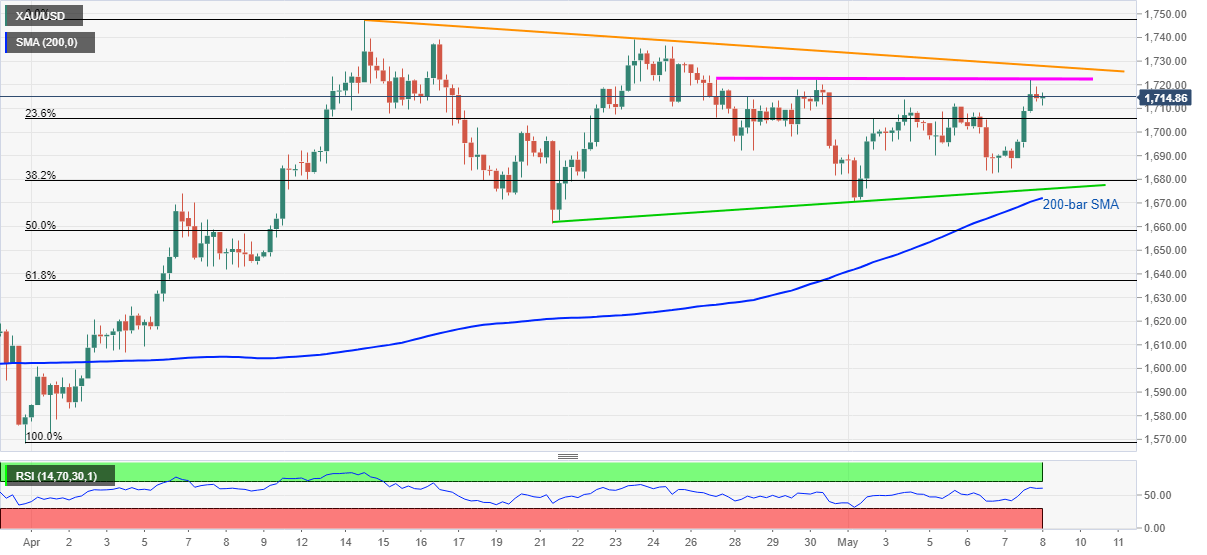

- Gold again aims to break nine-day-old horizontal resistance.

- A three-week-old falling trend line adds to the upside barriers.

- A short-term support line, 200-bar SMA restrict immediate downside.

Gold prices maintain the retreat from the weekly top while taking rounds to $1,715 during Friday’s Asian session.

In doing so, the bullion registers another U-turn from a nine-day-old horizontal resistance, which in turn keeps sellers hopeful.

As a result, intraday bears are looking for entries below $1,700 to aim for a two-week-long support line, at $1,675. Though, 200-bar SMA near $1,672 could restrict the metal’s further downside.

Meanwhile, an upside clearance of $1,722/23 horizontal resistance isn’t a sure sign for the safe-haven’s run-up as a falling trend line from April 14, currently at $1,728, can check the buyers afterward.

Should buyers manage to cross $1,728, their run towards the previous month high surrounding $1,748 can’t be ruled out.

Gold four-hour chart

Trend: Pullback expected