Our free forex signals service trade today is a sell order on the USD/SGD. The pair will go downside if the USD finds bullish momentum.

The USD/SGD pair dropped in the short term as the Dollar Index retreated. The DXY showed overbought signs. A potential corrective phase registered by the dollar index could force the USD to depreciate versus its rivals.

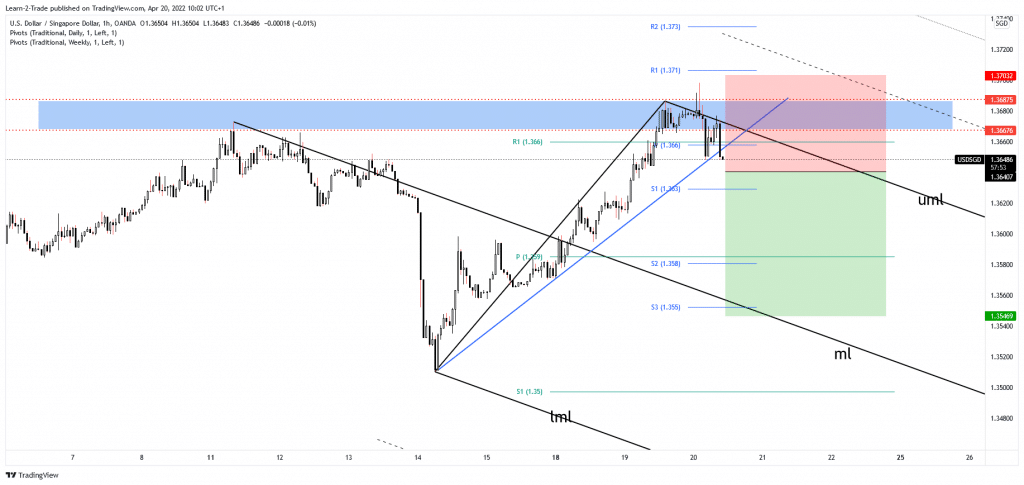

Technically, the currency pair reached a resistance zone of 1.3667 – 1.3687. A temporary decline is natural after its strong upwards movement, but we still need confirmation.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

The US data came in better than expected yesterday, but the USD seems overbought in the short term. Housing Starts was reported at 1.79M above 1.74M expected, while the Building Permits indicator came in at 1.87M versus 1.83M estimates versus 1.86M in the previous reporting period.

US Existing Home Sales 5.78M expected

Today, the US Existing Home Sales are expected to report a potential drop from 6.02M to 5.78M in March. Worse than expected, data could weaken the USD. Better than expected data could help the USD to stay higher. Also, the Canadian inflation data could bring some action to the USD.

The USD/SGD pair registered only false breakouts above the descending pitchfork’s upper median line (UML). It could drop as long as it stays under this level.

3 Free Forex Every Week – Full Technical Analysis

Free forex signals – Sell USD/SGD at 1.3640

Free forex signals entry price and take-profit

Instrument: USD/SGD

Order Type: SELL STOP

Entry price: 1.3640

Stop Loss: 1.3703

TP1: 1.3546

My Risk: 1%

Risk / Reward Ratio: 1:1.5

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money