- USD/JPY bulls denied yet another stab at the upside.

- 4-hour structure is now critical if the weekly and daily prospects are to playout.

USD/JPY is back into the hands of the bears in a choppy consolidation phase and range between 103.40 and 104.20.

The following is a top-down analysis that illustrates the bullish bias on the longer-term time frame, albeit within a bearish environment on the daily and 4-hour chart.

Weekly chart

The weekly chart is bullish according to the W-formation while the neckline support holds the bears at bay.

Daily chart not quite playing out

However, the upside playbook is not in favour currently with price now below the structure.

An optimistic scenario

However, a break higher, in accordance with the bullish weekly narrative, would draw in demand and likely send the price in a daily bullish extension.

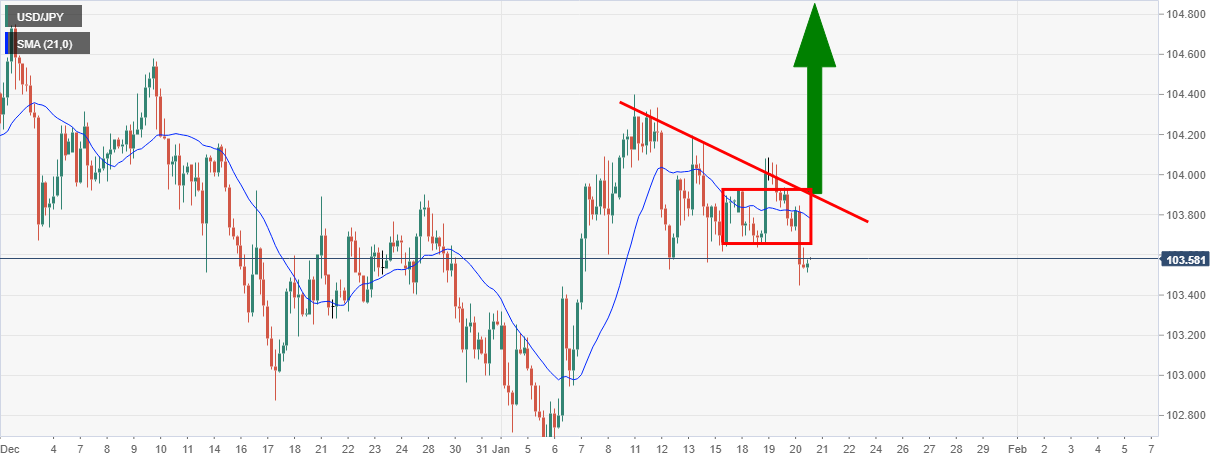

4-hour chart

On the 4-hour chart, there is a significant structure to break, including the 20 moving average and the dynamic resistance line.

-637467850964892040.png)

-637467851669009798.png)

-637467852424069840.png)