Yesterday’s events were a dark spot on American democracy Cleveland Fed President Loretta Mester said in a Bloomberg TV interview

She was repeating that the Fed’s policy is well calibrated to expectations for softening in the first half of the year and stronger in the second.

Mester says that the Fed will be patiently accommodative and says it will be a while before inflation gets to 2% and on the path to above 2%.

Market implications

Yesterday, Mester said she thinks it’s unlikely that the economy will meet the threshold of substantial progress to warrant tapering this year, as the virus continues to spread and weigh down sectors that rely on close human interaction.

She said only if the economy rebounds much more quickly than anticipated, that would move up the timeline for adjusting policy.

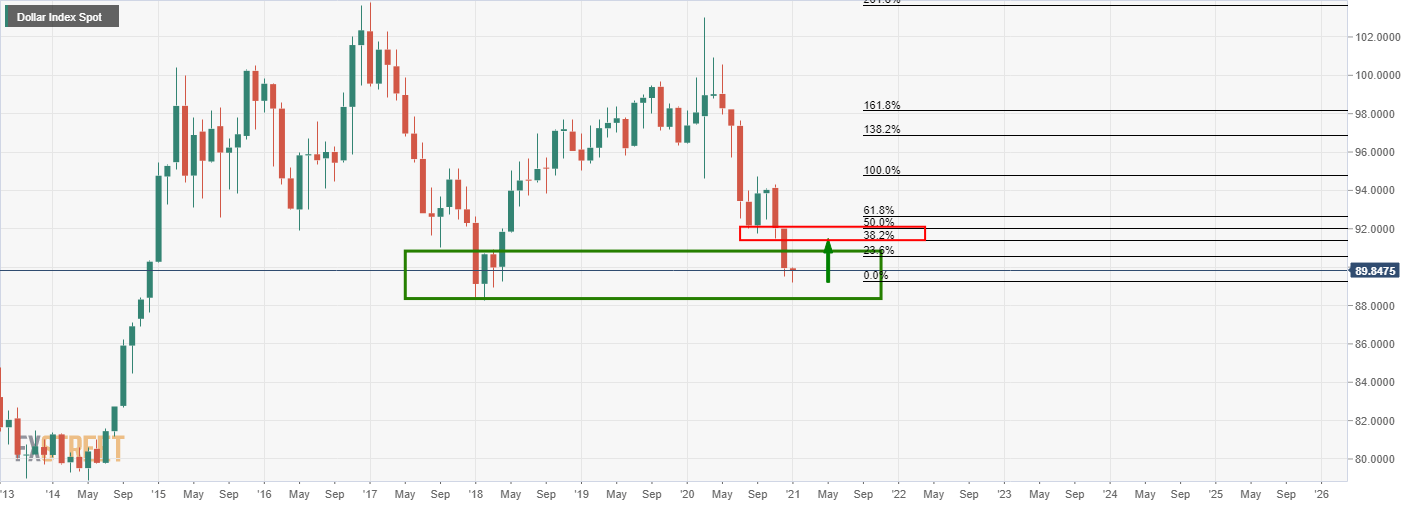

Hence, the dollar is likely to remain with a downside bias, besides some give and take to the upside in a healthy correction.

DXY monthly chart

In a Reuters poll, dollar weakening trend to last at least another year, says 35 of 63 strategists.

The same poll has the euro to rising around 1.9% in a year to $1.25 from current levels.