The Bank of Japan did it: they indeed eased by setting an interest rate of -0.1% for excess reserves – following the lead of the ECB. They did leave the QE program unchanged with the monetary base at 80 trillion yen as a target.

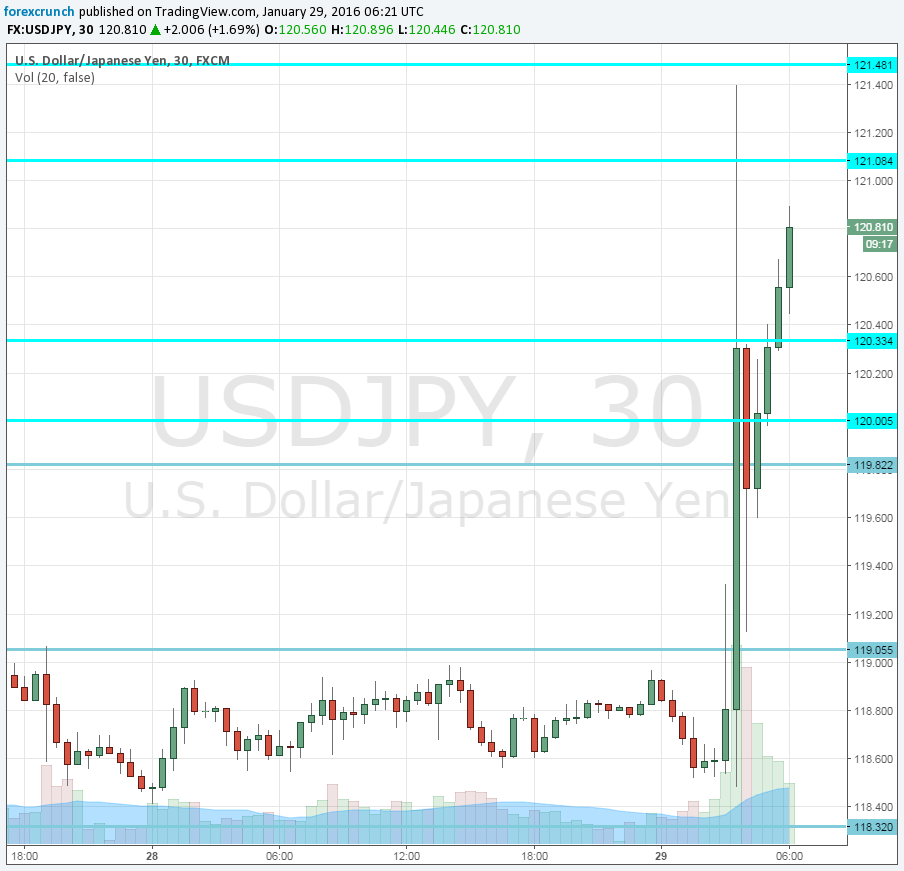

USD/JPY reacts quite strongly, with a leap of around 300 pips all the way to 121.39 before stabilizing just under 121.

This was no easy decision, with a tight 5:4 majority for the negative rate, while a wider majority of 8:1 on the monetary base. The rates will have a 3-tier system and the idea is to lower the short end of the yields curve.

All this is meant to lift inflation. The target has been pushed back, and not for the first time, to the fiscal year 2017/2018. This was accompanied with a downgrade of forecasts: core CPI now stands at 0.8% instead of 1.4% as the median seen beforehand for fiscal 2016/2017.

According to their own inflation calculations, the current level of their core CPI is at 1.3% y/y. There are so many measures of inflation in Japan, and the BOJ has its own one, which is the highest one. Interesting.

Earlier, we learned that industrial output fell by 1.4% in December, worse than expected. Household spending also dropped, by 4.4%. The official inflation numbers did not surprise too much.

Here is how USD/JPY looks on the 30 minute chart. Note that also GBP/JPY and EUR/JPY are seeing similar moves.The rise was not a one way street and involved a lot of choppiness.