- EUR/USD offered despite the ECB’s subtle hawkish tone.

- Technically, the price is meeting a critical daily and hourly support area.

Despite what might have been expected to be welcome news for the euro from a Goldilocks outcome of the European Central bank, EUR/USD has dropped on the day by some 0.30% so far to meet a critical support structure.

- ECB Quick Analysis: Lagarde offers four subtle changes that may send the euro higher

However, the moves in the forex space in recent trade are not related to the ECB but more to Wall Street and traders hitting the bid following the recent reaction to US President Joe Biden’s proposal to almost doubling the capital gains tax rate for wealthy individuals to 39.6%.

The news has sent stocks sharply lower and has sent the DXY higher as illustrated in the following price comparison hourly chart between the S&P 500 and DXY:

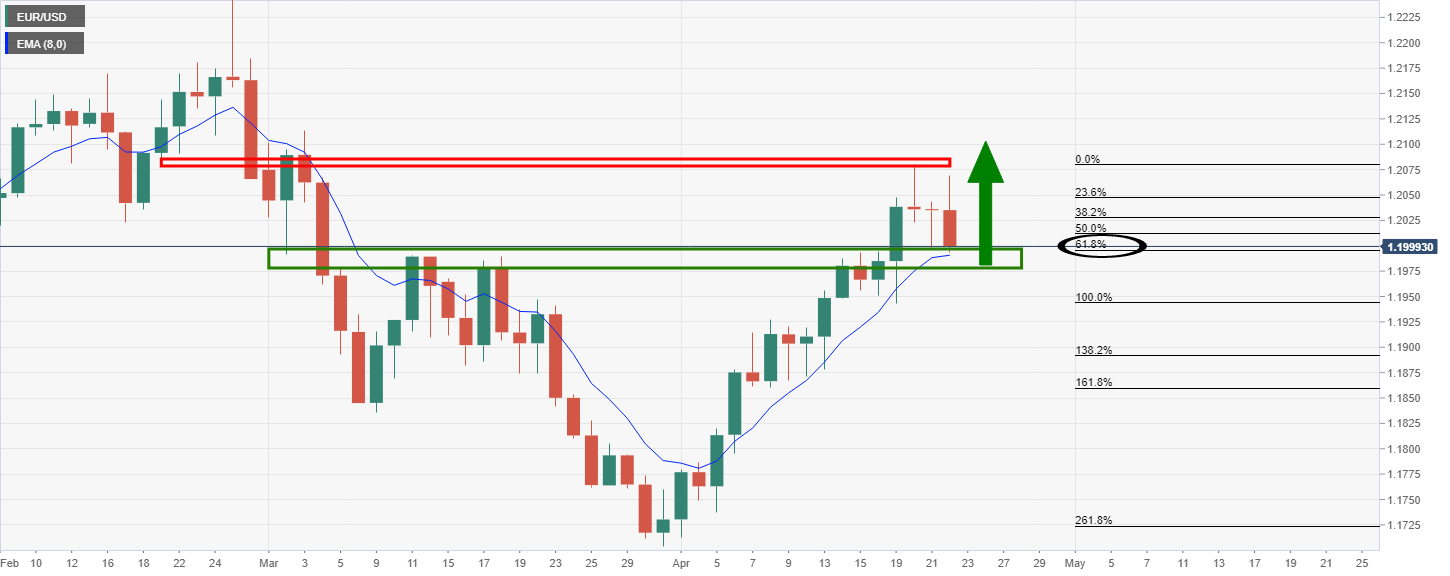

Meanwhile, EUR/USD has dumped into what would be expected to be a strong support area considering the confluence of the golden ratio, the 61.8% Fibonacci retracement level, the 8 EMA and prior resistance on the daily chart as follows:

Daily chart

At this juncture, an upside extension would be anticipated according to the dominant bullish trend following a healthy correction and clean out of stops.

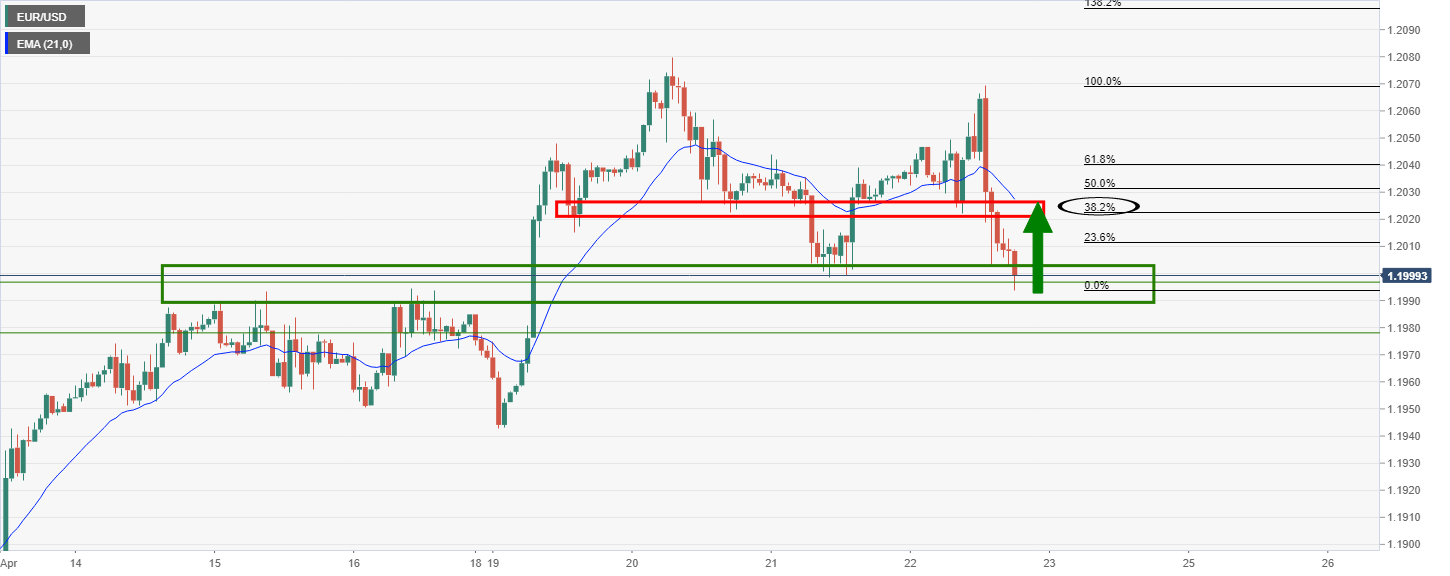

From a lower time frame vantage point, the most probable scenario is a rally back to test old hourly support and the confluence of a 38.2% Fibonacci retracement level:

1-hour chart

That being said, there is room for a deeper test into the demand area but all things considered on a fundamental basis and taking into account the bullish trend, the path of least resistance is to the upside.

-637547115431294610.png)