- WTI prints mild gains after refreshing the highest level since late February 2020.

- Overbought RSI, key upside hurdle challenge bulls, sellers await entries below 21-day EMA.

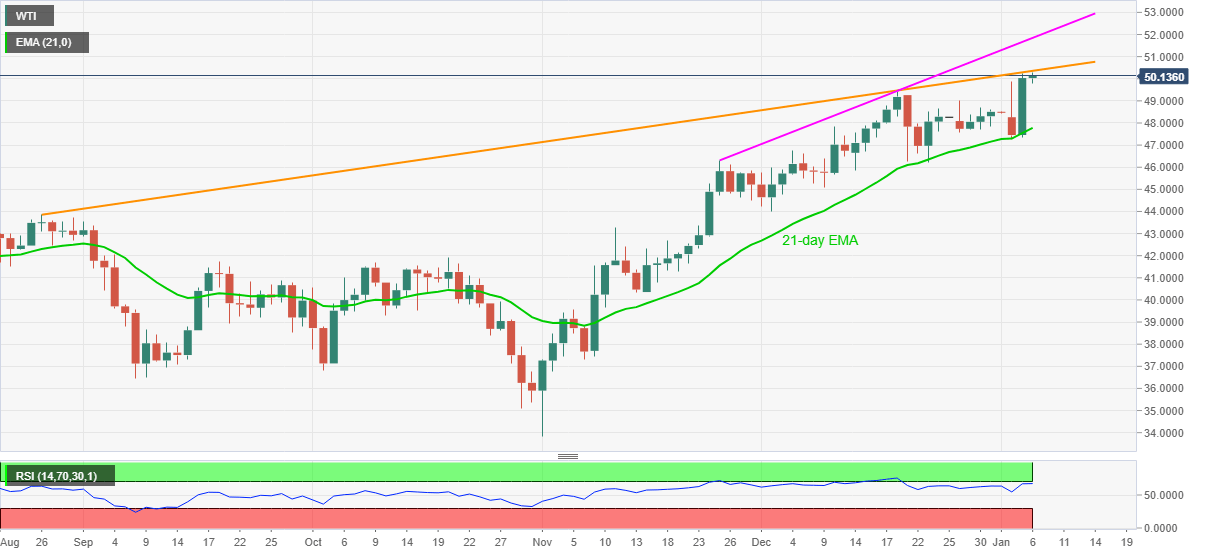

Having recently refreshed a 10-month-high with $50.30, WTI takes rounds $50.20, up 0.36% intraday, during early Wednesday. In doing so, the oil benchmark confronts an upward sloping trend line from August 26, 2020, amid overbought RSI.

Considering the strong resistance line and RSI conditions, WTI is likely to witness pullback moves towards the December high of $49.43 for a short-term. However, any further downside will be tested by 21-day EMA near $47.80.

Should oil sellers sneak in below $47.80, highs marked in November and August, respectively around $46.30 and $43.85, will be in the spotlight.

On the contrary, the commodity’s upside break of the immediate resistance line, at $50.35, will direct the WTI bulls to October 2019 low near $51.00.

Also acting as the key resistance is an ascending trend line from November 25, at $51.85 now, a break of which can challenge the February 2020 peak surrounding $54.70.

WTI daily chart

Trend: Pullback expected