- USD/CHF bounces off intraday low while teasing 12-day top.

- An upside break of 0.9175 will confirm rounding bottom bullish chart formation.

- SNB is expected to keep the monetary policy unchanged.

- 50, 100-SMA confluence restricts short-term downside, late-June tops can lure bulls beyond 0.9175.

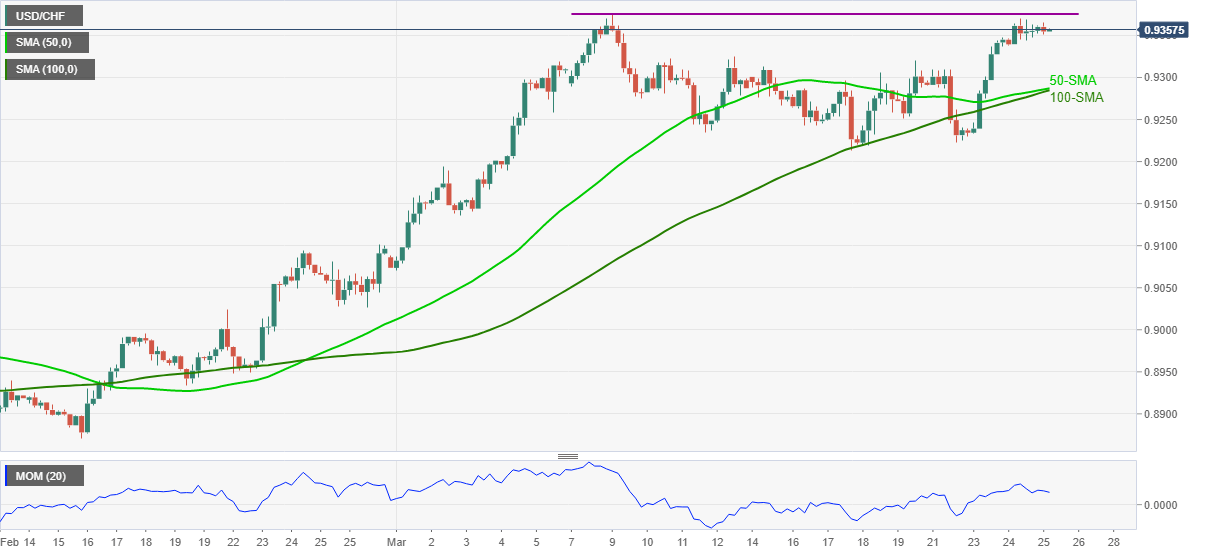

USD/CHF picks up bids from intraday low to 0.9356 during early Thursday. In doing so, the quote keeps an upside break of 50-SMA and 100-SMA while portraying a rounding bottom bullish chart pattern on the four-hour play ahead of the Swiss National Bank’s (SNB) Interest Rate Decision scheduled for publishing at 08:30 GMT.

Although the SNB isn’t expected to alter the benchmark rate of -0.75%, chatters surrounding the bank’s view on the market intervention will be the key to watch.

Should the central bank turns dovish, which is less likely, a clear break of the 0.9175 hurdle comprising the March 09 top will be eyed as the same will confirm the pair’s rally.

During the rise, USD/CHF can initially eye the July top near 0.9470 before heading towards the theoretical target near the mid-June peak surrounding 0.9550.

Meanwhile, pullback moves may recall the 0.9320 support but a convergence of the key moving averages around 0.9285 will be a tough nut to break for the USD/CHF sellers.

Also acting as the strong support is the monthly bottom near 0.9215 and the 0.9200 threshold.

USD/CHF four-hour chart

Trend: Pullback expected