- DXY meets support in the 91.50 area on Thursday.

- Advanced Retail Sales crushed estimates in March.

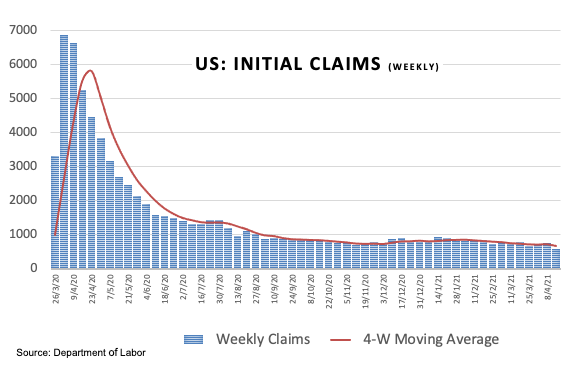

- Initial Claims dropped to multi-month lows last week.

The US Dollar Index (DXY), which gauges the greenback vs. a basket of its main competitors, looks to rebound from recent lows in the 91.50 zone.

US Dollar Index ignores data

After bottoming out in the 91.50 region, or new 4-week lows, the index now manages to pick up some upside impulse amidst the broad-based consolidative mood and lower yields, all despite recent solid US data results.

In fact, yields of the US 10-year note slipped back below the 1.60% level on Thursday in spite of better-than-expected results from key US fundamentals.

That said, the buck failed to gather steam after advanced headline Retail Sales expanded 9.8% MoM in March, while Core sales rose 8.4%. in addition, weekly Claims rose by 576K – the lowest level in a year – and the Philly Fed rose to 50.2 for the current month. Same path followed the NY Empite State index, improving to 26.3 in the same period.

On the not-so-bright side, both Industrial and Manufacturing Production expanded below estimates at a monthly 1.4% and 2.7%, respectively, during last month.

Later in the NA session, Busine Inventories, the NAHB Index and TIC Flows will close the calendar followed by speeches by Atlanta Fed R.Bostic (voter, centrist), San Francisco Fed M.Daly (voter, centrist) and Cleveland Fed L.Mester (2022 voter, hawkish).

What to look for around USD

The dollar breached the 92.00 support and extended the leg lower to the 91.50 area so far. This view is supported by the retracement in US yields and the loss of enthusiasm on the US reflation/vaccine trade. Furthermore, the mega-accommodative stance from the Fed (until “substantial further progress” in inflation and employment is made) and hopes of a strong global economic recovery (now postponed to later in the year) remain a source of support for the risk complex and carry the potential to undermine further the dollar’s momentum in the second half of the year.

Key events in the US this week: Housing Starts, Building Permits, advanced Consumer Sentiment (Friday).

Eminent issues on the back boiler: Biden’s new stimulus bill worth around $3 trillion. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating? Future of the Republican party post-Trump acquittal.

US Dollar Index relevant levels

At the moment, the index is gaining 0.03% at 91.66 and a break above 92.23 (200-day SMA) would open the door to 93.43 (2021 high Mar.31) and finally 94.30 (monthly high Nov.4). On the downside, the next support is located at 91.49 (monthly low Apr.15) followed by 91.30 (weekly low Mar.18) and then 91.03 (100-day SMA).