- AUD/USD’s latest move higher probes the 50-DMA at 0.7739.

- The bounce in Treasury yield fizzles while the DXY holds steady.

- Daily chart shows stiff resistance for the aussie bulls.

AUD/USD extends the Asian gains heading towards the European opening, as a renewed uptick in the Treasury yields appears to have stalled, lifting the aussie’s allure as an alternative higher-yielding asset.

Also, the US dollar holds steady amid the US stimulus passage and weak inflation data, underpinning the sentiment around the spot.

All eyes remain on US President Joe Biden’s national address for fresh trading impetus. Meanwhile, the movement in the bond markets will continue to play a pivotal role.

AUD/USD: Technical Outlook

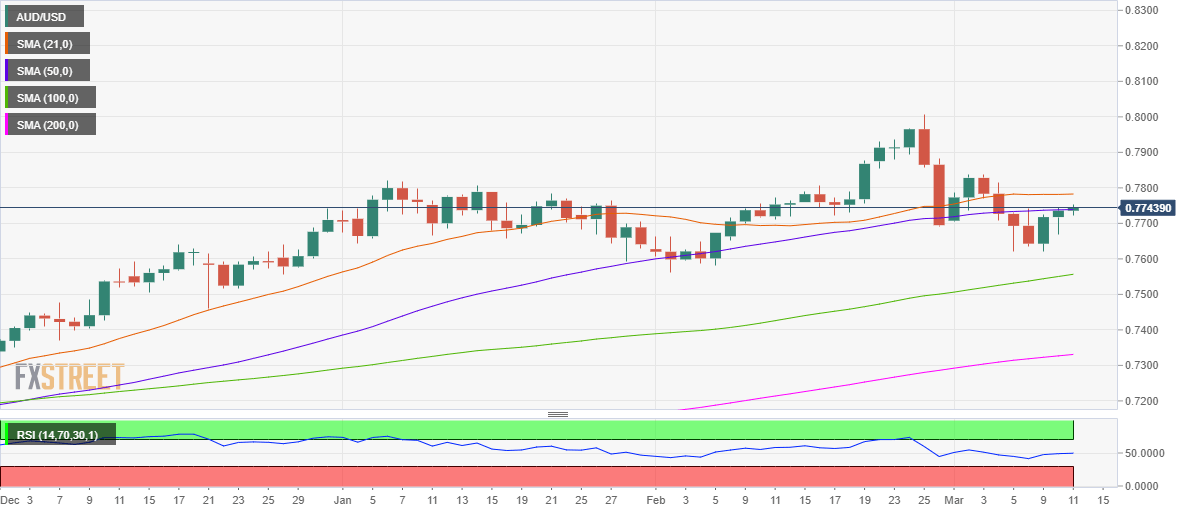

As observed on the daily chart, the aussie is looking for a convincing move above the 50-daily moving average (DMA) at 0.7739.

A daily closing above the latter is needed to extend the three-day uptrend towards the horizontal 21-DMA at 0.7783.

The next critical barrier is located at the psychological barrier at 0.7800.

The 14-day relative strength index (RSI) trades flat just below the midline, suggesting that it could likely be an uphill battle for the bulls going forward. The RSI currently stands at 49.66.

Any turnaround in the sentiment, could see the price drop back towards the static support at 0.7620.

The sellers will then aim for the upward-sloping 100-DMA at 0.7556 as the downside cushion.

AUD/USD: Daily chart

AUD/USD: Additional levels