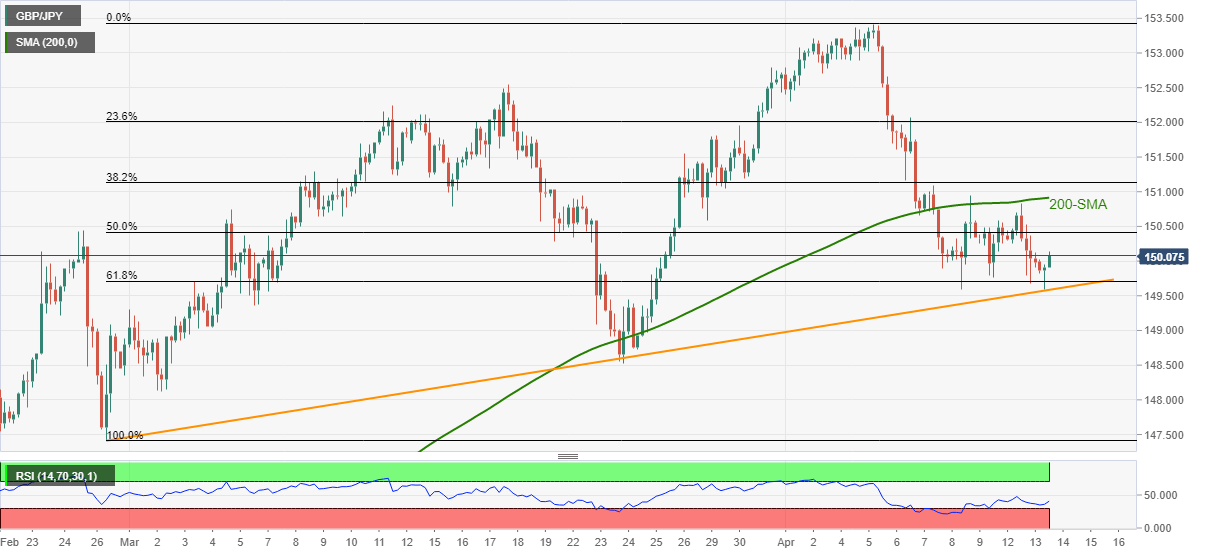

- GBP/JPY picks up bids after refreshing three week low.

- An ascending trend line from February 26 tests bears.

- Bulls need to cross 200-SMA for fresh entries.

GBP/JPY prints mild gains while picking up bids near 150.06 ahead of Wednesday’s London open. In doing so, the quote keeps bounce off a seven-week-old support line.

While RSI recovery backs the quote’s corrective pullback from the key trend line support, 200-SMA level of 150.91 becomes a tough nut to crack for the bulls.

However, extended recovery towards 50% Fibonacci retracement level of late-February to early April rise, around 150.40, can’t be ruled out.

Alternatively, a 61.8% Fibonacci retracement level of 149.70 can act as immediate support ahead of highlighting the stated support line, near 149.60, for the GBP/JPY bears.

In a case where GBP/JPY remains depressed below 149.60, March 24 low close to 148.50 will be in the spotlight.

Overall, GBP/JPY remains pressured but the bears need validation.

GBP/JPY four-hour chart

Trend: Further weakness expected