- AUD/JPY fails to extend the recovery moves.

- RBA’s FSR cites risks to the financial system that was earlier strong.

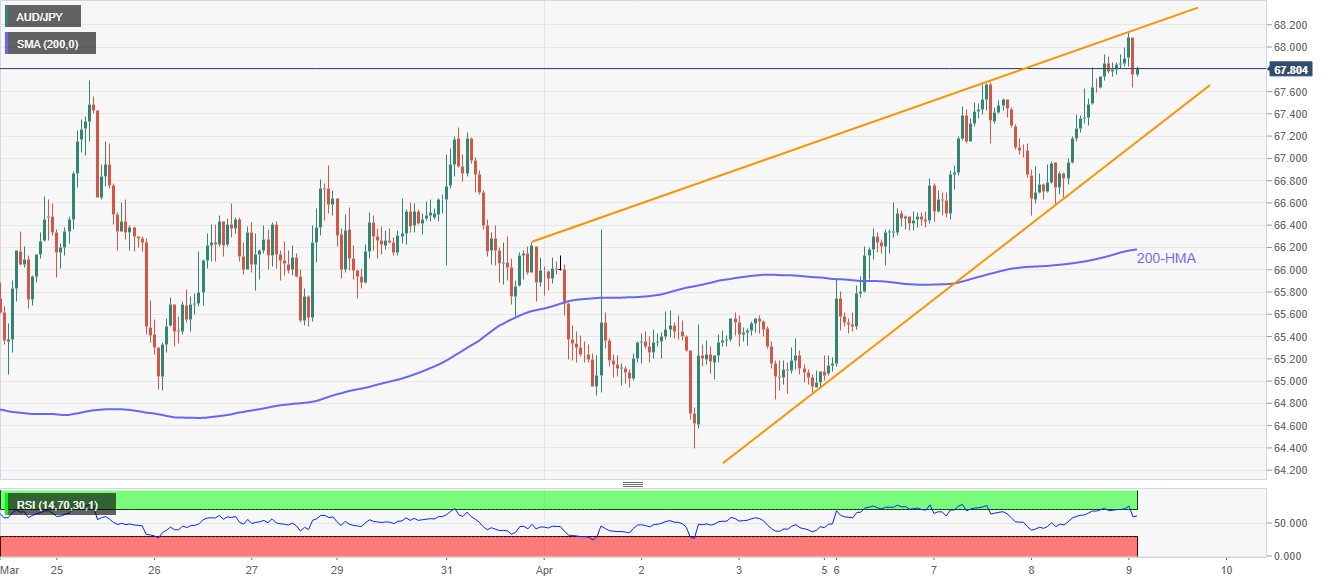

- Sellers will wait for the confirmation of the bearish chart pattern.

- Bulls will aim to fill the early-March gap during fresh advances.

With the RBA’s Financial Stability Review (FSR) citing downside risks, AUD/JPY drops from the short-term rising trend line to the intraday low of 67.64, currently around 67.78, during the early Thursday.

Read: RBA’s Financial Stability Review: Financial system was in a strong position heading into virus impacts, faces increased risks

The pair’s pullback from the key resistance line also takes clues from the overbought RSI conditions, which in turn suggests further declines towards the formation support, at 67.15 now.

If at all AUD/JPY prices drop 67.15, it confirms the bearish pattern and indicates the fall towards 63.00. However, a 200-HMA level of 66.18 can offer an intermediate halt during the declines.

Alternatively, the pair’s recovery moves beyond 68.16 will defy the pattern and escalate the run-up to fill the early-March month gap below 69.60.

AUD/JPY hourly chart

Trend: Pullback expected