- DXY keeps the bearish note unchanged below 91.00.

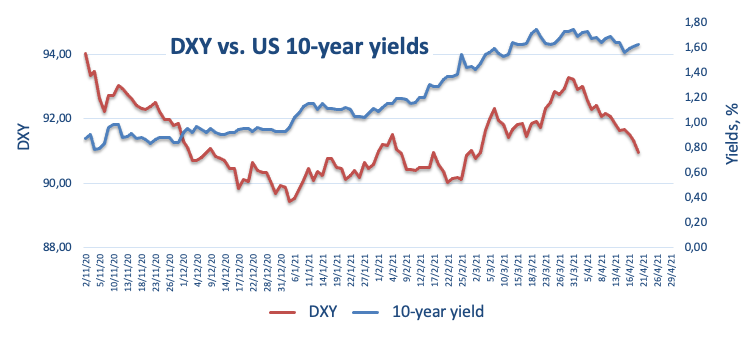

- The leg lower in the dollar comes despite the rebound in US yields.

- The weekly report by the API will be the only release of note.

The greenback remains on the defensive for yet another session and extends the drop further south of the key 91.00 support when tracked by the US Dollar Index (DXY).

US Dollar Index weaker on risk-on trade

The index extends the leg lower to new 7-week lows in the 90.90/85 band on turnaround Tuesday.

The dollar remains unable to gather some fresh oxygen in spite of the rebound in yields of the US 10-year note to the 1.63% region after bottoming out around 1.55% at the beginning of the week.

In the meantime, investors continue to favour the risk complex, always with expectations of a strong rebound in the Old Continent on the rise along with the firmer pace of the vaccine campaign.

In the US data space, the weekly report on US crude oil supplies by the API will be the sole release later on Tuesday.

What to look for around USD

The dollar stays offered and retreats to the sub-91.00 levels for the first time since early March, always amidst the retracement in US yields and the loss of enthusiasm on the US reflation/vaccine trade. Also weighing on the buck emerges the mega-accommodative stance from the Fed (until “substantial further progress” in inflation and employment is made) and hopes of a strong global economic recovery, all morphing into a source of support for the risk complex and a most likely driver of probable weakness in the dollar in the second half of the year.

Key events in the US this week: Initial Claims, CB Leading Index, Biden’s virtual Climate Summit (Thursday) – Flash Markit Manufacturing PMI (Friday).

Eminent issues on the back boiler: Biden’s new stimulus bill worth around $3 trillion. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating? Future of the Republican party post-Trump acquittal.

US Dollar Index relevant levels

At the moment, the index is losing 0.13% at 90.96 and faces the next support at 90.85 (weekly low Apr.20) ahead of 89.68 (monthly low Feb.25) and then 89.20 (2021 low Jan.6). On the other hand, a break above 91.60 (50-day SMA) would open the door to 92.16 (200-day SMA) and finally 93.43 (2021 high Mar.31).