- GBP/JPY struggles to extend three-day winning streak of the key UK inflation data.

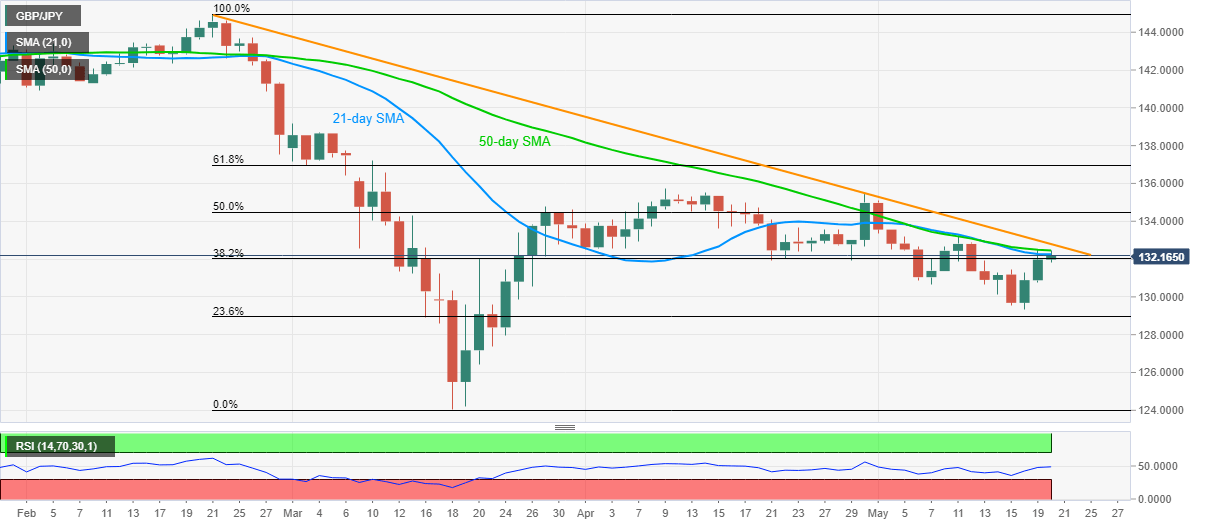

- A confluence of 21/50-day SMA, three-month-old falling trend line keep buyers in check.

- Sellers may aim for 130.00 during fresh downside.

GBP/JPY stays depressed around 132.15, up 0.13% on a day, during the pre-UK session on Wednesday.

While the buyers are waiting for the UK’s April month Consumer Price Index (CPI) data for fresh impulse, a confluence of key SMAs and a multi-day-old resistance line keep sellers hopeful ahead of the release.

Read: When are the UK CPIs and how could they affect GBP/USD?

Should the headline inflation figures disappoint the pair buyers, 130.00 round-figure could regain market attention ahead of the monthly low near 129.30.

On the contrary, a surprise positive data will not only have to cross 132.25/45 SMA confluence but also the descending trend line from February 21, at 132.80 now.

In doing so, the bulls can aim for April 30 high near 135.45, followed by the previous monthly top surrounding 135.75.

GBP/JPY daily chart

Trend: Pullback expected