- AUD/JPY’s bulls could face some exhaustion above 75.00.

- 4-hour chart stays bullish, but signals caution.

- Will the spot sustain the gains ahead of US data, RBA?

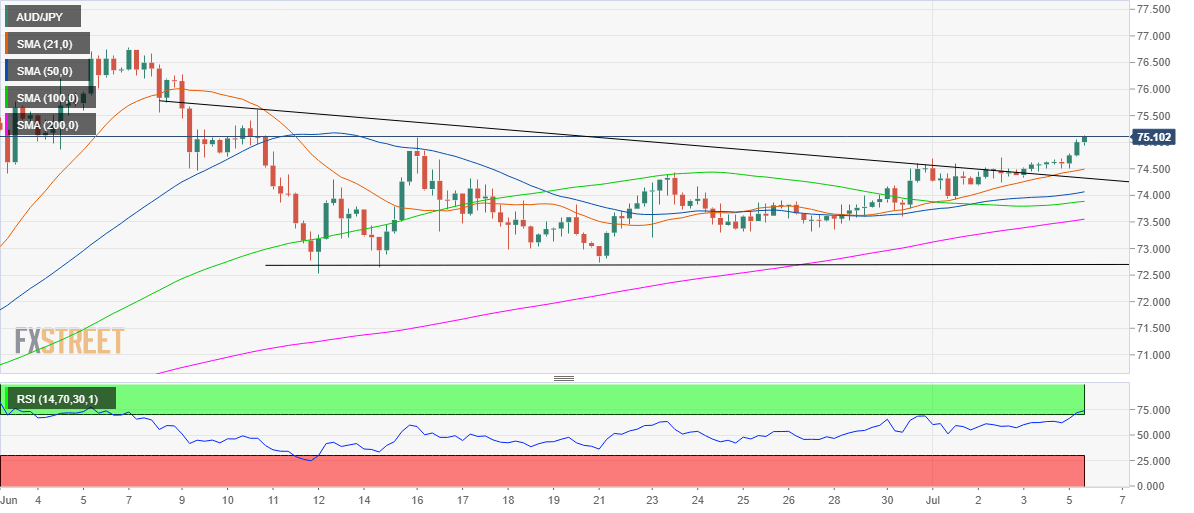

AUD/JPY spotted a descending triangle breakout on the four-hour chart this Monday, with the risk-on mood having emerged as the main catalyst supporting the bullish break.

The price hit fresh session highs at 75.13 before retreating slightly to battle the 75 handle ahead of the European open. The bulls are seen facing some exhaustion, as the 4-hour Relative Strength Index (RSI) has extended into the Overbought territory.

Therefore, the cross could enter a phase of upside consolidation before embarking upon its journey towards pattern target near 77.50 levels in the coming days.

To the downside, the 21 4-hour SMA at 74.49 could offer immediate respite to the bulls below which the pattern resistance-turned-support could be tested.

Looking at the hourly chart, the spot has confirmed a symmetrical triangle breakout in early Asia, having pierced through the falling trendline (pattern) resistance at 0.6943.

A break below the strong support around 74.00, the confluence of the 50 and 100 4-hour SMAs will negate the near-term bullish bias.

AUD/JPY 4-hour chart

AUD/JPY additional levels