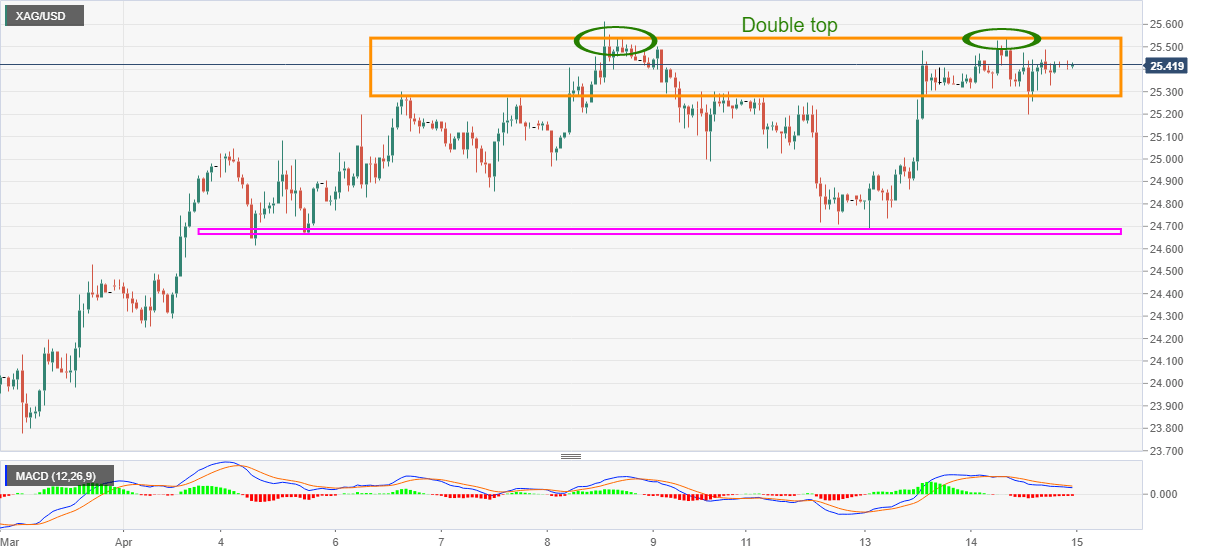

- Silver wavers around monthly top, fails to extend bounce off $24.65-70 horizontal area.

- Sluggish MACD keeps sellers hopeful but confirmation of bearish formation becomes necessary.

Silver hangs around $25.40 amid Thursday’s Asian session. In doing so, the white metal nears the monthly high following its U-turn from an eight-day-old horizontal area, which in turn portrays a “double top” bearish formation.

Given the downbeat MACD conditions, coupled with the commodity’s inability to keep bounce off $24.65-70 support-zone, silver prices are likely to witness a pullback towards the lower-end of the immediate trading range between $25.30 and $25.55.

However, any further weakness below $25.30, may take a rest around the $25.00 threshold before highlighting the $24.65 key support, a break of which will confirm the bearish chart play and drag the quote towards the March-end lows near $23.75.

Meanwhile, an upside clearance of $25.55 will defy the chart formation and can aim for March 18 top near $26.65.

During the run-up, the $26.00 round-figure may offer an intermediate halt whereas the previous month’s high near $27.10 can lure the bullion buyers afterward.

Silver hourly chart

Trend: Pullback expected