- Prices of the WTI shed more than 4% to the sub-$51.00 zone.

- Coronavirus fears re-emerge and weigh on traders’ sentiment.

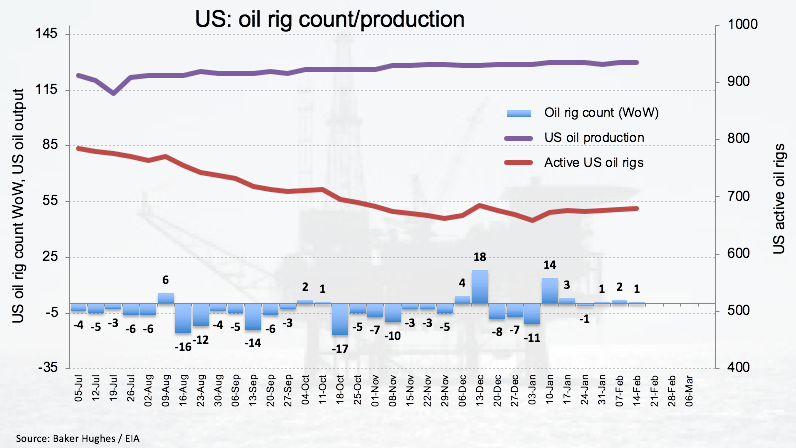

- US oil rig count went up by 1 during last week to 679 active oil rigs.

Prices of the WTI are trading deep into the negative territory at the beginning of the week, breaching the key support at the $51.00 mark per barrel and slipping back to fresh multi-day lows at the same time.

WTI weaker on COVID-19 concerns

Prices of the West Texas Intermediate are losing ground for the third consecutive session on Monday after climbing to fresh monthly tops beyond the $54.00 mark per barrel on Thursday.

Renewed an increasing concern on the Chinese coronavirus and its impact on global growth are badly hurting the risk-associated complex on Monday, forcing crude oil prices to give away nearly 5% to levels below the $51.00 mark.

Also collaborating with the downside, the OPEC+ has decided to leave unchanged the date of the next meeting on March 6th, while Russia refused to implement deeper cuts to the oil output under the current agreement.

Further out, US crude oil supplies remained on the rise during last week as per the API and EIA reports, while driller Baker Hughes reported that US oil rig count went up by one to 679 active oil rigs, also during last week.

What to look for around WTI

The rebound in crude oil prices from YTD lows in the $49.30 region seems to have run out of impetus above the $54.00 mark per barrel so far. In the very near term, jitters surrounding the fast-spreading COVID-19 are expected to keep weighing on prices along with persistent worries over the excess of supply of the markets. On the supportive side – albeit relegated by the current coronavirus developments – emerges the situation in Libya, which not only remains unsolved, but it is also worsening by the day. No news instead from the OPEC+, which is due to meet early in March.

WTI significant levels

At the moment the barrel of WTI is losing 4.83% at $50.62 and a breach of $50.00 (key support level) would aim for $49.31 (2020 low Feb.5) and finally $42.20 (2018 low Dec.24). On the upside, the next hurdle aligns at $54.40 (monthly high Feb.20) seconded by $56.29 (200-day SMA) and then $59.73 (high Jan.20).