- It has been a mixed day in the equities markets and the VIX has reflected that.

- The volatility index is now 0.18% lower at 27.9 on Thursday.

Fundamental backdrop

It has been a mixed session in the equities markets on Tuesday. All of the major cash markets are trading in the red, led by the Dow which currently trades 0.78% lower. In terms of winners and losers (S&P 500), CBOE global is struggling down around 10% after the company completed its acquisition of EuroCCP, the pan-European equities clearing house last week. CBOE was also downgraded to “neutral” from “overweight” at Piper Sandler as the research firmed cited lighter volumes. On the topside, Rollins are up over 8% as the firm anticipates Q2 revenue to grow low to mid-single digits against the consensus of -7.8% from USD 523.96mln revenue in 2Q19.

Technical levels (4-hour chart)

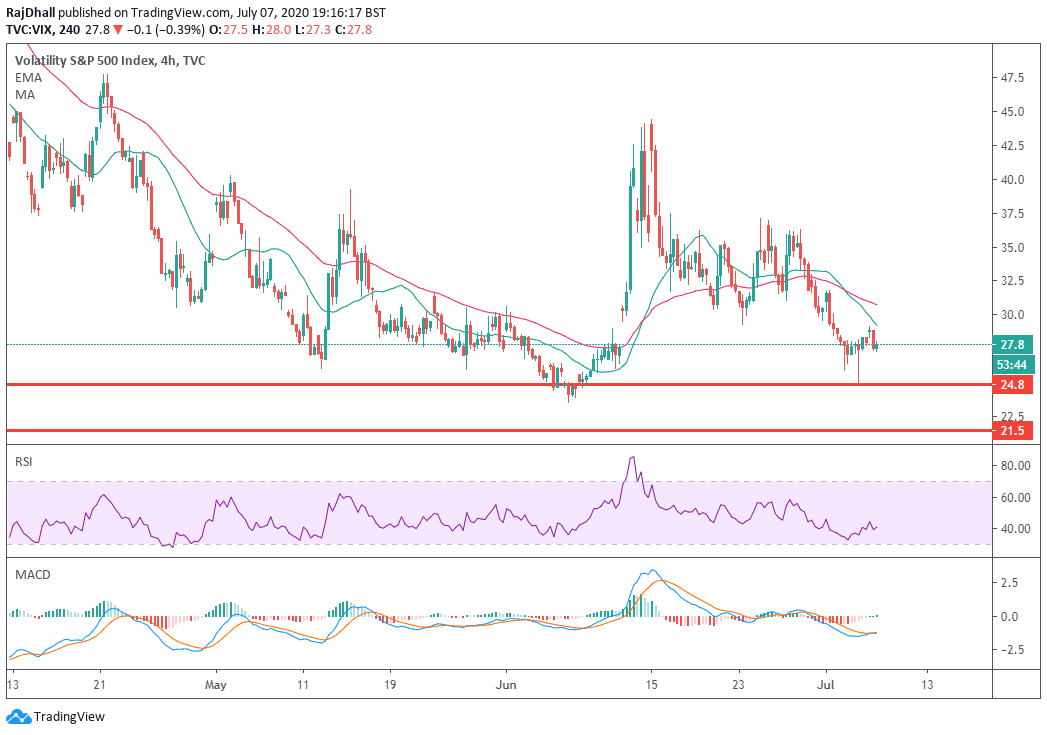

Looking at the chart, after a blip higher at the start of the session the VIX has now dropped. The price is in a clear downtrend since 15th June and this latest move could cement the index’s status below 30 which could also be the next resistance point. On the downside, the main support is around 24.9. This is where the price met some support with the red hammer candle on Monday’s session. Below that, the main support on the chart is at 21.5 as if this level breaks it would take the VIX into its historical normal range.