- The BOE is set to leave its rates unchanged on “Super Thursday”

- England’s lockdown could push the bank to set negative rates, weighing on sterling.

- Opting for more QE would boost sterling.

“I am asking you to stay at home” – UK Prime Minister Boris Johnson’s second lockdown announcement is already weighing on sterling. Will the move – triggered by a surge of coronavirus cases – also push the Bank of England to action? That is the question for pound traders.

The BOE’s decision is a “Super Thursday” – an event in which the bank publishes its quarterly Monetary Policy Report, in addition to the rate decision. The “Old Lady” had probably lowered its growth and inflation forecasts – a critical part of the MPR – due to the surge in COVID-19 cases. The PM’s announcement of a month-long shuttering probably caused officials to revisit and downgrade it.

Negative rates or more QE?

A more depressing projection could prompt BOE Governor Andrew Bailey and his colleagues into action. The head of the bank and several colleagues have been publically contemplating setting negative interest rates and even announced they are examining its implementation. Similar experiments in the eurozone and Japan have failed to provide a meaningful boost to the economy, but they have weighed on the underlying currencies.

Indeed, sterling suffered on each mention of sub-zero rates but bounced every time “Old Lady” officials clarified it is not imminent. How long can Bailey and his colleagues scare markets with the menace of negative rates without making good on their promise? They could turn into the boy who cried wolf – being ignored.

After talking about the practical steps in setting sub-zero rates, the new lockdown could be the ultimate trigger to enact such a policy. In that case – which markets are not pricing – the pound would suffer badly.

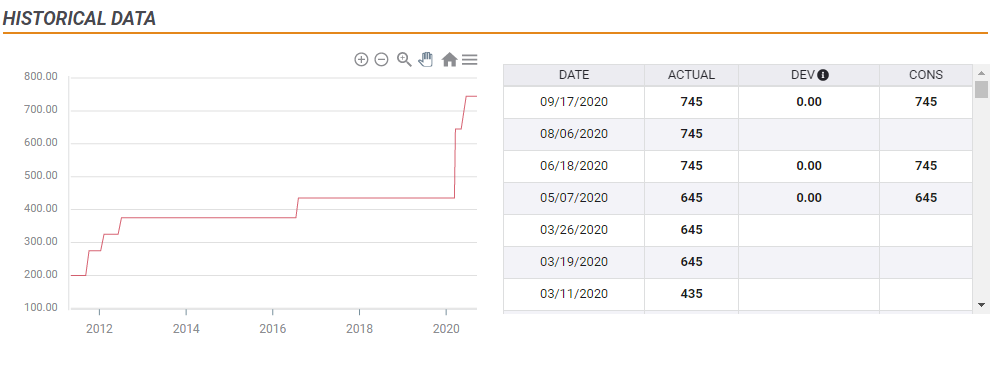

Another option would be to enlarge its bond-buying scheme. In response to the first wave, the BOE boosted the total Asset Purchase Facility from £435 to £745 billion, in two steps. Since the last expansion in June, Bailey and his colleagues signaled they were on hold.

Source: FXStreet

Contrary to pre-pandemic logic, printing more pounds did not devalue the currency but sent it higher. The narrative was that additional funds from the central bank would allow the government to keep the economy afloat during the shuttering, assist the recovery – and therefore beneficiary for sterling.

Alongside the announcement of the new lockdown, PM Johnson announced that the government’s successful furlough scheme would be extended. The program pays workers to stay at home during the temporary economic struggle, keeping employees attached to their jobs.

Will the extension of the furlough scheme trigger the expansion of the BOE’s QE program? If it happens, the pound jump instead of falling.

Timing

The lockdown will likely come into effect on Thursday, the same day as the BOE’s decision, and after the House of Commons approves it on Wednesday. For markets, the main event of the week, the month, and perhaps the year is the US elections.

If Democrat Joe Biden wins the White House and his party flips the Senate, prospects of fiscal stimulus would weigh on the safe-haven dollar. Such a reaction is likely if President Donald Trump is reelected. However, a split between a Biden presidency and a GOP-controlled Senate – or a contested election – would boost the greenback.

If critical, election-determining votes are still counted while the BOE announces its decision, headlines from the US could outweigh the decision in London, yet chances are low. Nevertheless, the general market mood could have an impact on GBP/USD.

See 2020 Elections: Three states traders should watch, plus places that could provide surprises

Conclusion

The BOE’s decision comes amid the UK’s second covid wave and could push it into announcing new stimulus. Negative rates would weigh on sterling while more QE will probably boost it. The US election result could have a substantial impact on GBP/USD’s moves, even around the BOE’s “Super Thursday” decision.

See How three US election outcomes (and a contested result) could rock the dollar