Today, our free forex signals service trade is a sell order in USD/JPY. The price will go down if the JPY gains momentum after the US NFP.

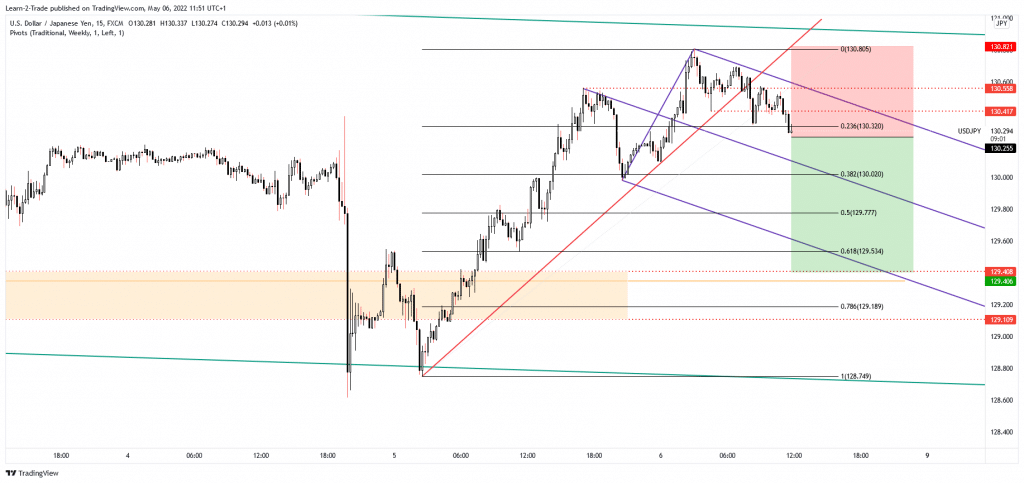

The USD/JPY pair registered a strong leg higher in the short term, but the buyers seem exhausted. As a result, the price started to drop, and it could activate a larger correction soon. After that, it could come back down to test and retest the near-term support levels before developing a new leg higher.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

Fundamentally, the Japanese data came in mixed today. The Monetary Base rose by 6.6% versus 8.2% expected, while the Tokyo Core CPI registered a 1.9% growth compared to 1.8% estimates. Later, the volatility could be high as the US releases high-impact figures. Most likely, the USD/JPY pair could register sharp movements.

Non-Farm Employment Change 390K expected

Today, the fundamentals will move the price. For example, the NFP is expected at 390K in April versus 431K in March. The unemployment rate may also drop from 3.6% to 3.5%, while the Average Hourly Earnings could register a 0.4% growth. Also, the Canadian data could impact the greenback as well.

Technically, it has dropped below the uptrend line signaling that the upside movement is over. However, as long as it stays within the descending pitchfork’s body, the USD/JPY pair could drop deeper.

3 Free Forex Every Week – Full Technical Analysis

Free forex signals – Sell USD/JPY at 130.25

Free forex signals entry price and take-profit

Instrument: USD/JPY

Order Type: SELL STOP

Entry price: 130.25

Stop Loss: 130.82

TP1: 129.40

My Risk: 1%

Risk / Reward Ratio: 1:1.5

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money