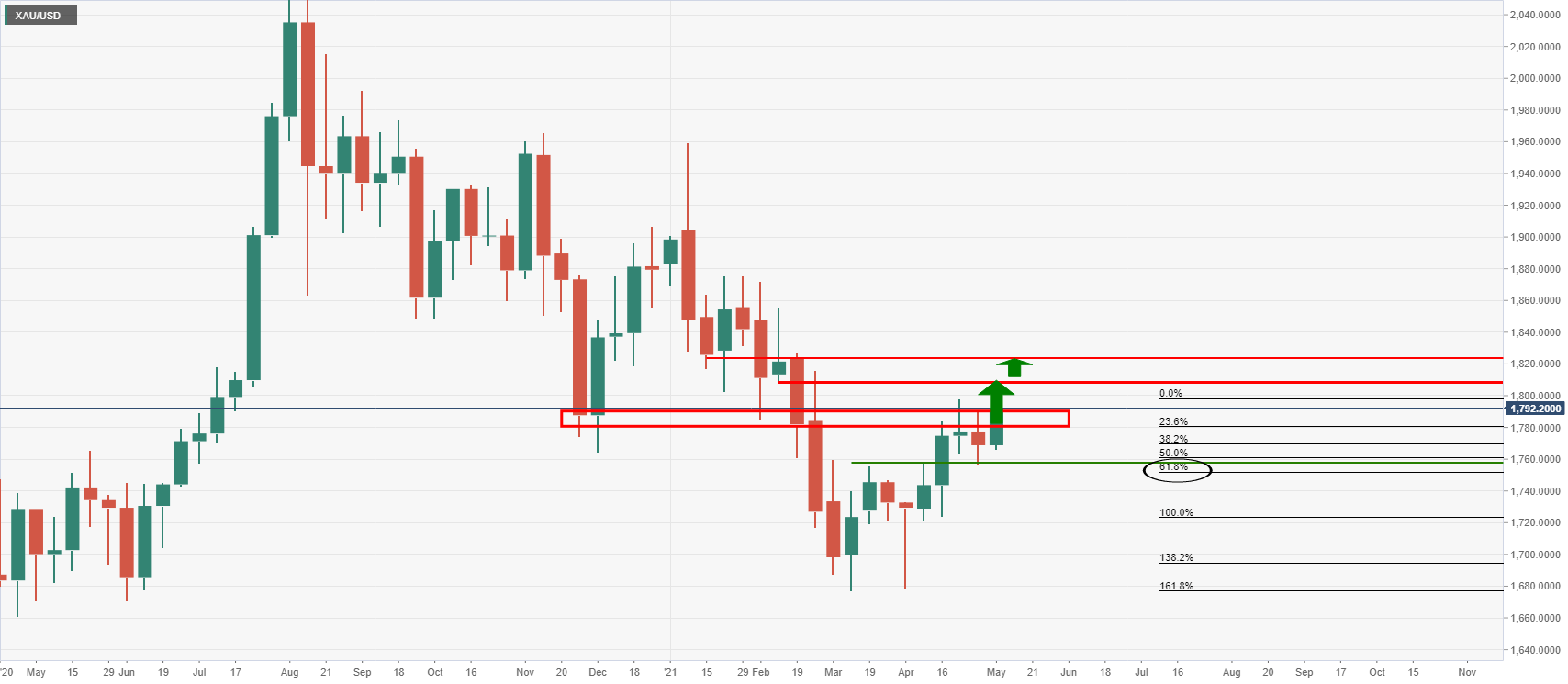

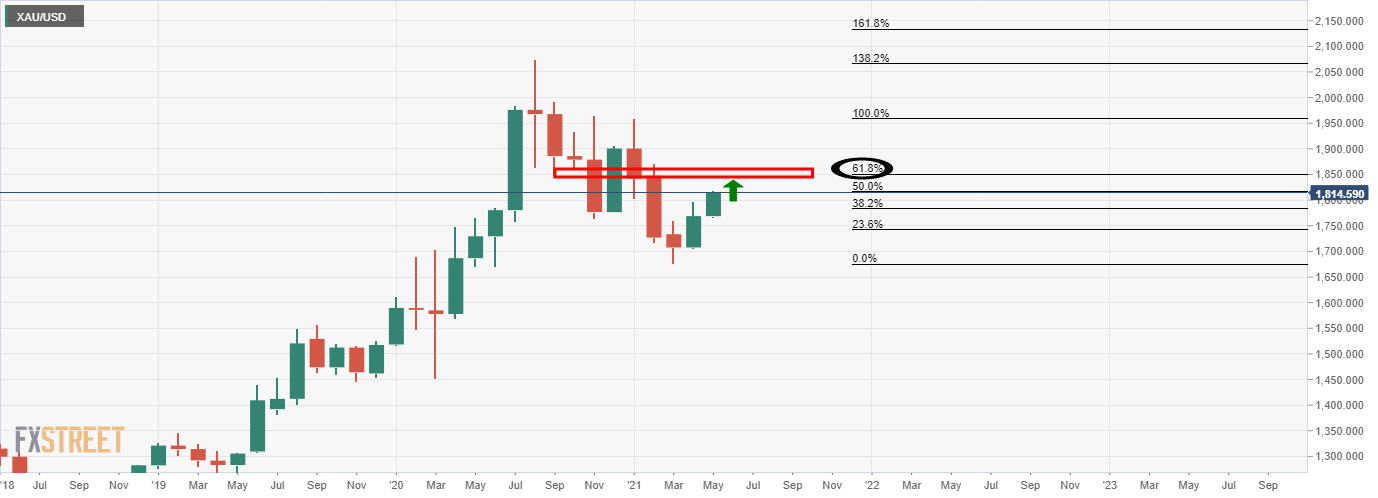

- Gold bulls have eyes on a 61.8% Fibo monthly target of $1,850.

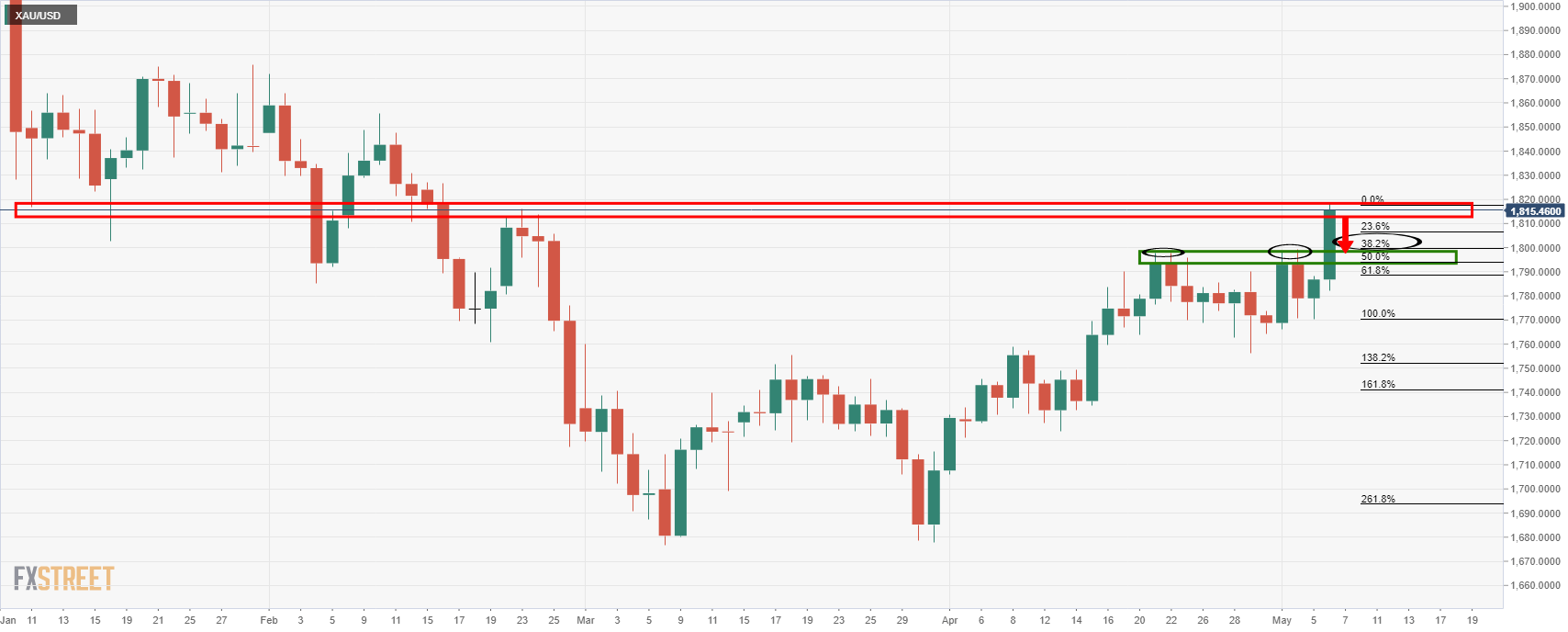

- Shorter-term, the bears can target at least a drift to a 38.2% Fibo at 1.807 or the daily support, near $1,800.

- Will NFP be the catalyst to test the commitments at $1,820/25 on a soft US dollar?

Gold prices were well and truly bid on Thursday as the US dollar took a trip to the downside.

XAU/USD had added some 1.57% by the close of play on Wall Street after travelling from a low of $1.782.04 to break the psychological $1,800 level and to go on to score a high of $1,818.13.

The US dollar slipped to its lowest point in three days as global market risk appetite improved.

The DXY was losing around 0.4% by the close after falling from a high of 91.37 to a low of 90.88.

US jobs data was the focus this week.

Fewer Americans filed new claims for unemployment benefits COVID-19 vaccination efforts and massive amounts of government stimulus led to a further reopening of the economy.

With that being said, Federal Reserve speakers have continued to downplay the risks of higher inflation this week.

Ahead of Friday’s Nonfarm Payrolls, the data on Thursday proved that the number of jobs cut by US companies fell 25% MoM in April and was down a huge 96.6% for the year.

Initial Jobless Claims fell to the lowest level since mid-March 2020. Markets are expecting that core inflation will likely consistently exceed the Fed’s target over the next few years but the Fed is not expected to begin hiking interest rates until 2023.

For the day ahead, analysts at Westpac see ”1.1mn new jobs and believe further upward revisions to prior months could also be seen.”

The analysts argue that this should see the unemployment rate fall to 5.8%.

Moreover, they said average hourly earnings should edge up a more muted 0.1%, given the remaining slack in the labour market.

Meanwhile, it may take a surprise in the data to really convince the market that the Fed will taper or raise rates sooner than they would like to.

Prior analysis, weekly gold chart

Source: Gold Price Analysis: Bulls back in town through critical resistance

Live market, weekly gold chart

Meanwhile, the prior gold news that has been updated throughout the past few sessions identified various levels in using the Technical Confluences Detector and by eye.

Here is that gold article: Gold Price Analysis: Gold bears seeking a correction to test bullish commitments

It was noted that ”The Technical Confluences Detector is pointing to showing that the next resistance line is at around $1,822, which is where the Pivot Point one-week Resistance 3 hits the gold price chart.”

Other levels of not were as follows, ”The next substantial hurdle for XAU/USD awaits at $1,850, which is the convergence of the 200-day Simple Moving Average and the Pivot Point one-month Resistance 2.

Initial support is at around $1,810, which is where the PP one-month R1, the PP one-day R3 and the Fibonacci 161.8% one-week all meet up on the gold price chart.’‘

Meanwhile, from a pure price action analysis and forecast, using the Fibonaccis and typical price action habits, the following was presumed:

Considering that the gold price has now reached a resistance structure, and given the daily ATR of around $21, gold can easily drop back to ”test the prior resistance which has a confluence with a 38.2% Fibonacci retracement of the latest bullish impulse.”

Daily gold charts, prior analysis

The daily gold chart zoomed-in, live market

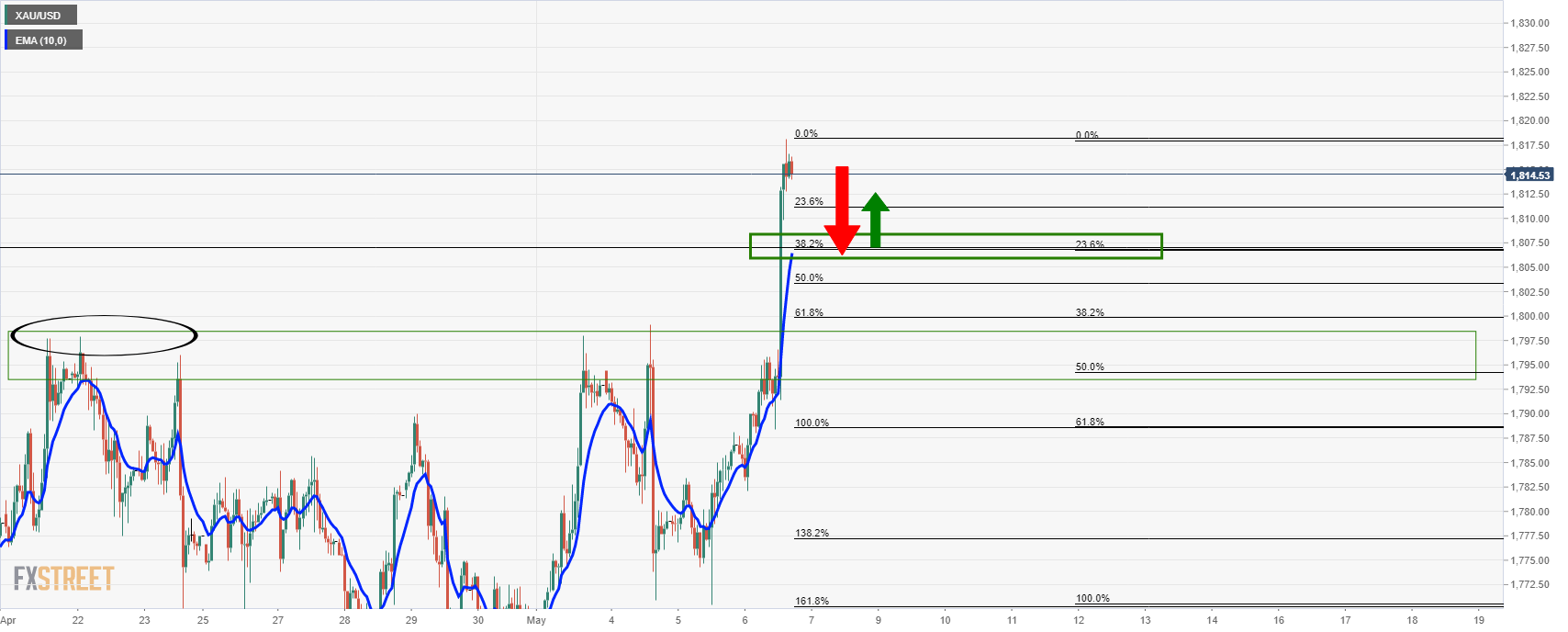

Nearer term, however, and while considering that the Nonfarm Payrolls is just around the corner, should the market take a breather, ”on the hourly time frame, there is a compelling case for demand higher up at the confluence of the daily 23.6% Fibo that meets the hourly 38.2% Fibo and the 10 EMA.”

1-hour gold chart, prior analysis

Live gold market, 1-hour time frame

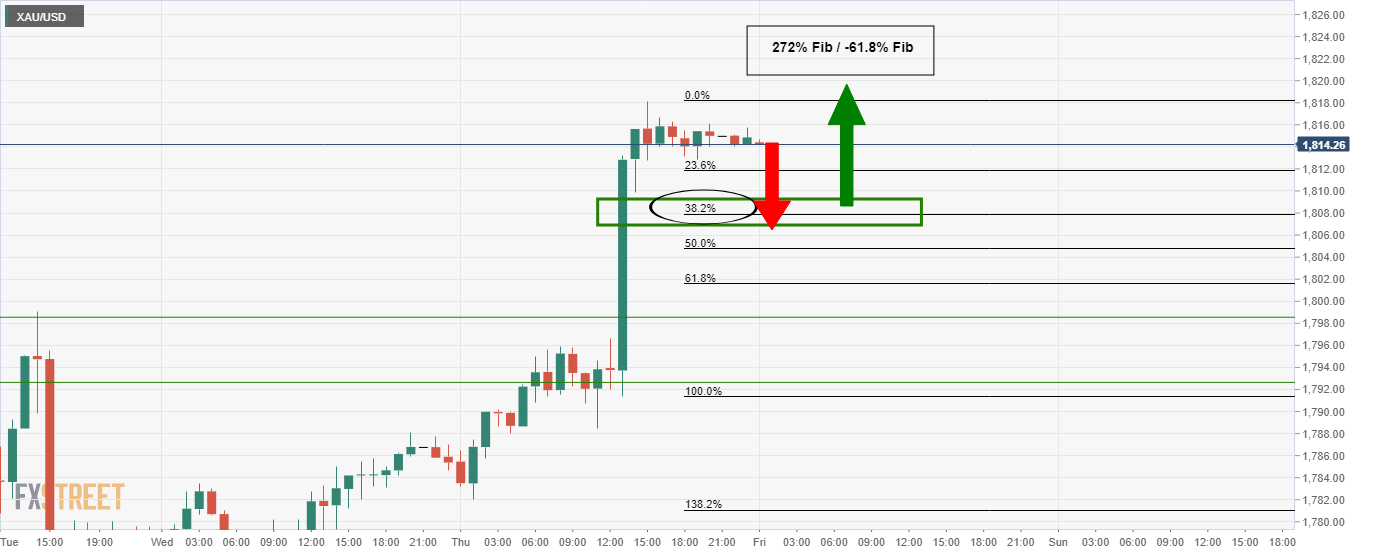

Should the Nonfarm Payrolls ‘only’ live up to expectations or indeed even disappoint, then we have a scenario where the US dollar could continue to fall and support gold prices.

The thesis is that the Federal Reserve will look through transitory rises in inflation and keep benchmark interest rates around zero for the foreseeable future.

That is bearish for real yields and should, in theory, be positive go gold and negative for the US dollar.

A drift lower to the 38.2% Fibo could be met with demand and the price could well make an onwards extension to test the targetted box between the -272% and 61.8% Fib retracements of the forecasted hourly correction’s range.

This area guards a run to the aforementioned $1,850 target area on the monthly chart:

For a longer-term in house FXStree outlook for the gold price, the following can be read:

Gold Price Forecast 2021: XAU/USD looks to build on 2020 gains with central banks staying dovish