- EUR/USD battles the previous day’s pullback from seven-week high.

- Downside break of 61.8% Fibonacci retracement, MACD conditions favor further selling.

- Horizontal area from early March, two-week-old rising support line will test the bears.

- March’s peak adds to the upside barrier, bearish Doji on multi-day top back the sellers.

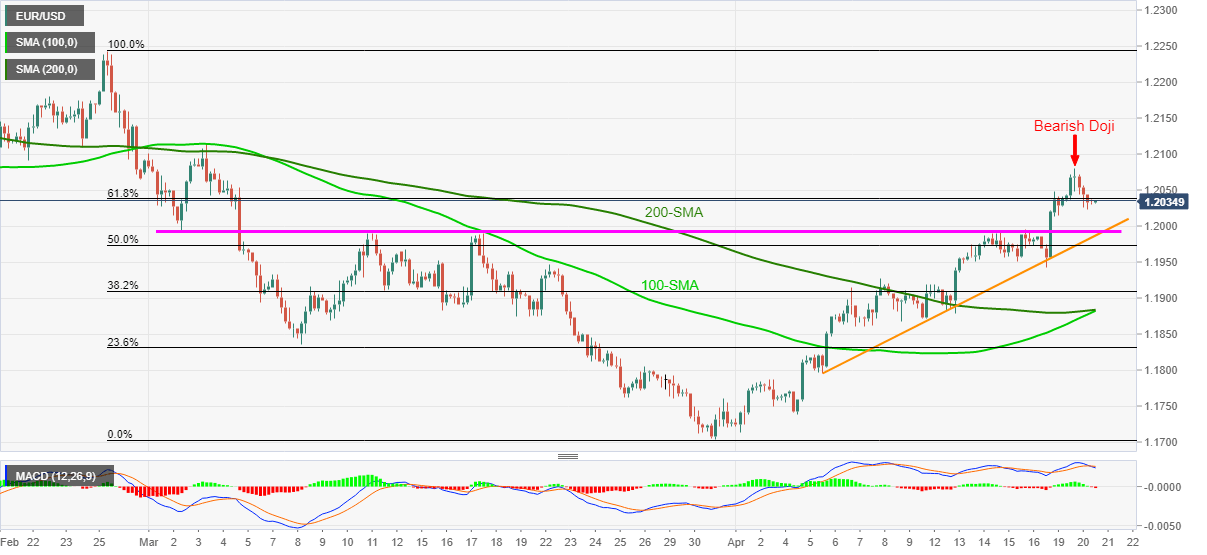

EUR/USD remains pressured around 1.2030, extending the pullback from a multi-day top, during Wednesday’s Asian session. In doing so, the major currency pair justifies the bearish Doji candlestick on the four-hour (4H) formation portraying the latest high.

Additionally, the pair’s downside break of 61.8% Fibonacci retracement of late February to March-end downside as well as MACD’s recent turn in favor of the sellers also back the EUR/USD bears.

Hence, the recent losses are likely to mount as short-term sellers aim to revisit the horizontal area established from March 02, around 1.1990.

However, the pair’s further weakness will be tamed by an ascending trend line from April 06, near 1.1985 by the press time.

Meanwhile, corrective pullback beyond the 61.8% Fibonacci retracement level of 1.2037 will not be an open invitation to the EUR/USD buyers as the recent peak, as well as the one marked in early March, respectively around 1.2080 and 1.2115, be the tough resistances.

EUR/USD four-hour chart

Trend: Further weakness expected