- EUR/GBP trades a little lower on Thursday amid some technical selling.

- The euro sold off versus GBP and EUR ahead of downbeat Eurozone data.

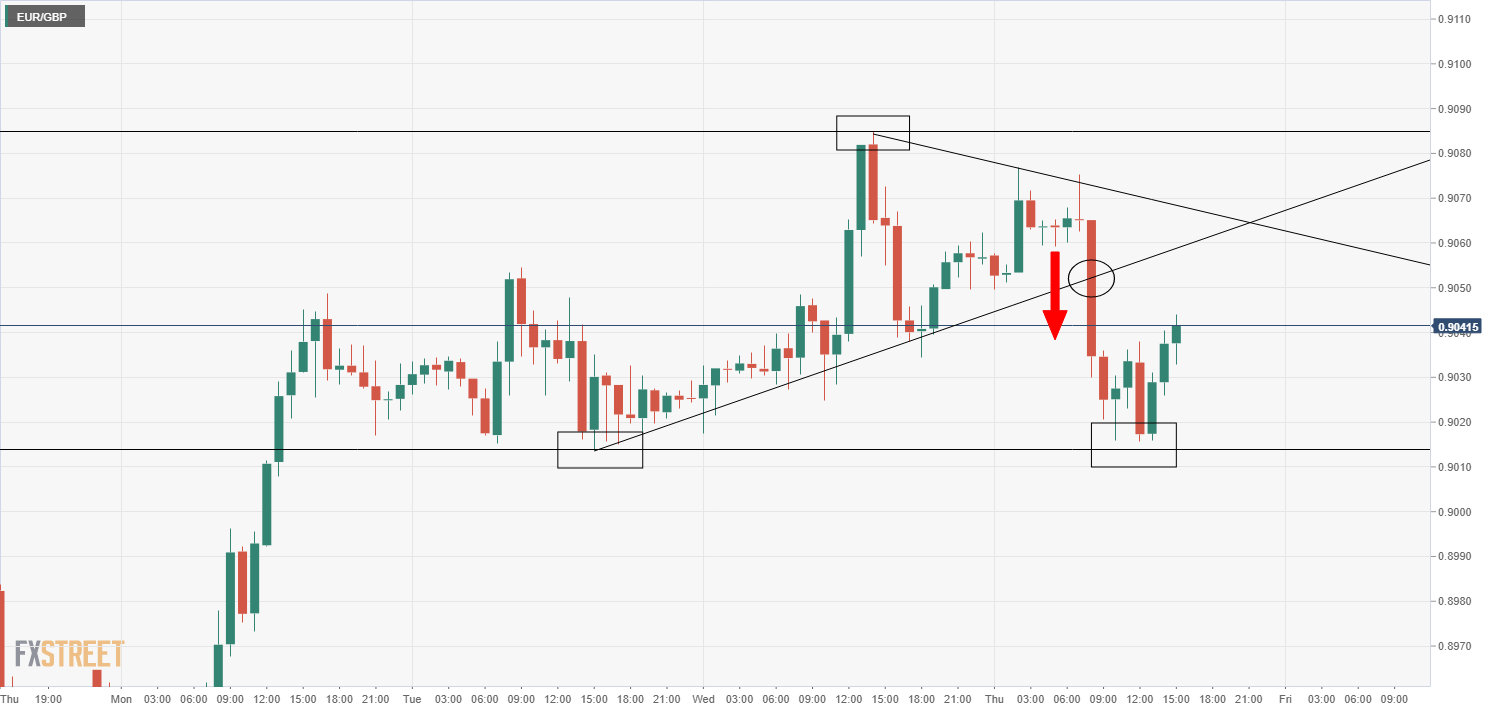

EUR/GBP has is off sub-0.9020 lows and trading in the 0.9030s but continues to trade a reasonable amount below its Thursday opening level at 0.9055 and under the 0.9050 level. Technical selling appears to have been in play upon the break of a short-term uptrend.

After the US dollar, pound sterling is the next best performing G10 currency, lower by roughly 0.3% on the day versus the buck. Meanwhile, while EUR is not the worst performing G10 currency on the day (AUD, NZD, JPY and CHF are all lower by between 0.7-0.8%), it is fairing substantially worse than sterling on the day and is down about half a percent versus the US dollar. EUR/GBP thus trades with losses of around 0.1%, which translates into about 10 pips, on the day.

Euro drops versus the pound

Eurozone data on Thursday was poor on balance; German Industrial Orders for November were much stronger than expected, rising at a MoM pace of 2.3% versus expectations for a -1.2% drop. However, preliminary Eurozone inflation numbers for December were disappointing; headline inflation (HICP) came in at -0.3% YoY, lower than expectations for -0.2% and unchanged from November’s annual HICP reading of -0.3%. The Eurozone has now been in deflation for three months. The core and super core measures came in as expected and in marginally positive territory on an annual basis.

Inflation is expected to pick up marginally from here on out; the German VAT reduction ends, the negative impact on prices from the oil price drop earlier on in 2020 will start to fade and most expect service price inflation to pick up later in 2021 as the industry reopens as the virus is brought under control. Whether this pick up will take inflation back anywhere close to the ECB’s inflation target is another question entirely (unlikely, think most analysts). EUR’s continual appreciation against the USD certainly makes this more difficult.

Meanwhile, November retail sales numbers were also released and made for ugly reading; the annual rate of retail sales growth dropped 2.9% in the month versus expectations for an expansion of 0.8%. The MoM rate of contraction was an even steeper -6.1% versus expectations for a more modest 3.4% drop in retail spending on the month. The drop in spending was predominantly triggered by closures of non-essential businesses across the bloc as countries struggle to contain the Covid-19 outbreak.

Though Thursday’s data did not make for upbeat reading, most of EUR’s depreciation versus USD and GBP occurred before its release. Thus, the move lower in USD cannot be explicitly pinned on the downbeat data. It looks as though the move might have in part been technically driven upon a break below a short-term uptrend. The pair now appears to be ranging within its recent intra-day ranges as markets look for fresh direction.

Opposing views on EUR/GBP from MUFG versus Rabobank

Rabobank are bullish…

“While the UK’s relatively rapid roll-out of its vaccine programme is allowing optimism for H2 to persist, headlines surrounding the risk of a ‘double-dip’ recession have been appearing in reference to the souring of the outlook for the early months of this year. The market is also pricing in an increased risk of a 10 bp rate cut from the BoE later this year, though we may have to wait for the Bank’s next policy meeting on February 4 for further policy clues.”

“In addition to economic hurdles, politics also has the potential to weigh on the GBP this year. Brexit is unlikely to stray far from the headlines as commentators attempt to evaluate the initial impact on the economy and as discussions around aspects related to issues such as equivalence for financial services persist.”

“The Scottish parliamentary election is due to take place in May. Polls suggest that Sturgeon’s Scottish National party could be the biggest party in Holyrood after the election and it is expected that its manifesto will be calling for a second referendum on independence. In 2016 Scotland voted in favour of staying in the EU.”

“Our central view is that the pound can make up some ground vs the EUR in the latter part of the year in line with an expected rebound in UK growth. However, the coming months could still bring plenty of hurdles for the pound. Our end of year forecast is EUR/GBP 0.87.”

MUFG are bearish…

“The relative cyclical underperformance is set to continue in the near-term after the UK government announced a third national lockdown in England which is expected at last until March. There is a high risk the lockdown could last longer given the higher transmission of the new COVID-19 variant.”

“The UK government is now in a race against the virus which is increasing pressure to significantly step up the pace at which vaccines are delivered in the coming weeks and months. If the UK government is successful and leads the way in rolling out vaccines, the pound could eventually benefit from a stronger UK recovery from Q2 onwards. However, we expect things to get worse for the pound before then.”

“The hit to UK economy from the third lockdown will increase pressure on the BoE to deliver additional monetary stimulus as soon as their next meeting in February. Interestingly, it was announced yesterday that BoE plans to publish research on negative rates in February. We now expect the BoE to move rates into negative territory in February by lowering the key policy rate from 0.10% to -0.15%. We had previously forecast a cut to 0.00%. It should push EUR/GBP back up towards last year’s highs.”

EUR/GBP hourly chart