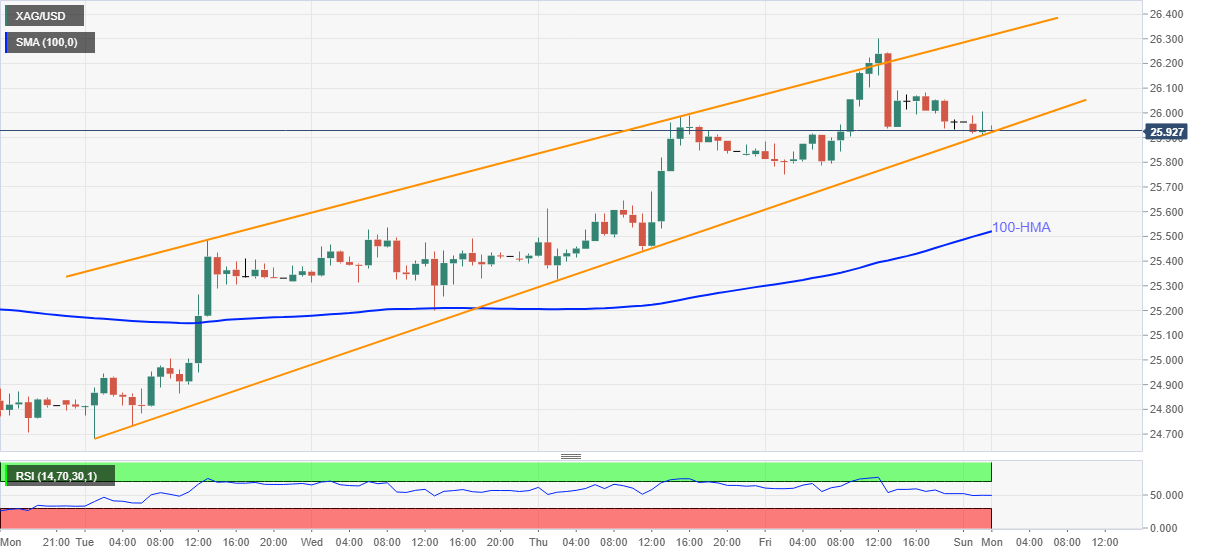

- Silver prints mild losses near the support line of a bearish chart pattern.

- 100-HMA adds to the downside filters, multiple hurdles to test recovery moves.

Silver snaps a four-day winning streak while easing to $25.92, down 0.15% intraday during Monday’s Asian session. In doing so, the white metal teases the confirmation of a rising wedge bearish chart formation on the hourly play.

Given the normal RSI conditions and the commodity’s failure to stay strong beyond $26.00, silver prices are likely to confirm the bearish move towards the monthly low of $24.25.

Though, a clear break of $25.90 will be necessary for the said fall while 100-HMA near $25.50 can offer an extra filter to the south.

Meanwhile, the corrective pullback will have to cross the $26.00 threshold before challenging the upper line of the stated rising wedge, near $26.30.

Even if the silver prices manage to pierce the $26.30 resistance, March 18 top near $26.65 will be an additional upside challenge for the commodity.

Silver hourly chart

Trend: Further weakness expected