- AUD/USD bulls meeting a critical area of resistance.

- Bulls may look to reengage following significant correction.

- US dollar (DXY) under pressure at key support dispute higher 10-year Treasury yield.

AUD/USD is currently trading at 0.7731 between a range of 0.7634 and 0.7737, rising 1.2% on the day.

Overall, the USD is trading lower for a third consecutive session while the antipodeans are leading the session.

US yields had been crashing lower this week and removing some crucial support for the dollar.

However, there has been a pickup on Wednesday on the 10-year yield which may eventually see a response in the greenback, but so far this has not transpired on Wednesday.

On data, the US Consumer Price Index came in a tad higher than expected on Tuesday but not enough to warrant a rally in the greenback for markets presume a lower for longer Federal Reserve.

Even all of the heavy US Treasury issuance this week was easily absorbed.

Markets will now look to the Fed’s Beige Book today and then US Retail Sales later on in the week.

”With US data coming in strong this week, we still believe the dollar’s rise can resume. However, this will require a turnaround in US yields and we’re not there yet,” analysts at Brown Brothers Harriman have argued.

”DXY broke below near 92 and the next key retracement objective from the February-March rally comes in near 91.56. Break below that would target the February 25 low near 89.683,” the analysts also pointed out.

DXY has already reached a low of 91.5740 so far in this recent cycle of dollar weakness.

Meanwhile, on the domestic front, the Westpac Consumer Sentiment rose by 6.2% MoM in Apr to 118.8.

This was the highest reading since Aug 2010 which coincided with Australia’s post GFC rebound and mining boom, analysts at TD Securities noted.

”Today’s stronger consumer confidence print coupled with the improvement in business conditions seen in NAB survey yesterday will provide some comfort to the RBA as the economic recovery is likely to pick up even as fiscal support unwinds.”

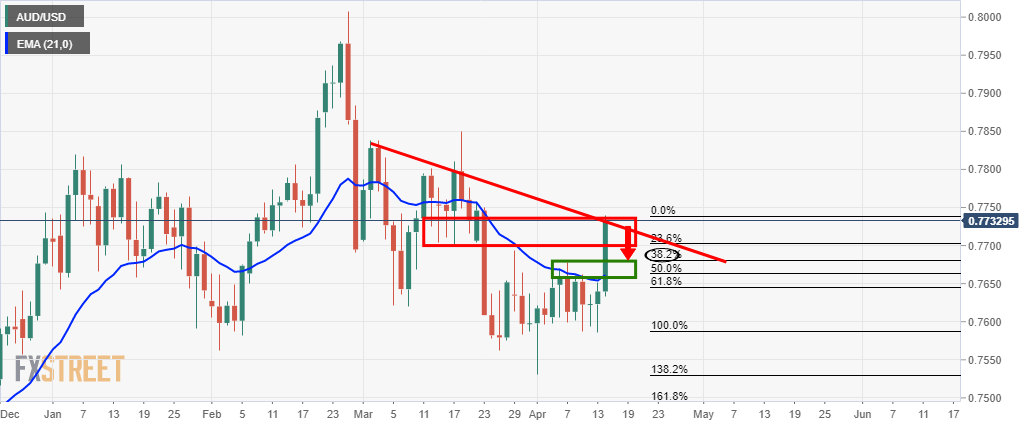

AUD/USD technical analysis

The daily outlook is bearish while below the resistance structure and given the rally will likely require a correction on profit-taking.

The most compelling area of support comes at the prior highs that meet the 38.2% Fibonacci retracement level of the bullish impulse at around 0.7680.

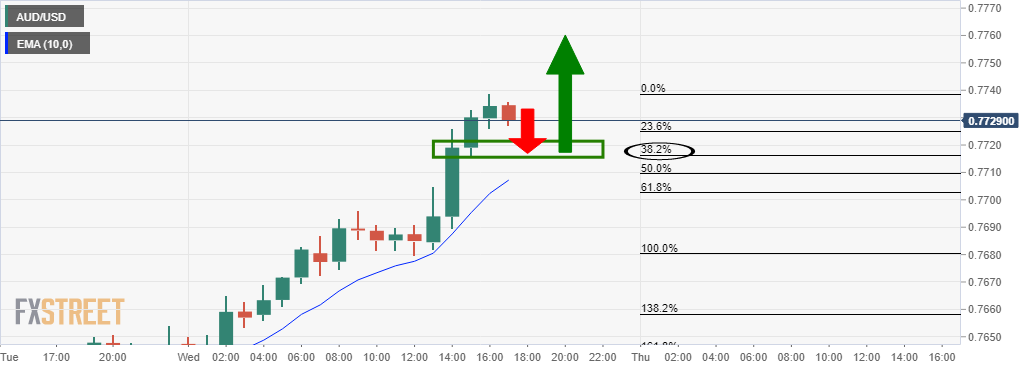

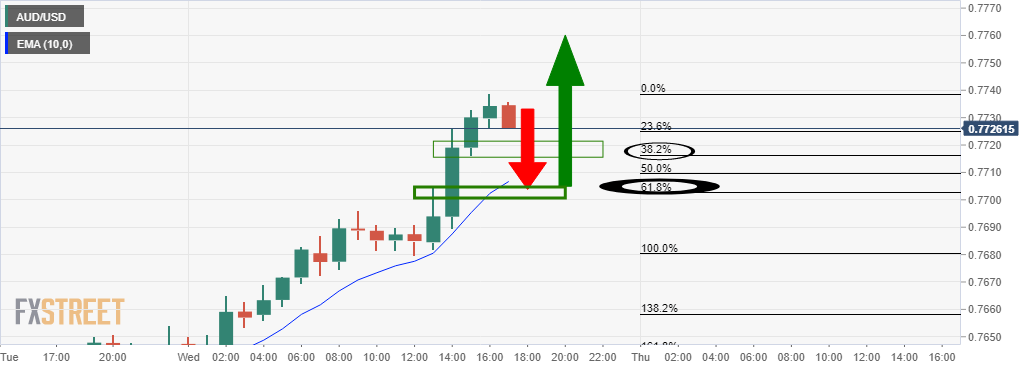

With that being said, there are prospects of a meanwhile upside extension deeper into the supply zone from an hourly perspective:

A 38.2% Fibo retracement of the hourly leg in the bullish impulse meets prior support from where bulls might wish to reengage, consequently taking the price higher.

A deeper retracement to a 61.8% Fibo meets the prior resistance and a 10-hour EMA confluence: