Speaking to the parliamentary committee last week at the inflation report hearings, the Bank of England Governor, Mark Carney defended the central bank’s monetary policy. He said that the central bank would not hesitate to change monetary policy if it was appropriate. The comments suggested that the central bank continues to remain on the sidelines but ready to intervene with monetary policy action, which can include either a rate cut or a rate hike. The remarks were consistent with the BoE’s early February monetary policy meeting where the central bank said that rates could move in any direction.

The inflation report hearing comes at a time when the UK is inching closer to invoking the Article 50, required to formally chalk out exit plans with the EU, close to a year after the UK voted to leave the European Union. Amid concerns on various aspects such as trade and immigration, the latest survey revealed that Britons were starting to get more worried about the economy.

Survey data from Neilsen, a market research firm released last week showed that the UK’s economy was one of the top two concerns for nearly 28% of Britons at the end of 2016. It was previously just 12%, the year before.

Following the Brexit vote and the slump in the British pound, consumer prices have drastically increased with the most recent inflation figures for January showing the headline consumer prices at 1.8% on an annual basis. The latest inflation reading was a few points shy from the BoE’s 2% inflation target rate. Even when excluding the volatile components such as food and energy, Britain’s core CPI was seen rising 1.6%. The central bank has so far communicated its willingness to tolerate an overshoot on inflation.

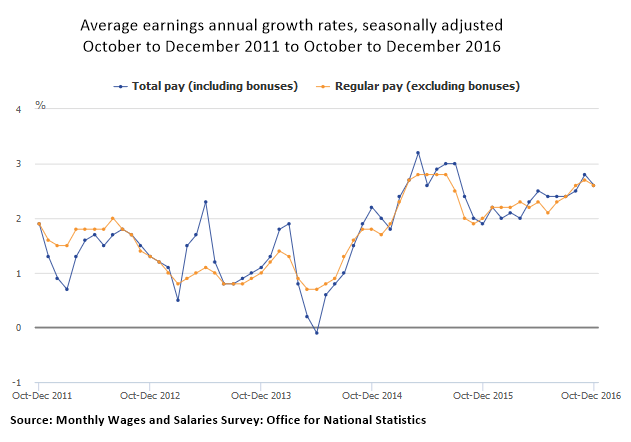

Latest unemployment data from the nation showed that while the unemployment rate remained unchanged at 4.8% for the fourth consecutive month, the average earnings index rose only 2.6%, slower than the 2.8% increase registered previously. A continued slowdown in the pace of earnings could only heighten suspicions that the economy was likely to slow down.

While market expectations for a Bank of England rate hike start to build up, the central bank itself is not quite convinced. At its most recent monetary policy meeting on the 2nd of February, the central bank said that weaker consumer spending; as a result of the slower pace of wage growth would compel it to act further to ease monetary conditions.

“A sharp rise in market interest rates, in expectation of the bank rate being raised in the near future, would tighten credit conditions and potentially hit both consumer spending and business spending,” BoE’s Chief Economist Andrew Haldane told the parliamentary committee last week during the inflation report hearings.

Q4 2016 GDP figures upgraded

Last week also saw the release of the second estimates for the fourth quarter GDP growth. Data from the Office for National Statistics showed that the UK’s economy expanded at a faster pace than what was initially estimated in the first revision.

Official data showed the fourth quarter GDP rising 0.7%, more than 0.6% increase registered during the first estimate. However, UK’s annual GDP rate was unchanged at 2% during the fourth quarter, compared to the year before. The revision to the changes came about from manufacturing output which saw an increase of 1.2% compared to the previous estimates which showed only 0.7% increase. Mining, quarrying output was however revised down to 7% from the initial 6.9%. The services sector, which has been dominant, remained unchanged at 0.8% while construction output was revised to 0.2% from 0.1%.

As per the second estimates, the UK’s annual growth rate is slightly above forecasts of 1.8%, but slower than 2015’s growth rate of 2.2%