- EUR/USD begins the week on a back foot.

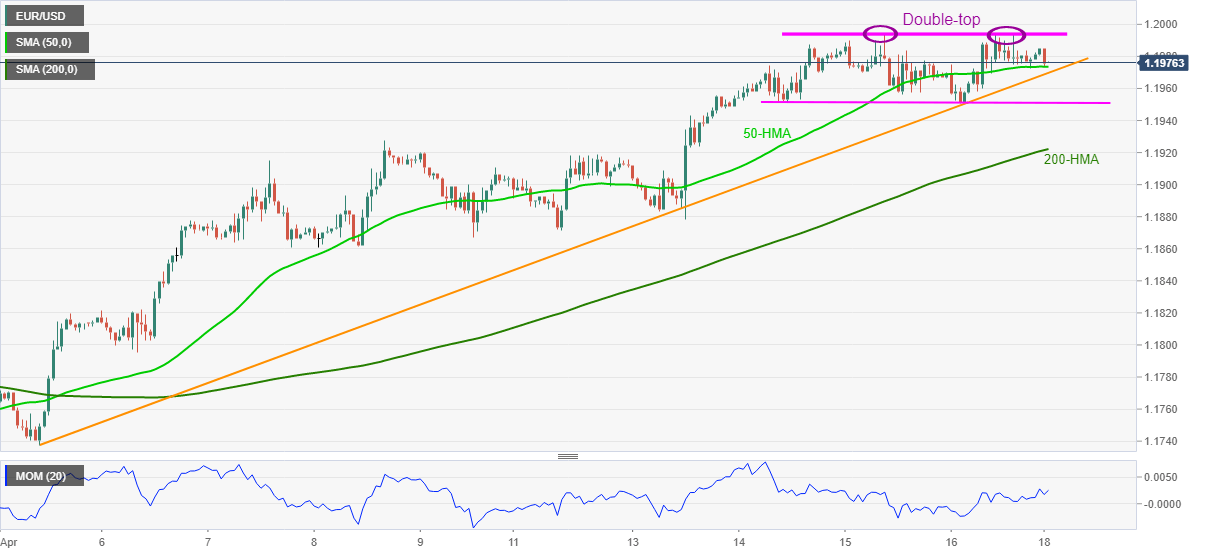

- 50-HMA, two-week-old support line test intraday sellers ahead of confirming the bearish chart pattern.

- 200-HMA adds to the downside filters, bulls need clear break of 1.2000 for fresh entries.

EUR/USD holds lower ground near 1.1975, down 0.07% intraday, following a sluggish start to the week’s trading during Monday’s Asian session. In doing so, the sellers battle 50-HMA while teasing the double-top bearish chart formation on the hourly play.

Given the recently downbeat Momentum, coupled with rejection below the 1.2000 threshold, EUR/USD may witness further pullback.

However, sellers may wait for a clear break below the 1.1950 horizontal support before taking fresh entries.

While a downside break of 1.1950 will confirm the bearish chart pattern, directing the quote towards the 1.1900 round-figure, 200-HMA and an upward sloping trend line from April 05, respectively around 1.1965 and 1.1920, add to the downside filters.

Alternatively, EUR/USD buyers should wait for a clear upside break of the 1.2000 hurdle before eyeing the mid-February lows near 1.2025 during the fresh recovery moves.

EUR/USD hourly chart

Trend: Further weakness expected