- GBP/JPY stalls the advance, as 151.50 beckons.

- Key hurdle on the 4H chart caps the rally in the spot.

- Overbought RSI conditions also triggered the retreat.

GBP/JPY is retreating from two-week highs of 152.03, looking to test the 151.50 support area amid a sharp pullback in GBP/USD from above the 1.4000 mark.

The downside in the cross remains by the solid gains in the USD/JPY, as the major continues to benefit from rising US Treasury yields.

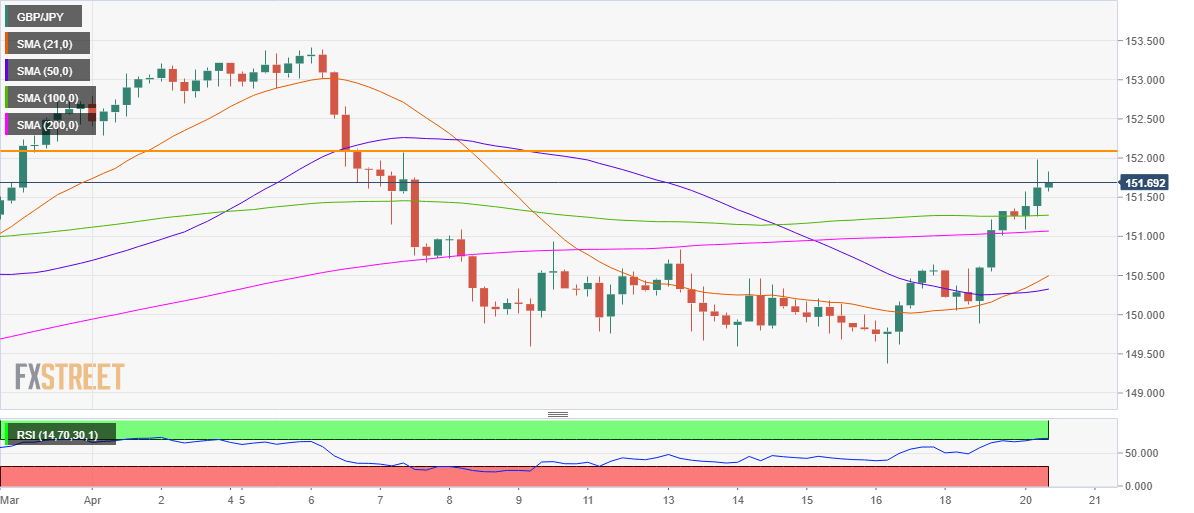

Technically, GBP/JPY turned south after facing stiff resistance near the critical horizontal (orange) trendline at 152.08.

The overbought Relative Strength Index (RSI) conditions on the four-hour chart justified the retracement from higher levels.

Although a bull cross seen on the said time frame earlier on, suggests that the uptrend could resume after the pullback. The 21-simple moving average (SMA) pierced through the 50-SMA from below, which represented a bullish crossover.

To the upside, the bulls look to retest the abovementioned powerful hurdle, above which doors would open towards 152.50 levels.

On the flip side, the bears target the 100-SMA at 151.27 if the retreat extends. Further south, the 200-SMA at 151.08 could emerge as strong support.

GBP/JPY four-hour chart

GBP/JPY additional levels to watch