- Gold bulls extend control in the European session.

- US-China woes over the Hong Kong issue fuels the upside.

- Technical set up has turned in favor of the bulls in the near-term.

Gold prices (XAU/USD) snap three-day losing streak and rebound sharply on Thursday, mainly driven by the increased flight to safety buying, as the US-China tensions spike up over the Hong Kong security issue.

Investors fret over a likely Trump administration’s response to Beijing’s forceful act on Hong Kong, which could revive the trade war between both the economies.

Alongside the bullish fundamental factors, the short-term technical set up has also turned in favor of the XAU bulls, which is likely to translate into further gains for the yellow metal.

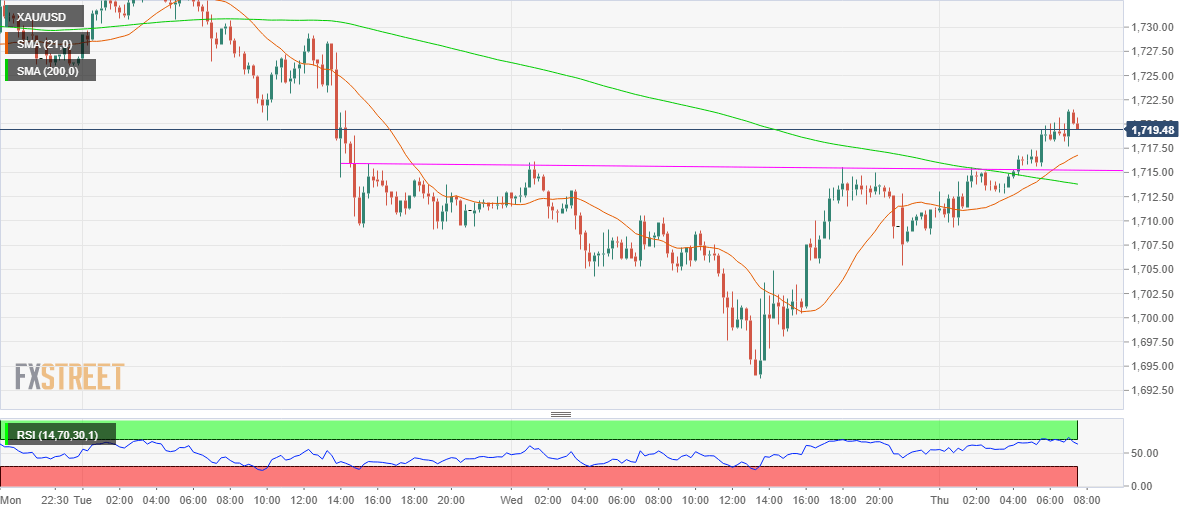

The price has confirmed an inverse head and shoulders breakout on the 15-minutes chart, following a convincing break above the pattern neckline located at 1715.40.

Subsequently, the buying pressure intensified, driving the rates to hit a fresh two-day high at 1721.66 before reversing slightly to around 1720 levels, where it now wavers.

The upside break towards the pattern target of 1736.53 is also backed by the bulls’ conviction, especially after the spot breached the bearish 200-bar Simple Moving Average (SMA) from below. En route the pattern target, gold may face stiff resistance at 1730 (round number).

Should the bulls face exhaustion, the price could pull back towards the upward sloping 21-bar SMA at 1716.21, below which the pattern neckline will get tested.

All in all, the upside bias appears more compelling, with the Relative Strength Index (RSI) probing the overbought territory near the 65.50 region.

Gold: 15-minutes chart

Gold: Additional levels to watch