- USD/JPY refreshes two-day low under 107.50 following the fresh risk aversion wave.

- BOJ’s stimulus for small and medium-sized figures, updates from China heavy the pair.

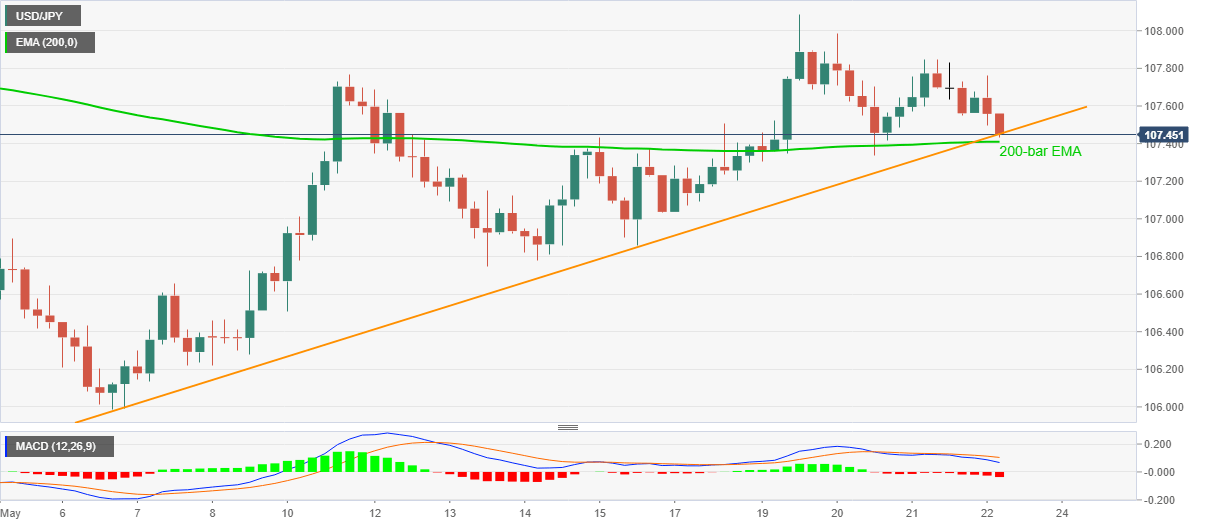

- A 12-day-old support line, 200-bar EMA restrict immediate declines.

USD/JPY extends its post-BOJ fall to refresh the intraday low of 107.44, down 0.14%, during the pre-European session on Friday.

In addition to the BOJ’s status-quo, the latest updates from China’s 13th National People’s Congress (NPC) also exert downside pressure on the pair.

Even so, the sellers await a clear break below an upward sloping trend line from May 06, as well as trading under 200-bar EMA, currently near 107.40, to further stretch the south-run towards 107.00 round-figure.

In a case where the pair keep declining below 107.00, May 13 low near 106.75 will be on the bears’ radars.

On the contrary, buyers will hesitate to enter unless the pair crosses 107.85. Following that, multiple highs marked since mid-April around 108.10 becomes the key to watch.

USD/JPY four-hour chart

Trend: Further downside expected