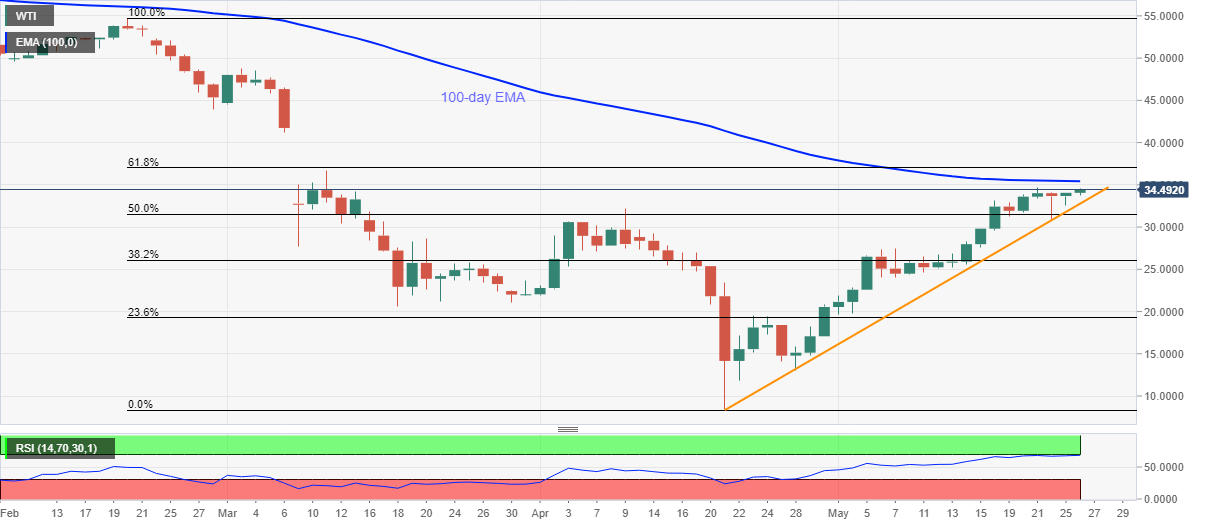

- WTI remains above the monthly support line, marks four-day high beyond $34.00.

- 100-day EMA has been restricting the upside since last four months.

- Seller may catch a breath near $30.00 in a case of declines below a short-term rising trend line.

WTI remains on the bid near $34.44, up 1.12% on a day, while heading into the European session on Tuesday.

The black gold currently trades near three-day high as following an ascending trend line from April 21.

Even so, a 100-day EMA level of $35.43 is likely to again challenge the bulls amid overbought RSI conditions, which if ignored could propel the quote towards 61.8% Fibonacci retracement of February-April fall, near $37.00.

Alternatively, a daily closing below the monthly support line, currently near $32.75, could trigger fresh selling pressure that can recall $30.00 on the charts.

Though the bears’ additional dominance beneath $30.00 might not hesitate to recall the early-Month tops near $27.50.

WTI daily chart

Trend: Bullish