- EUR/USD’s weekly upside lost momentum around 1.2180.

- The vicinity of 1.2200 emerges as the next target of note.

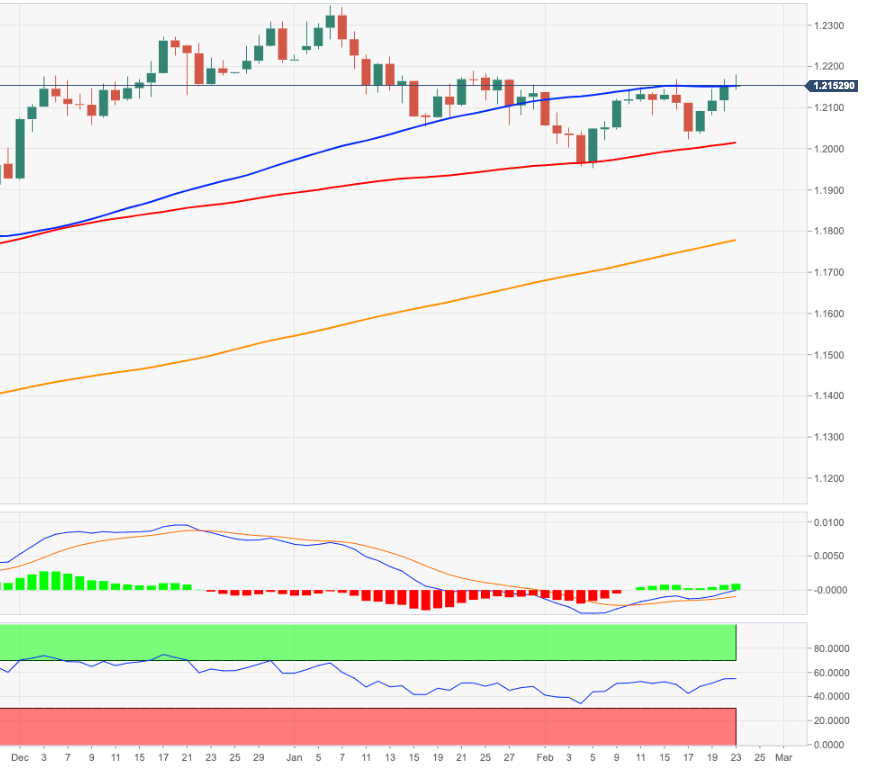

EUR/USD now alternates gains with losses in the mid-1.2100s after another bullish attempt has so far faltered around 1.2180, or multi-day highs. In this area also converges a Fibo level (1.2173).

If the buying impulse gathers extra steam, then the weekly high at 1.2189 (January 22) should return to the radar in the near-term. The selling pressure is expected to mitigate on a breakout of the latter, therefore opening the door to a probable visit to the YTD highs in the 1.2350 zone.

On the broader picture, the constructive stance in EUR/USD remains unchanged while above the critical 200-day SMA, today at 1.1764.

Looking at the monthly chart, the (solid) breakout of the 2008-2020 line is a big bullish event and should underpin the continuation of the current trend in the longer run.

EUR/USD daily chart