Reuters reported that Dallas Federal Reserve President Robert Kaplan has explained that despite what he expects to be a challenging next few months because of surging coronavirus cases, the US economy probably isn’t going to shrink this quarter.

He said, instead, that it will deliver 5% growth for the year as the whole.

He expects Unemployment to drop to 4.5% or 4.75% by the end of the year, from 6.7% now.

Kaplan is speaking in a virtual town hall event, explaining that the next couple of months will be challenging because of virus resurgence.

Kaplan says GDP growth in first quarter will probably be positive;

Says expects 2021 GDP to grow 5%;

Says will be working our way back to normal in 2021;

Says expects unemployment to fall to 4.5 to 4.75% by end of year;

Says it is possible if there is more fiscal stimulus there will be revisions to outlook;

Says he is hopeful that later this year will meet “substantial progress” bar for tapering QE;

Says would be strongly against use of negative interest rates in the US.

Market implications

We have seen an aggressive rise in Treasury yields with US market-implied breakeven long-run inflation expectations have been trending upwards to currently sit at 2.1%.

This is sparking speculation that inflation might be returning.

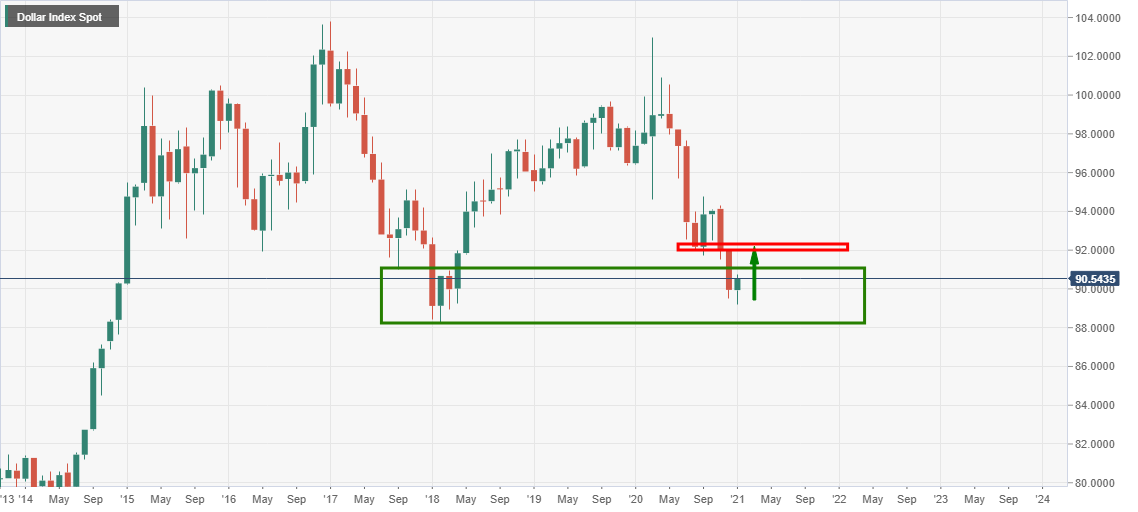

At the same time, the US dollar has started to correct from within a monthly demand area.