- EUR/USD loses the grip and trades in sub-1.2300 levels.

- Dollar’s recovery weighs on the pair and the riskier assets.

- EMU’s flash CPI next of relevance in the calendar.

The single currency is under pressure and forces EUR/USD to recede below the 1.2300 mark in the second half of the week.

EUR/USD looks weak on USD-recovery

EUR/USD turns negative after three consecutive daily advances and slips back below 1.2300 the figure amidst a moderate bounce in the greenback on Thursday.

In fact, the dollar picks up renewed pace in tandem with the solid recovery US yields to multi-month levels beyond the critical 1.0% hurdle.

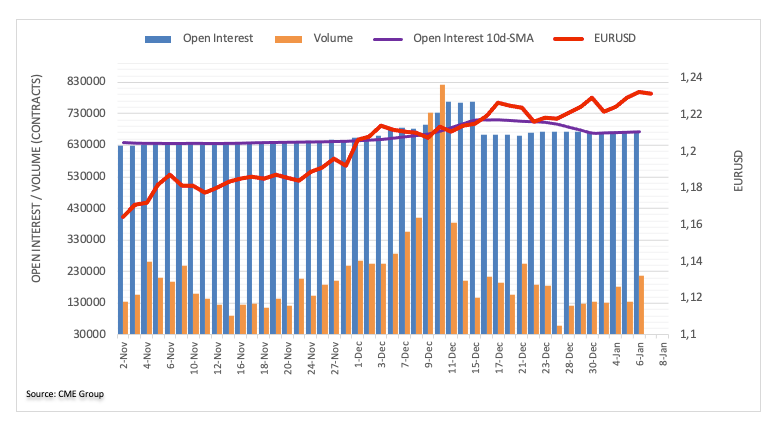

The recent rally in the pair was amidst a persistent upside in open interest in the EUR futures markets, which is supportive of extra gains in the near-term.

On another front, President elect Joe Biden got the green light from the US Congress to become the next US President on January 20th following Wednesday’s incidents in Washington.

In the euro docket, advanced inflation figures in Italy and the broader euro zone are due later ahead of retail sales in the bloc. In the US calendar, the focus of attention will be on the usual weekly Claims and the ISM Non-Manufacturing and speeches by FOMC’s Evans, Bullard and Harker.

What to look for around EUR

The upside momentum in EUR/USD run out of steam in the 1.2350 area for the time being. So far, EUR/USD appears supported by prospects of a strong recovery in the region (and abroad), which is in turn underpinned by extra fiscal stimulus by the Fed and the ECB. In addition, real interest rates continue to favour the euro area vs. the US, which is also another factor supporting the EUR along with the huge, long positioning in the speculative community.

EUR/USD levels to watch

At the moment, the pair is retreating 0.32% at 1.2284 and faces immediate contention at 1.2129 (weekly low Dec.21) seconded by 1.2058 (weekly low Dec.9) and finally 1.2032 (23.6% Fibo of the 2017-2018 rally). On the other hand, a breakout of 1.2349 (2021 high Jan.6) would target 1.2413 (monthly high Apr.17 2018) en route to 1.2476 (monthly high Mar.27 2018).