- The Bank of Canada is set to leave rates unchanged in its October meeting.

- Governor Macklem will likely stress growing uncertainty due to coronavirus.

- Canada’s recent upbeat performance may remain a side story.

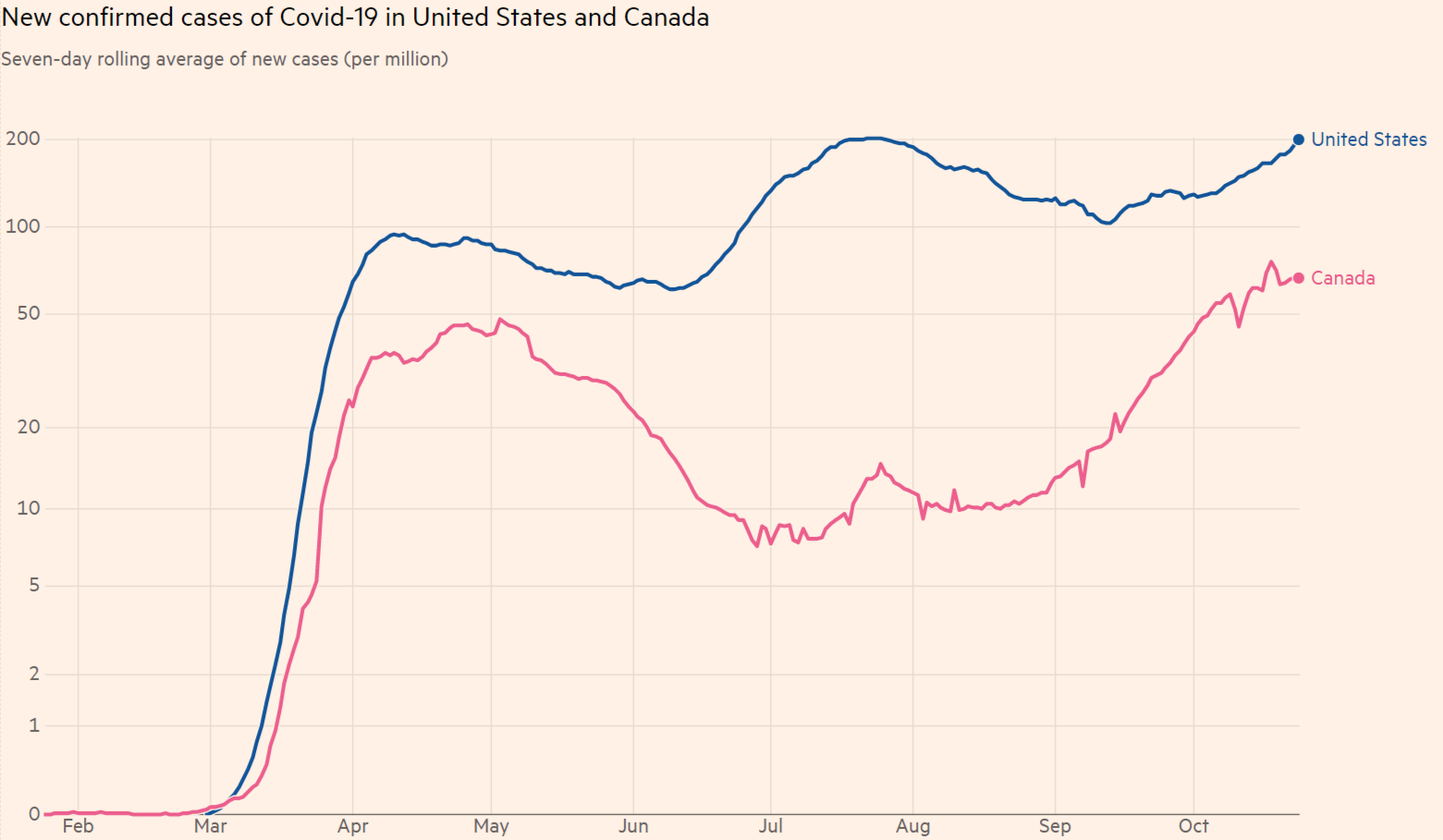

Winter comes early in Canada – the mercury drops rapidly in the northern country and COVID-19 cases are rising. As the same phenomenon is seen in the US – on which the Canadian economy heavily depends – that may push the Bank of Canada toward a cautious outlook in its rate decision.

Uncertain future vs. upbeat performance

Governor Tiff Macklem and his colleagues publish are set to leave the interest rate unchanged at 0.25% but may lay out hints about future policy via their quarterly Monetary Policy Report (MPR) which includes new forecasts. Graphs such as these will likely be on their minds.

The increase in coronavirus cases may cause consumers to shy away from buying, prompt companies to halt hiring and trigger restrictions, and even lockdowns. While Canada is doing better than its southern neighbor, it is exposed to demand coming from south of the border. Moreover, the recent flareup arrives early in the autumn, before the worst of winter arrives.

Another reason to be cautious about Canada’s prospects is the upcoming elections in the US. Markets are concerned about a scenario where both President Donald Trump and rival Joe Biden declare victory and America’s streets become chaotic. While the chances are low, Macklem and Deputy Governor Carolyn Wilkins – who will also attend the post-decision press conference – will likely be wary of the chance of such an event.

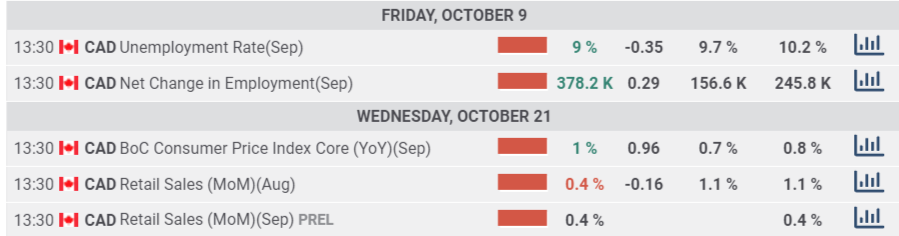

Uncertainty about the future contrasts the recent upbeat figures published in Ottawa. Canada’s Unemployment Rate unexpected fell to 9% in September as the nation added 378,200 jobs last month, pointing to a robust recovery.

The BOC’s main mission is keeping prices stable, and core inflation has also surprised to the upside, rising from 0.8% in August to 1% in September. Retail sales have been more stable, advancing 0.4% in each of the past two months.

Source: FXStreet Calendar

USD/CAD Reaction

If the BOC releases cautious forecasts that point to a slower recovery – and also accompanies it by stating uncertainty is high – the loonie would fall and USD/CAD would rise. This scenario has the highest probability.

If Macklem and co. strike a balance between recent growth and slower yet acceptable levels of recovery afterward, USD/CAD could chop around and swiftly return to moving on other factors such as the general market mood and oil prices. Barrel prices have been remarkably stable of late.

In the unlikely case that the bank focuses on the bouncing labor market and conveys an upbeat message, USD/CAD would fall.

Conclusion

The BOC is set to leave rates unchanged but rock markets with its quarterly report which includes new forecasts and is accompanied by a press conference. There are significant changes that Governor Macklem emphasizes the uncertain future over the recent recovery, weighing on the loonie.