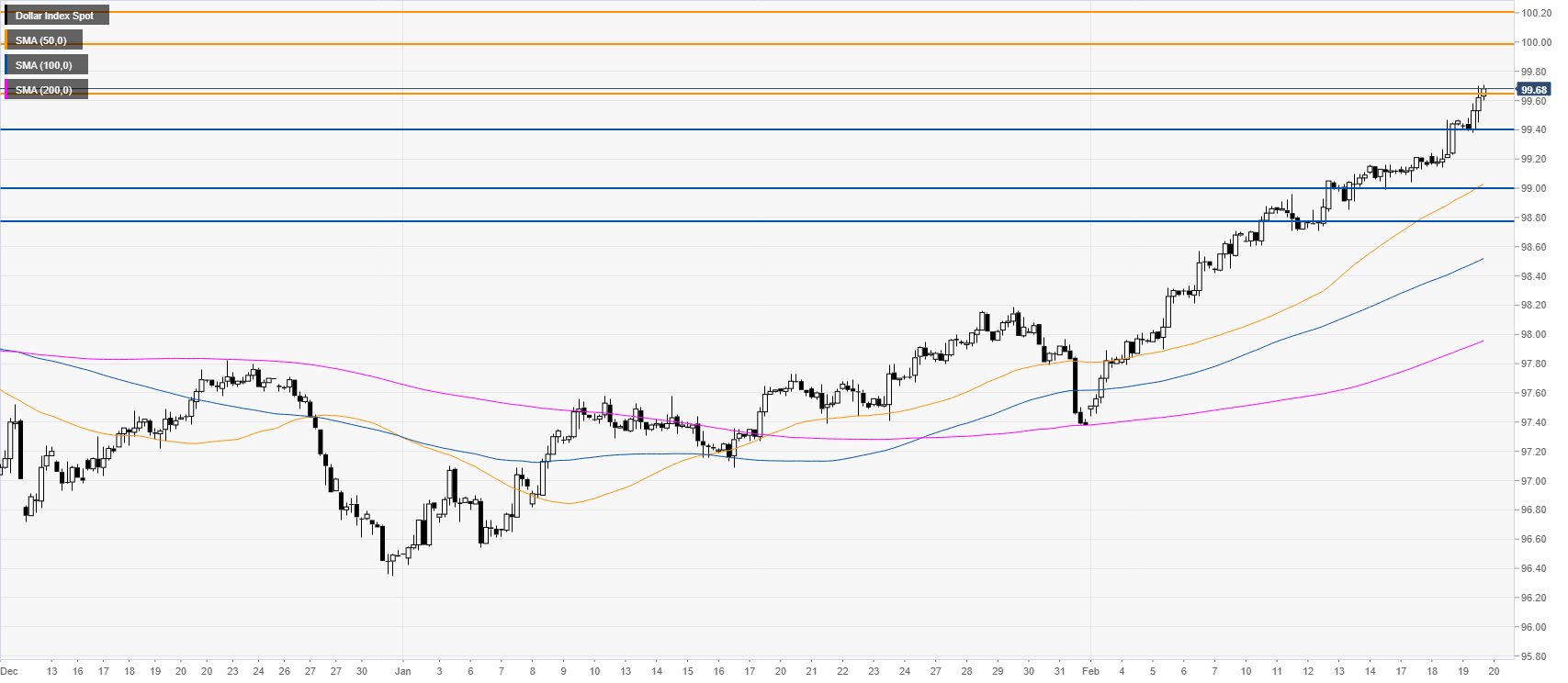

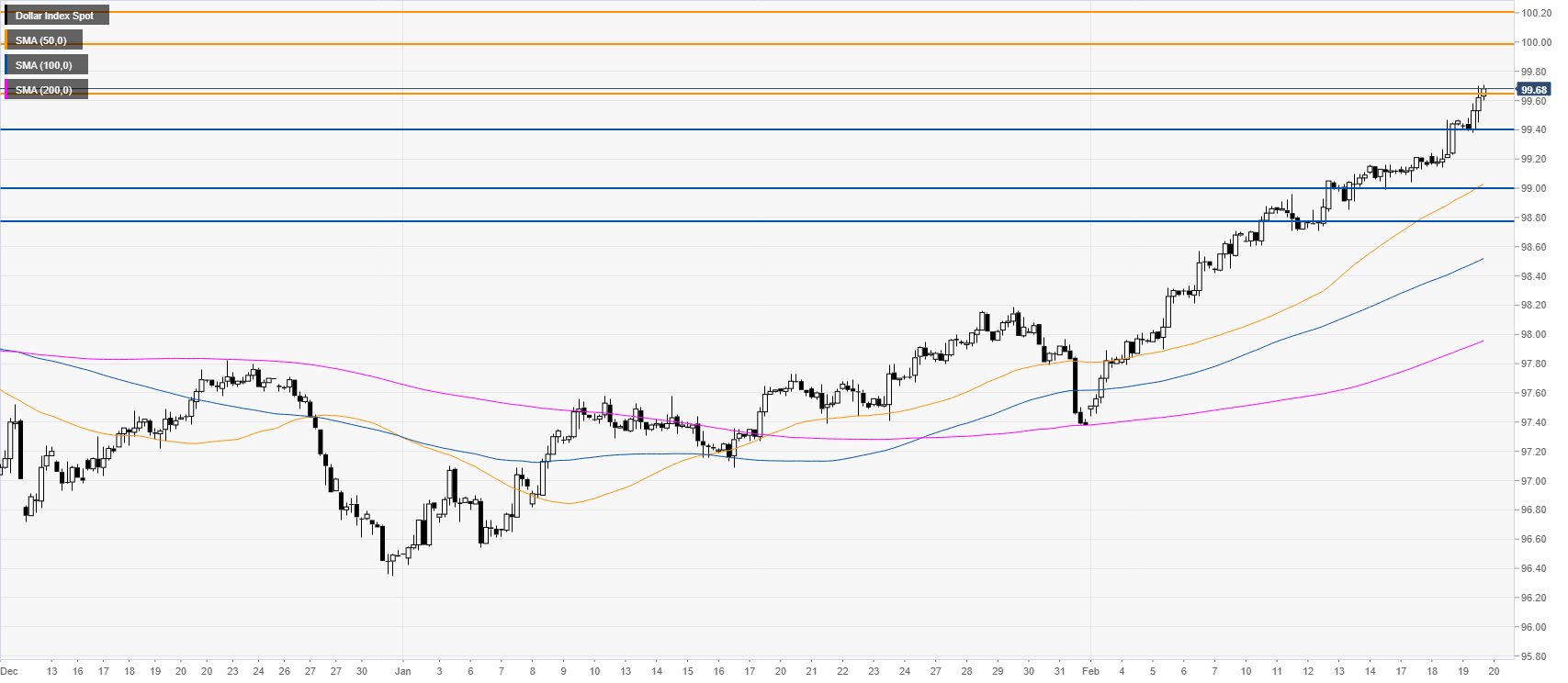

DXY four-hour chart

The bullish pressure remains unabated as DXY is trading near 45-month highs. After the break of 99.67 (2019 high) the bulls are looking to extend gains towards the 100.00 figure and the 100.20 level. Support is seen near 99.40 and 99.00 figure

Additional key levels