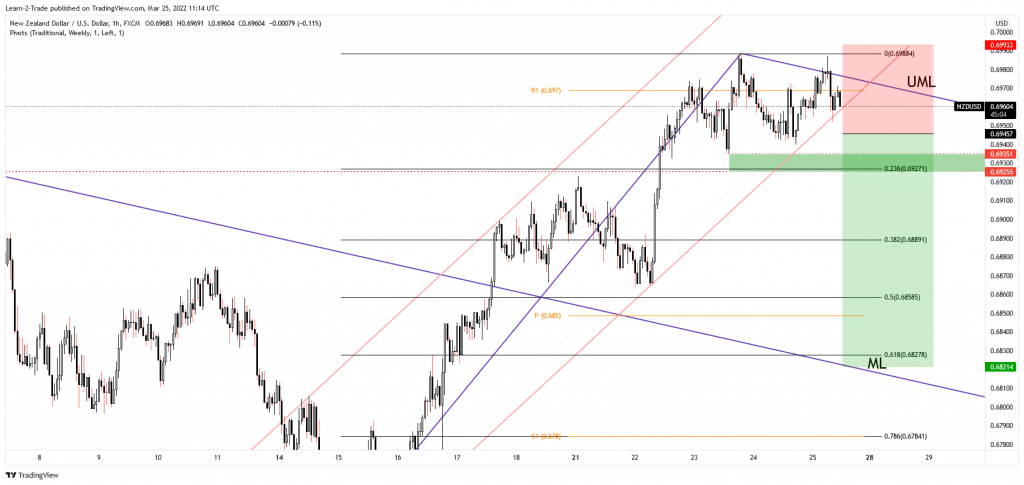

Our free forex signals service trade today is a sell order on the NZD/USD. The pair is looking for a downside after rejecting from the resistance.

The NZD/USD pair drops at the time of writing, signaling that the buyers are exhausted after failing to make a new higher high. The price action developed a potential Double Top pattern, indicating a downside reversal. After its amazing growth, a temporary correction is favored. In the short term, the NZD/USD pair rallied after DXY’s sell-off.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

Fundamentally, the USD is still somehow expected to dominate the currency market as the FED is expected to continue to hike rates. Yesterday, the US economic figures came in mixed. Durable Goods Order and Core Durable Goods Orders came in worse than expected.

Still, the Flash Manufacturing PMI and the Flash Services PMI reported better than expected data signaling further expansion in both sectors. Also, the Unemployment Claims indicator was reported at 187K below 210K expected.

US Revised UoM Consumer Sentiment

Later, the US will release its Revised UoM Consumer Sentiment, which is expected at 59.7 points. In addition, the Revised UoM Inflation Expectations and the Pending Home Sales indicators will be released as well.

Technically, the pair failed to stabilize above the R1 (0.6970), signaling exhausted buyers. Personally, I’ve drawn a descending pitchfork, hoping that I’ll catch a new leg down. However, a corrective phase may be activated by staying below the UML and making a valid breakdown below the up trendline.

3 Free Forex Every Week – Full Technical Analysis

Free forex signals – Sell NZD/USD at 0.6949

Free forex signals entry price and take-profit

Instrument: NZD/USD

Order Type: SELL STOP

Entry price: 0.6949

Stop Loss: 0.6993

TP1: 0.6821

My Risk: 1%

Risk / Reward Ratio: 1:2.9

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money