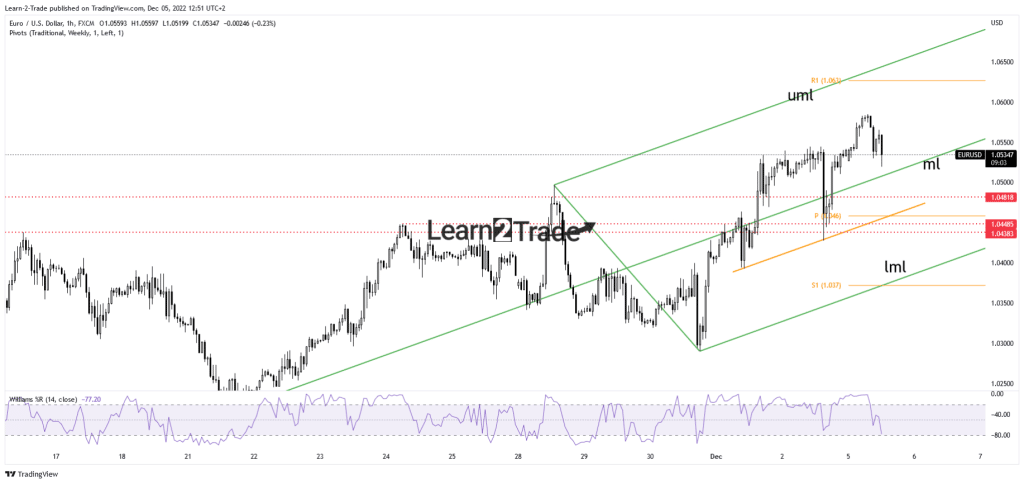

- The EUR/USD pair remains bullish as long as it stays above the median line.

- The US data could be decisive later today.

- The R1 and the upper median line (UML) represent upside targets.

The EUR/USD price dropped earlier on the day but managed to regain the lost ground. The USD appreciated after the US data on Friday. However, the gains couldn’t last long.

–Are you interested in learning more about buying NFT tokens? Check our detailed guide-

The NFP figures came in at 263K in November versus the 200K expected. Average Hourly Earnings rose by 0.6%, beating the 0.3% growth estimated, while Unemployment Rate remained steady at 3.7%, as expected.

Today, the Eurozone data came in mixed today. The Retail Sales indicator dropped by 1.8% versus the 1.7% drop expected. Final Services PMI came in at 48.5 points versus 48.6 expected, while Sentix Investor Confidence was reported at -21.0, above -27.6 expected.

In addition, the German and French Final Services PMI came in worse than expected, while Italian Services PMI and Spanish Services PMI came in better than expected.

Later today, the US data could be decisive. The ISM Services PMI could drop from 54.4 to 53.5 points, Final Services PMI could remain at 46.1 points, while Factory Orders are expected to report a 0.7% growth versus 0.3% growth in the previous reporting period.

Fundamentally, the USD remains bearish as the FED is expected to deliver a 50 bps hike instead of 75 bps after the US reported lower inflation in October.

EUR/USD price technical analysis: Correcting lower

Technically, the pair retested the 1.0448 – 1.0438 support zone before resuming its rally. After its strong rally, a minor retreat was natural. The bias is bullish as long as it stays above the median line (ML).

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

The 1.0481 historical level represents a downside obstacle as well. Today, it has retreated after the surge. As long as it stays above the median line (ML), the price could approach the weekly R1 (1.0630) and the upper median line (UML).

Only dropping and stabilizing below the median line could signal that the upside movement ended. Temporary retreats or consolidations could announce an upside continuation. The bias remains bullish as the US dollar is in a corrective phase. As long as the DXY drops, the EUR/USD pair could approach and reach new highs.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.