- USD/CHF snaps four-day losing streak while bouncing off the five-week low.

- 200-day EMA acts as the key upside barrier.

- Late-March lows can offer intermediate halts between the key Fibonacci retracement support levels.

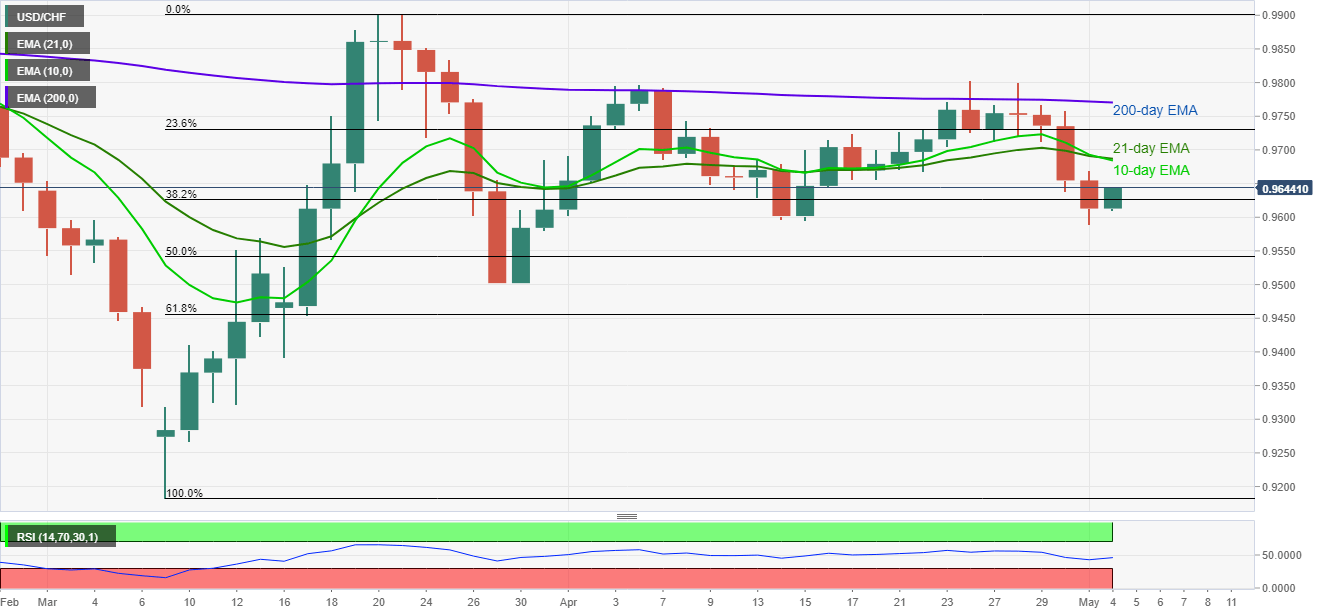

USD/CHF takes the bids to 0.9645, up 0.35% on a day, ahead of the European session on Monday. In doing so, the quote bounces off the five-week bottom while heading towards a confluence of 21-day and 10-day EMAs.

Other than 0.9685/90 immediate resistance, a 200-day EMA level of 0.9770 also acts as a tough upside barrier to crack for the buyers, which if broken could escalate the recovery moves towards April top above 0.9800.

Meanwhile, a daily close below March 31 low near 0.9580 can drag the USD/CHF prices to 50% Fibonacci retracement level of March-month upside, around 0.9540.

During the quote’s further downside past-0.9540, late-March month bottoms surrounding 0.9500 and 61.8% Fibonacci retracement around 0.9455 could lure the bears.

USD/CHF daily chart

Trend: Pullback expected