- The index loses further momentum and approaches 89.00.

- Investors continue to favour the risk complex in detriment of the dollar.

- FOMC Minutes, ADP report, Factory Orders next of relevance in the docket.

The greenback, in terms of the US Dollar Index (DXY), keeps losing ground and trades in fresh lows in the 89.20 region.

US Dollar Index looks to Georgia, data

The index trades with losses for the fourth consecutive session on Wednesday and reaches the 89.20 region – or April 2018 lows – opening the door at the same time for a potential challenge of the 89.00 mark.

The risk complex remains the sole beneficiary of the current upbeat sentiment among market participants, particularly following rising speculations of a Democrat win in Georgia, and with it, the increasing probability of extra stimulus under the Biden’s administration.

On the data space, the ADP report will take centre stage in the first turn seconded by Factory Orders, Markit’s final Services PMI, the EIA’s weekly report and the Minutes of the latest FOMC meeting.

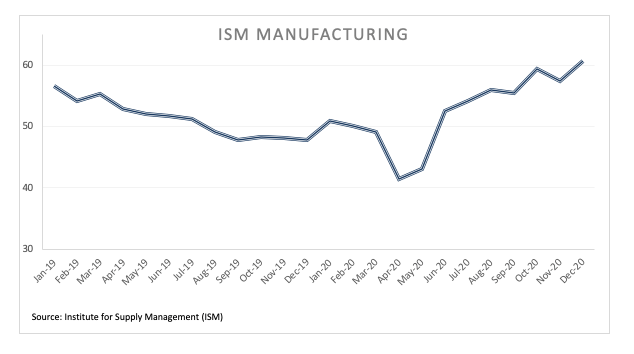

On Tuesday, the always-relevant ISM Manufacturing surprised to the upside at 60.7 during the last month of 2020, adding to the view that a strong economic rebound remains well on the cards.

What to look for around USD

The index regains downside momentum at the start of the new year, always on the back of the broad-based upbeat mood in the risk-associated universe. In addition, the outlook for the greenback remains immersed into the bearish side amidst extra monetary/fiscal stimulus in the US economy, the “lower for longer” stance from the Federal Reserve and prospects of a strong recovery in the global economy.

US Dollar Index relevant levels

At the moment, the index is retreating 0.16% at 89.29 and faces the next support at 89.22 (2021 low Jan.6) followed by 88.94 (monthly low March 2018) and the 88.25 (monthly low February 2018). On the upside, a breakout of 91.01 (weekly high Dec.21) would aim for 91.23 (weekly high Dec.7) and finally 91.92 (23.6% Fibo of the 2017-2018 drop).