The Bank of Japan left its policy unchanged in a meeting that was attended by special guests but yielded nothing. They did talk about acting in the future, but this was far from enough to weaken the yen, especially as they removed the language about further cutting rates into negative territory.

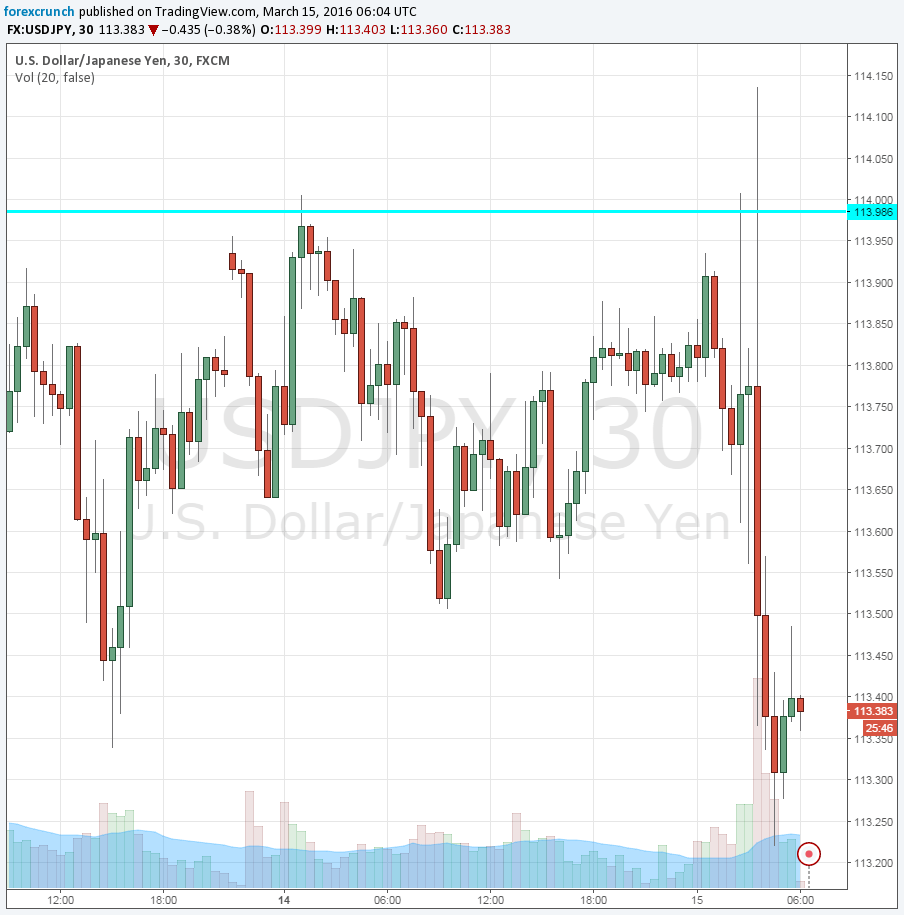

USD/JPY rattled and flirted with the 114 level but eventually slides to the lows of 113.22 and remains on lower ground.

The BOJ left the 80 trillion yen monetary base and 0.1% negative interest rate. They will closely monitor the impact of negative rates and the only meaningful announcement is the exemption of Money Reserve Funds (MRFs) from the negative rates.

All in all, no new negative rates now, no new forward guidance about negative rates and an exemption of negative rates for some.

They do see the economic recovery as continuing, but quite moderately. They do cite uncertainty in emerging markets and the impact of the Fed policy as risks and do watch out for volatility.

The Bank of Japan may have learned from the European Central Bank: taking its time with action and also downplaying expectations. They announced they are examining the impact of negative rates.

Analysts say that the BOJ, like the ECB, fears it is reaching the limit of monetary policy and that it is working carefully. Perhaps further fiscal stimulus will be introduced.

Elections for the upper house in the Japanese parliament are due later this year. Perhaps this will inspire the government to announce some stimulus instead of the central bank. In any case, it seems the BOJ is not too keen about negative rates.

Here is how it looks on the chart. Further support awaits at 112.20, followed by the double bottom of 111. Resistance is at 114.55 and 116.