Kristin Forbes surprised markets by voting for a rate hike in the BOE’s March meetings. She sees inflation as moving up “notably”. In addition, other MPC members are considering a reduction in monetary stimulus and not much is needed to trigger that.

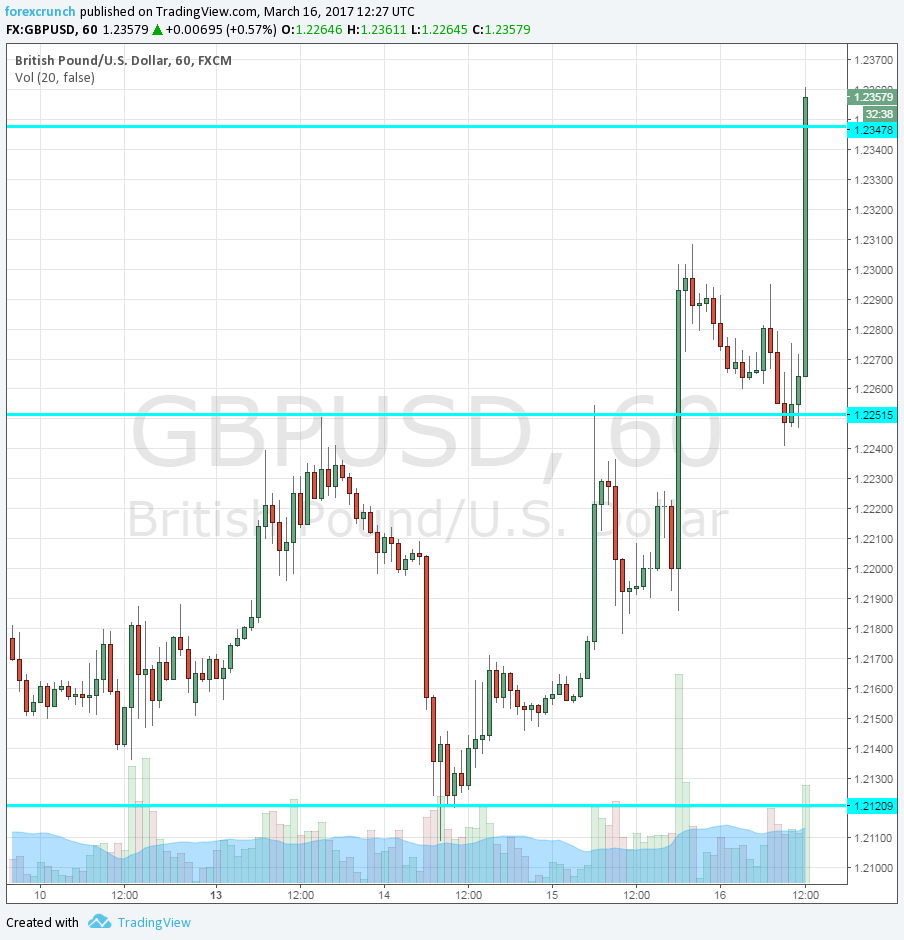

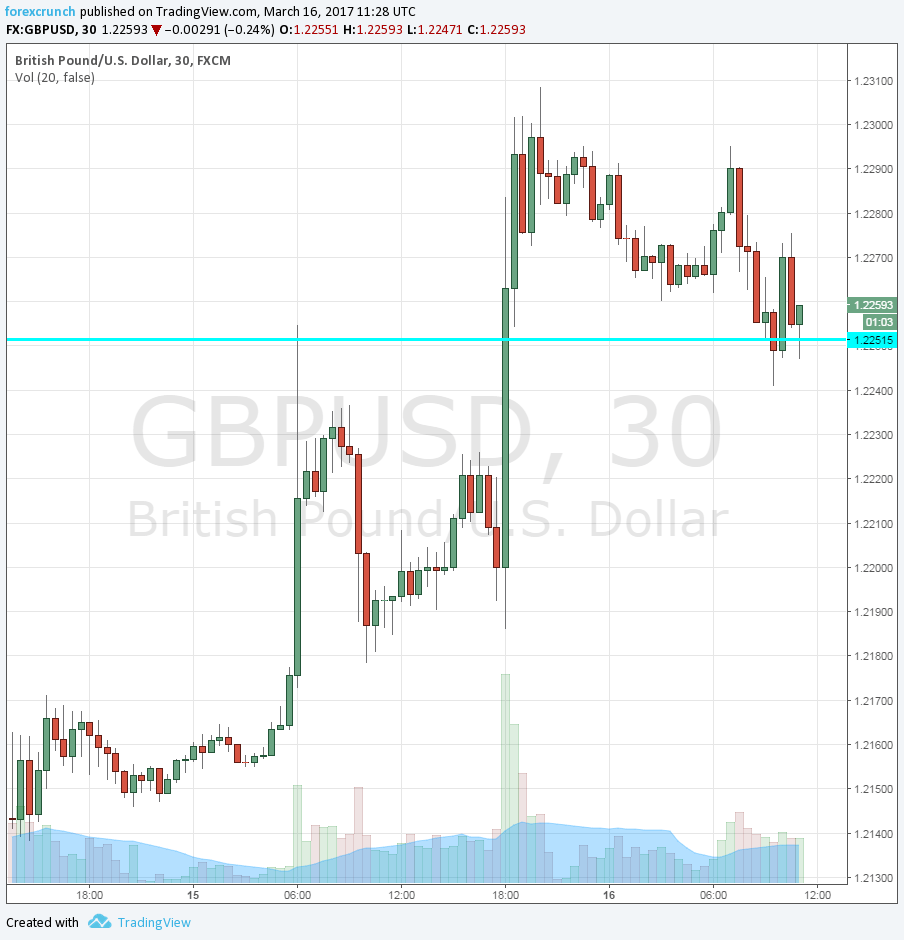

GBP/USD reacted very positively: rising above 1.23 and then extending its gains. It is making an attempt to break above resistance at 1.2345 and has already reached 1.2360. The breakout is awaiting a confirmation.

While Carney does not really intend to raise rates, the hawkish tone and the vote for a hike serve the Monetary Policy Committee quite well. A stronger pound pushes inflation lower and makes real wages more robust.

The Bank of England was expected to leave the interest rate unchanged at 0.25% and the QE program at 435 billion pounds, unchanged since the BOE reacted to Brexit back in August.

The focus is on the meeting minutes, released simultaneously with the decision. A unanimous vote is on the cards, with 9, including Governor Mark Carney and the about-to-retire Charlotte Hogg included.

Follow the live coverage with Valeria Bednarik, Mauricio Carrillo and I:

The weakness of the pound is beginning to take its toll. It is pushing the prices of imported goods to the upside, making real wages worth less. We have seen how wage growth has decelerated.

The pound was higher against the US dollar, but that is due to the Fed’s dovish rate hike. While Yellen and co. increased interest rates, this was widely expected and other factors disappointed markets. Here are 5 reasons why the dollar fell on the hike.