- The aussie sellers return as the DXY regains poise, commodities tumble.

- Bears testing 100-HMA cushion, as the 50-HMA target beckons.

- RSI has flipped bearish, backing the case for more declines.

Having faced rejection just below 0.7650 on multiple occasions, AUD/USD is pressurizing lows on the 0.7600 level, as the US dollar holds onto the recent upside.

The aussie also bears the brunt of the renewed weakness in the commodities complex, as oil prices wilt on news that Ever Given vessel stuck in the Suez Canal is fully afloat. Meanwhile, gold prices drop, as the persisting downbeat mood boosts the haven demand for the greenback.

AUD/USD: Technical Outlook

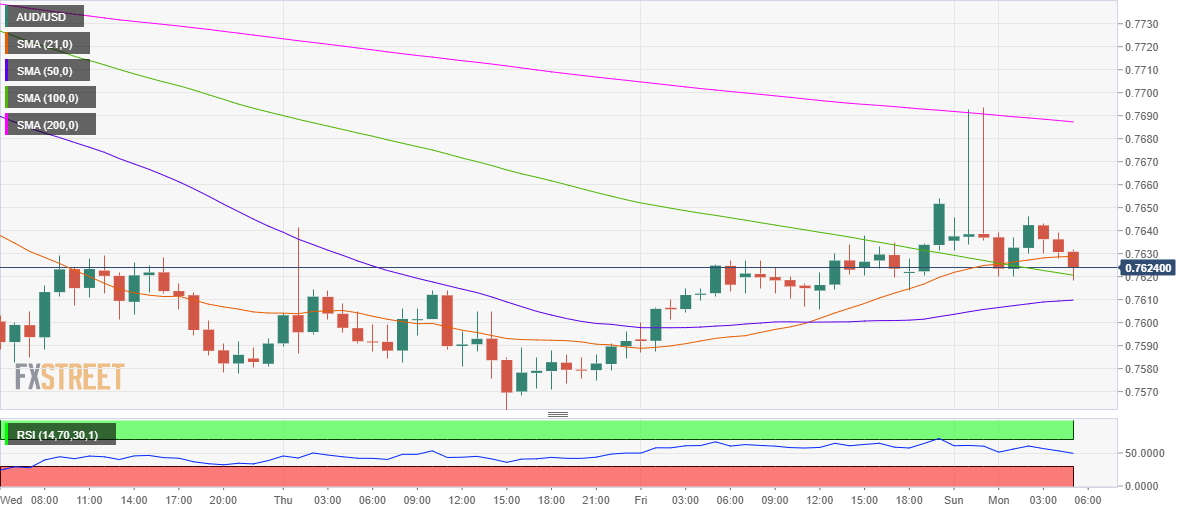

From a near-term technical perspective, the turnaround in the spot from the higher levels has prompted the sellers to pierce through the 21-hourly moving average (HMA) at 0.7629.

The AUD bears now eye a decisive break below the downward-facing 100-HMA support at $0.7620, in order to extend the bearish momentum toward then the next target aligned at 50-HMA. That cushion is at $0.7610.

A breach of the last would expose the 0.7600 level.

Adding credence to the renewed weakness, the Relative Strength Index (RSI) has flipped into the bearish territory, piercing the midline from above.

On the other hand, if the 100-HMA support holds, a bounce-back towards the daily high of 0.7645 cannot be ruled out.

The next critical resistance for the bulls is seen at 0.7689, which is the descending 200-HMA.

AUD/USD: One-hour chart

AUD/USD: Additional levels