Our free forex signals service today looks at the USD/MXN pair and we have the entry, stop and take profits levels for you.

In the fourth week of July, the Mexican peso hovered at just under $20.0. As a trader, the dollar enhances the prospects for pandemics, inflation and growth. According to preliminary data for June, INEGI estimates that the Mexican economy grew 14.4 percent during the year.

The share of the secondary sector was 14.4%, and the service sector – 14.0%. At the same time, the pandemic continued to evolve as the weekly average surged to unprecedented levels since early February, raising fears over long-awaited deregulation and the prospect of an economic recovery.

The US Dollar registered an increase of 0.72%; on the contrary, it still maintains a decrease of 10.97% in the last year. If we compare the value with past days, it ends two consecutive sessions with a positive trend. The volatility of the last seven days is clearly lower than the data obtained for the last year (11.9%). Therefore, its price is showing fewer changes than expected in recent dates.

The US Dollar has been at a high of 21.52 Mexican pesos in the yearly picture, while its lowest level has been 19.60 Mexican pesos. Thus, the US Dollar is closer to its low than its high.

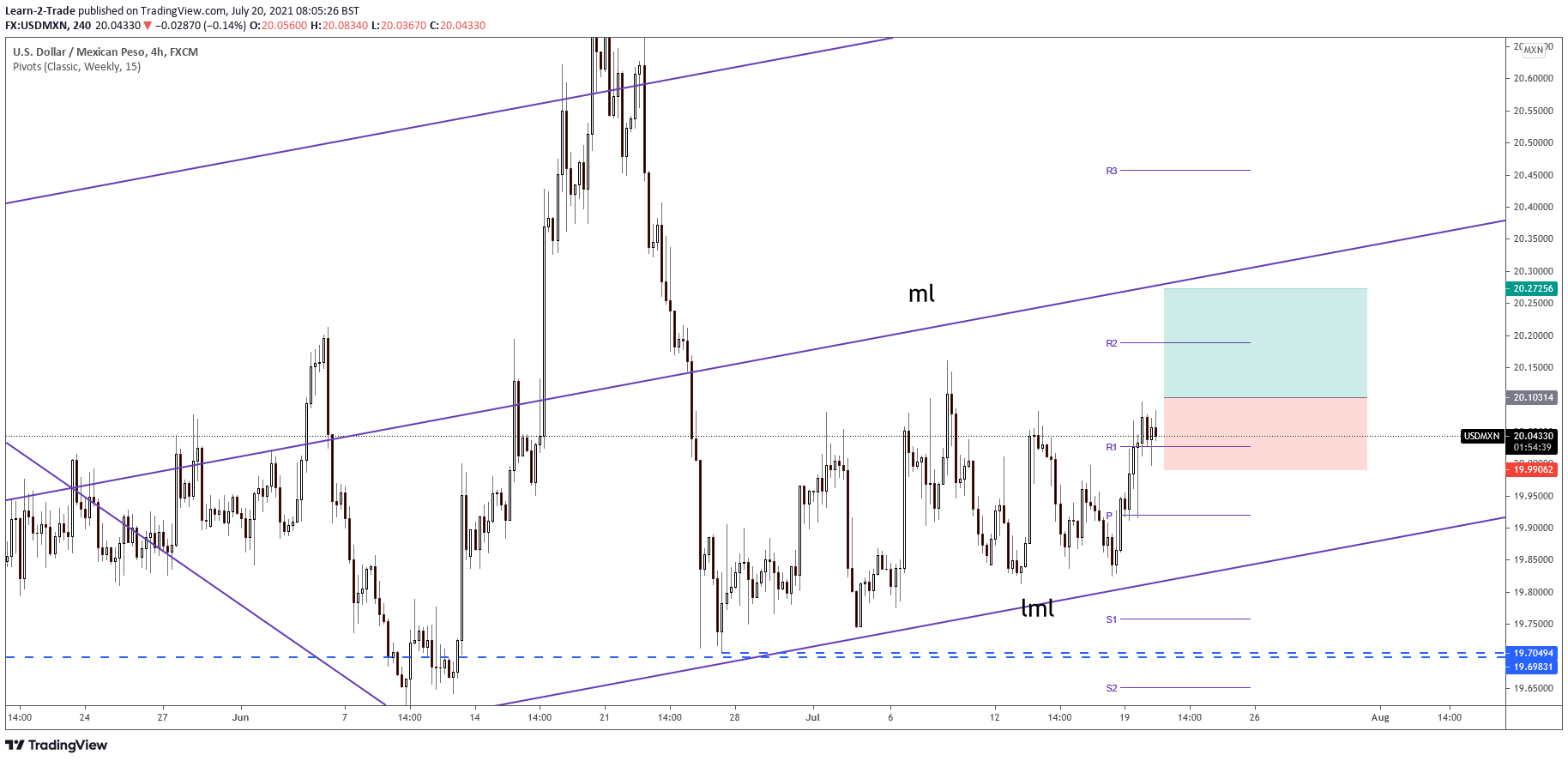

USD/MXN free forex signals

Instrument: USD/MXN

Order: BUY STOP

Entry price: 20.103

Stop Loss: 19.990

TP1: 20.272

Recommended Risk: 1%

Risk / Reward Ratio: 1:5

Signal validity period: Good until cancelled

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.