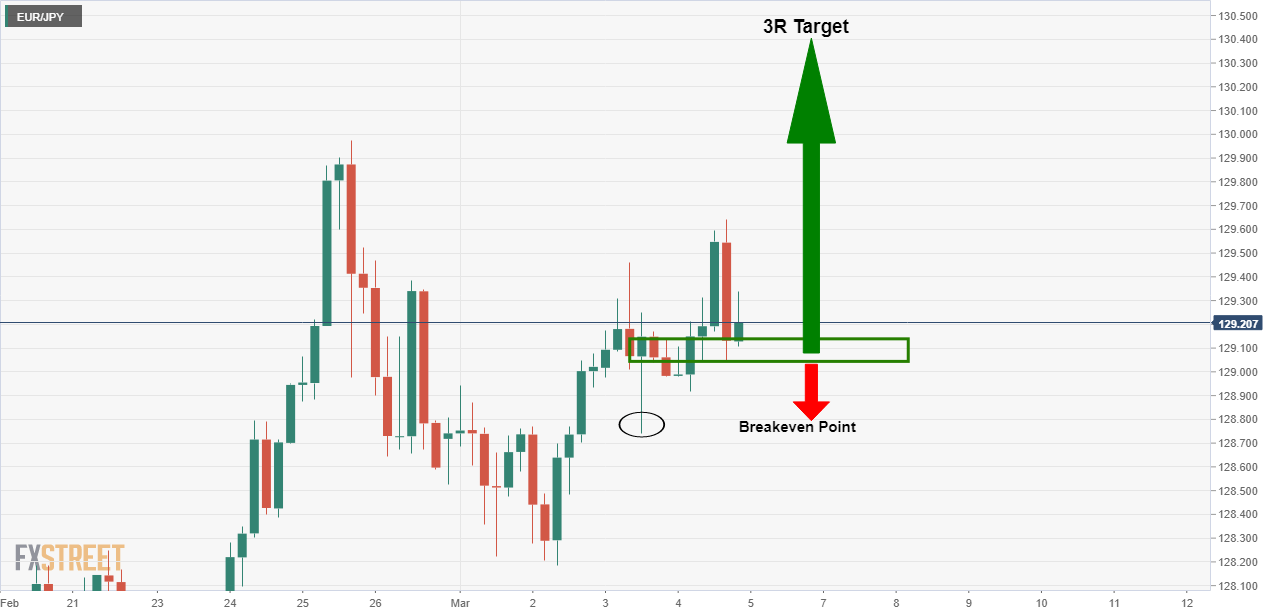

- EUR/JPY bulls holding the price up at 4-hour support.

- Now at breakeven, the bulls continue to target 130.40 in a daily bullish impulse.

As per the prior analysis, EUR/JPY Price Analysis: Bulls in control from 4-hour support, the pair has indeed to continue to move higher to a breakeven scenario as the market gets set for the do or die Nonfarm Payrolls event on Friday.

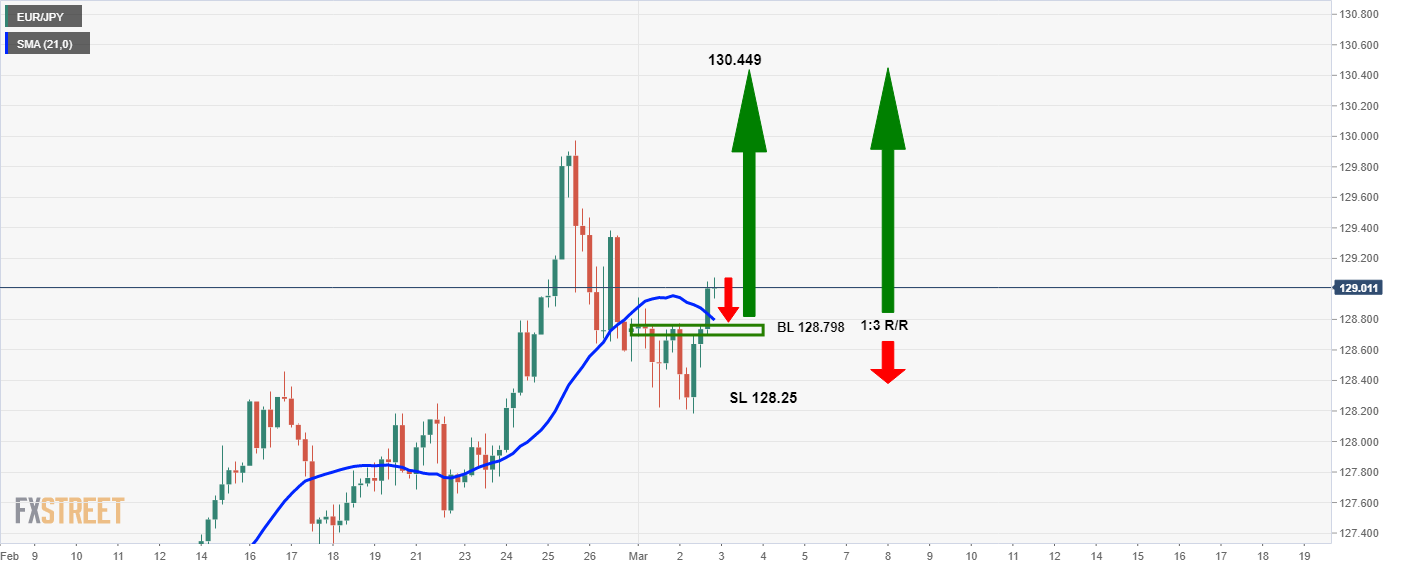

Prior analysis

Bulls need to get over the initial resistance and the 21-moving average. ”

4-hour chart

On a retest of the 21-moving average and/or the structure, a buy limit order will open a position for a 1:3 risk to reward set up to target the 130.40s.

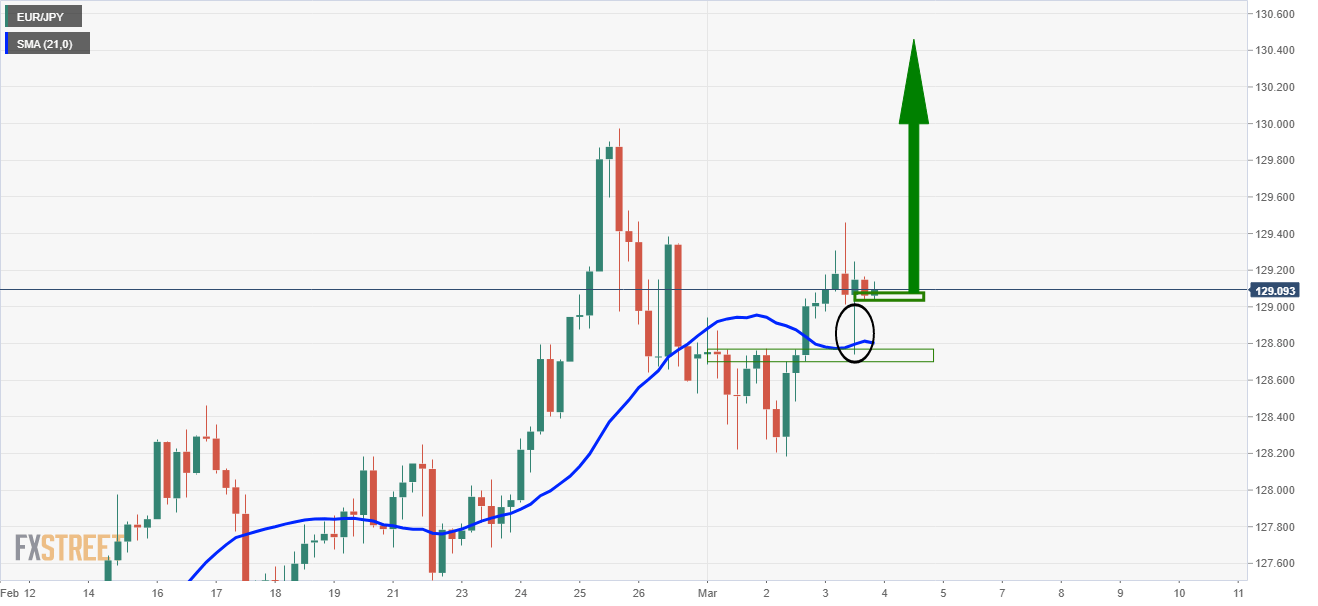

4-hour chart progress

In a perfect touch of the entry point, the price has since been taken higher with bulls fully committed to the upside.

Live market, 4-hour chart

Despite the big moves on Thursday following Federal Reserve Jerome Powell’s WSJ live webinar, the cross has held at support and would be now expected to move higher.

However, it could potentially be caught in the crossfire of Friday’s NFP event.

That being said, an inline or worse than expected report could see the US dollar give back some ground to the euro and help to propel the cross towards the target.